Innospec (IOSP): Has the Recent Share Price Slide Created a Value Opportunity?

Innospec (IOSP) has quietly slipped this year, with the stock down around 27% year to date even as revenue and net income have grown, raising a simple question for investors: Is the market overlooking something here?

See our latest analysis for Innospec.

That backdrop makes the recent bounce more interesting, with a 7 day share price return of 6.0 percent and a modestly positive 30 day move. However, the 1 year total shareholder return of negative 30.7 percent still signals fading long term momentum and lingering skepticism around valuation.

If Innospec’s pullback has you rethinking your watchlist, this could be a good moment to search beyond chemicals and uncover fast growing stocks with high insider ownership.

So with earnings still expanding while the share price lags and analysts seeing upside from here, is Innospec quietly undervalued for patient investors, or is the market already baking in its next leg of growth?

Most Popular Narrative: 21% Undervalued

With Innospec’s fair value pegged at $99.33 against a last close of $78.48, the dominant narrative points to meaningful upside if its forecasts materialize.

The analysts are assuming Innospec's revenue will grow by 5.4% annually over the next 3 years.

Analysts expect earnings to reach $457.7 million (and earnings per share of $16.97) by about September 2028, up from $19.3 million today. The analysts are largely in agreement about this estimate.

Curious how a modest revenue climb translates into a dramatic earnings surge and a lower future profit multiple than today? The narrative hinges on aggressive margin expansion, disciplined buybacks, and a valuation reset that could reframe what investors are willing to pay for those future profits.

Result: Fair Value of $99.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained margin pressure from raw material volatility, together with any prolonged weakness in Oilfield Services, could quickly challenge the bullish undervaluation case.

Find out about the key risks to this Innospec narrative.

Another Angle on Valuation

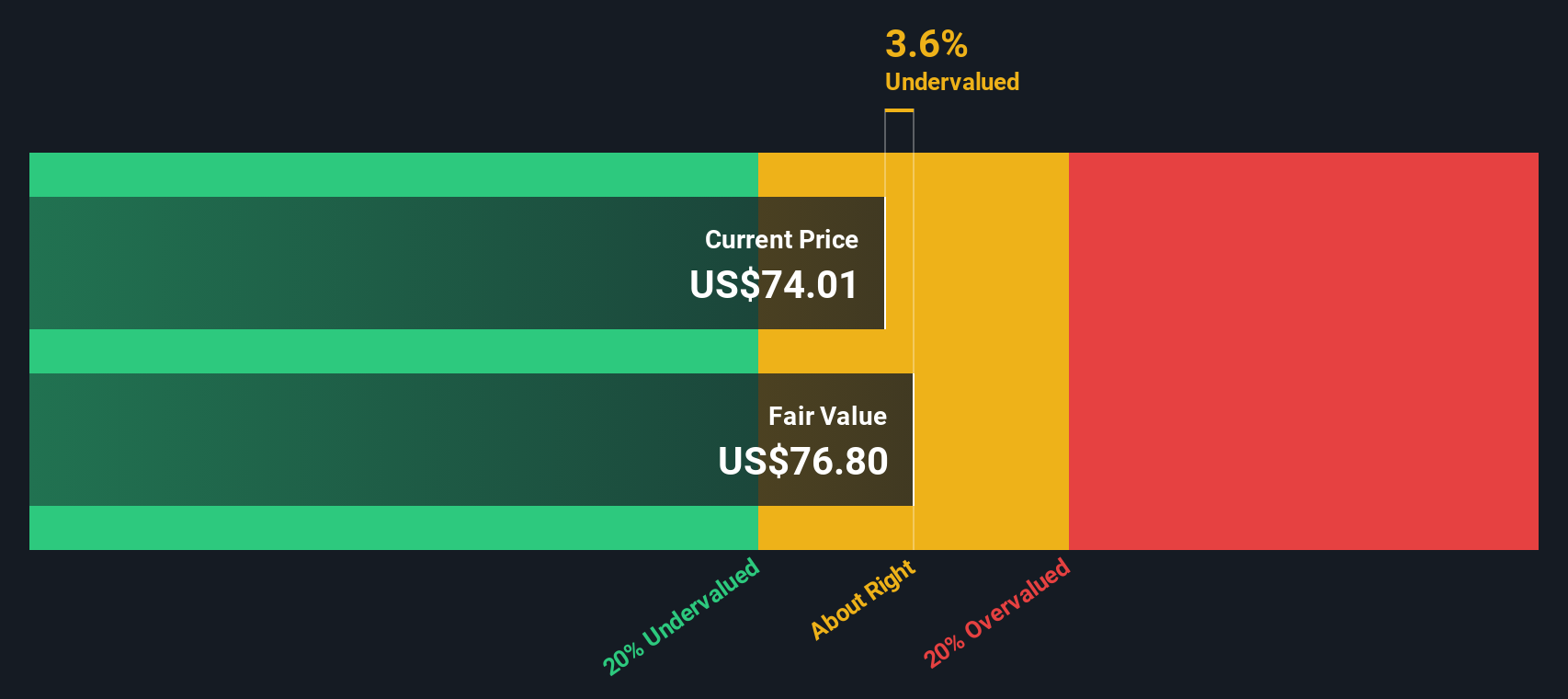

Our SWS DCF model paints a cooler picture, with Innospec’s fair value at roughly $77.09 per share, just below the current $78.48 price. That suggests the stock may already reflect much of its long term growth story, leaving investors to ask: how much upside is truly left?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Innospec for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Innospec Narrative

If you see the story differently or prefer to test the assumptions yourself, you can build a complete view in just a few minutes: Do it your way.

A great starting point for your Innospec research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next smart opportunity?

Before the market prices in the next wave of winners, put Simply Wall Street’s tools to work and secure your shortlist of high conviction ideas today.

- Capture potential multi baggers early by focusing on these 3603 penny stocks with strong financials that already show strong balance sheets and real, tangible financial strength.

- Target resilient income by using these 12 dividend stocks with yields > 3% to spot companies offering attractive yields backed by sustainable payout ratios.

- Position yourself ahead of the crowd with these 81 cryptocurrency and blockchain stocks, zeroing in on businesses shaping the future of digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal