3 High Growth Companies With Strong Insider Ownership

As the U.S. stock market experiences a surge following the Federal Reserve's recent interest rate cut, investors are keenly observing how these changes might impact growth companies and their potential for future expansion. In such a dynamic environment, high insider ownership can be an indicator of confidence in a company's prospects, making it an attractive feature for those seeking to identify promising growth opportunities.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 29.2% | 114.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.4% | 28.0% |

| Cloudflare (NET) | 10.2% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.5% | 27.3% |

Let's uncover some gems from our specialized screener.

Live Oak Bancshares (LOB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Live Oak Bancshares, Inc. is the bank holding company for Live Oak Banking Company, offering a range of banking products and services in the United States, with a market cap of approximately $1.59 billion.

Operations: The company generates revenue through its banking platform for small businesses, amounting to $434.21 million.

Insider Ownership: 23.2%

Live Oak Bancshares demonstrates growth potential with earnings forecasted to grow significantly above the US market average. Insider ownership remains strong, with more shares bought than sold recently, indicating confidence in its prospects. However, challenges include a high level of bad loans and recent delayed SEC filings. The appointment of Ewa M. Stasiowska as Chief Risk Officer could enhance risk management strategies crucial for sustaining growth amidst these challenges.

- Click here and access our complete growth analysis report to understand the dynamics of Live Oak Bancshares.

- According our valuation report, there's an indication that Live Oak Bancshares' share price might be on the cheaper side.

Spotify Technology (SPOT)

