European Value Stocks Trading Below Estimated Worth December 2025

As European markets show mixed returns, with the STOXX Europe 600 Index edging higher on hopes of interest rate cuts, investors are keenly analyzing opportunities in value stocks