Simply Wall St Growth Rating: ★★★★★☆

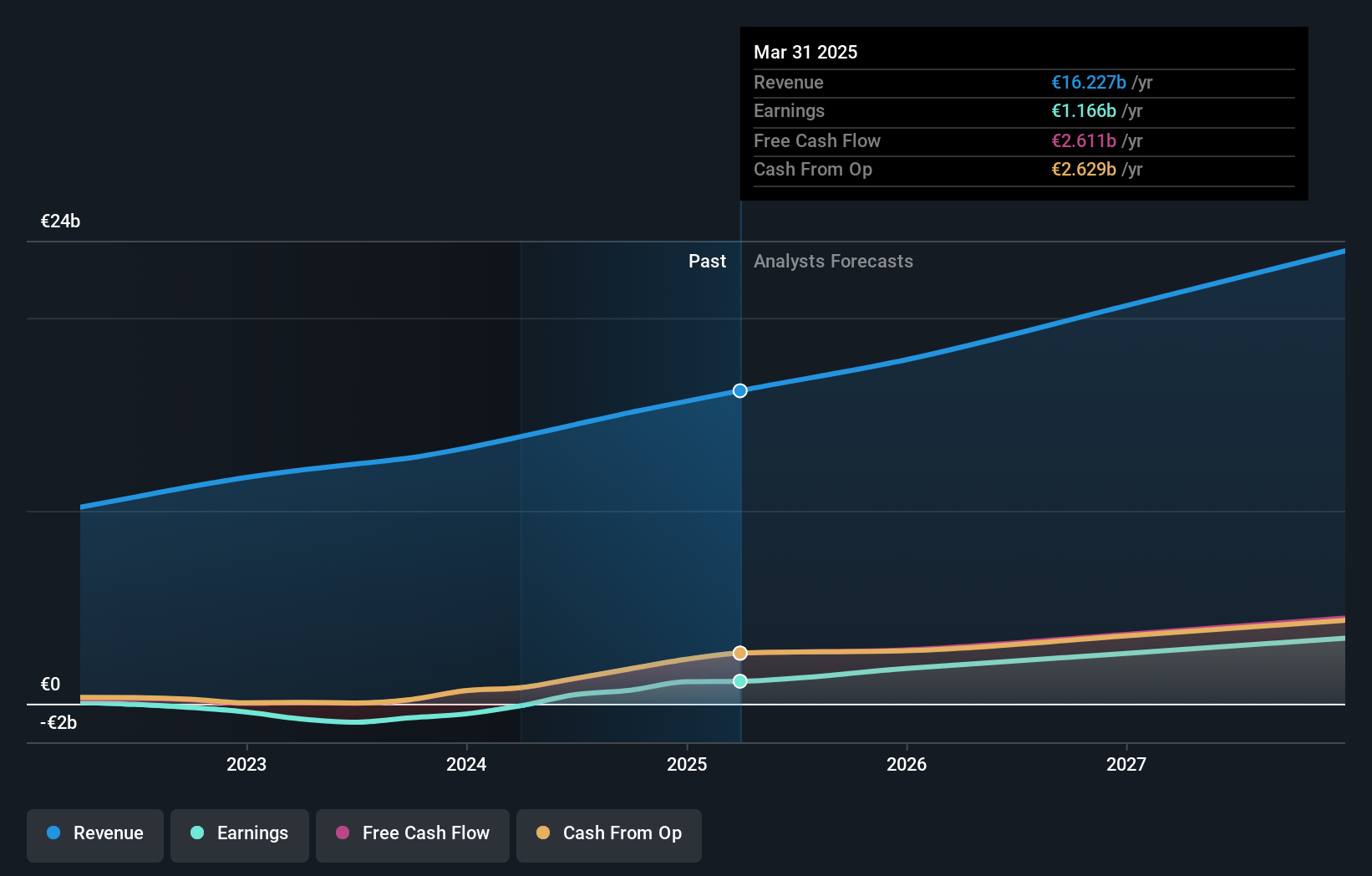

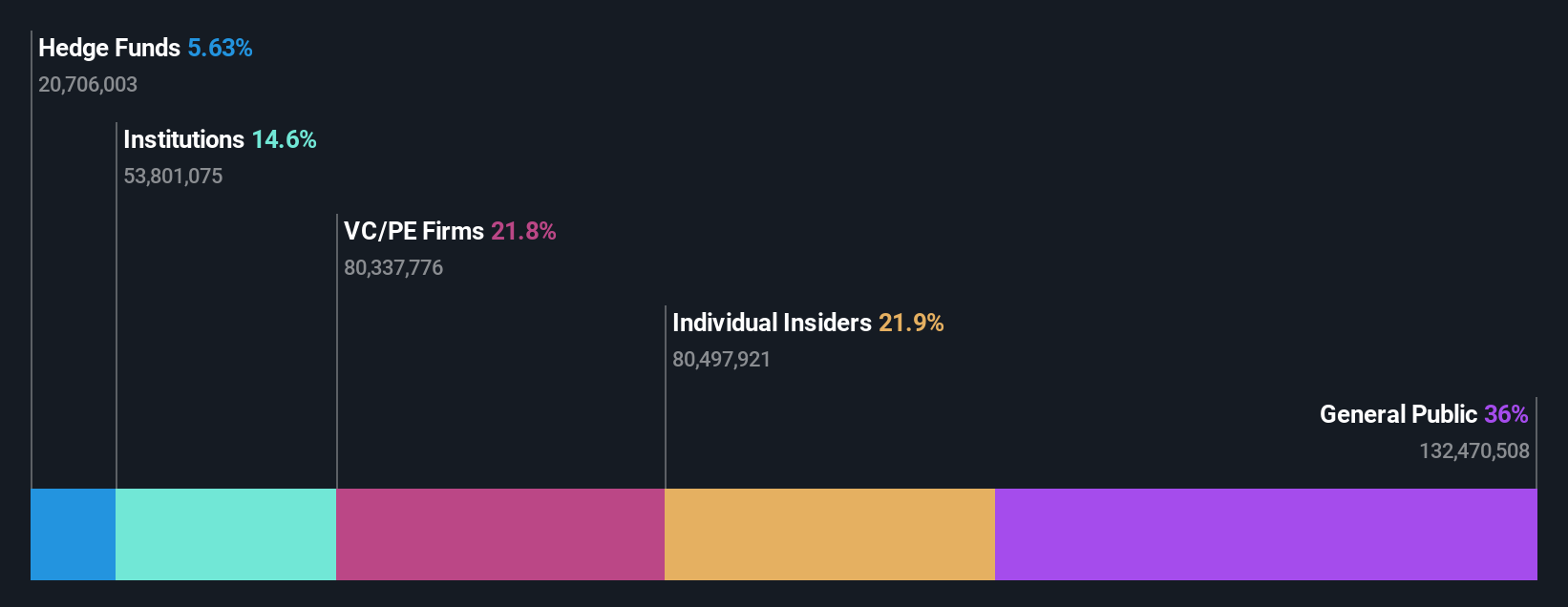

Overview: Spotify Technology S.A., along with its subsidiaries, offers audio streaming subscription services globally and has a market capitalization of approximately $125.59 billion.

Operations: The company generates revenue through its Premium segment, which accounts for €15.04 billion, and its Ad-Supported segment, contributing €1.86 billion.

Insider Ownership: 16.1%

Spotify Technology has shown strong growth potential, with earnings expected to rise significantly faster than the US market average. Recent leadership changes, including the appointment of co-CEOs and a new director of sales from Meta, suggest strategic shifts aimed at bolstering its competitive edge. Despite facing a class action lawsuit over streaming fraud allegations, Spotify continues to innovate in AI technology and maintains robust insider ownership, reflecting confidence in its future trajectory.

- Unlock comprehensive insights into our analysis of Spotify Technology stock in this growth report.

- The analysis detailed in our Spotify Technology valuation report hints at an deflated share price compared to its estimated value.

StubHub Holdings (STUB)

Simply Wall St Growth Rating: ★★★★★★

Overview: StubHub Holdings, Inc. operates a global ticketing marketplace for live event tickets and has a market cap of approximately $4.77 billion.

Operations: The company generates revenue primarily from its ticketing marketplace for live events, with the Recreational Activities segment contributing $1.83 billion.

Insider Ownership: 14.2%

StubHub Holdings is poised for significant growth, with forecasts indicating revenue expansion at 30.1% annually, outpacing the US market. Despite a volatile share price and substantial net losses reported recently, its strategic partnerships—such as with World Sevens Football—enhance its Direct Issuance capabilities and global reach. While insider ownership remains high, a class action lawsuit alleging misleading financial disclosures could impact investor sentiment. The company trades significantly below estimated fair value, suggesting potential upside if challenges are managed effectively.

- Take a closer look at StubHub Holdings' potential here in our earnings growth report.

- Upon reviewing our latest valuation report, StubHub Holdings' share price might be too pessimistic.

Where To Now?

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 201 more companies for you to explore.Click here to unveil our expertly curated list of 204 Fast Growing US Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal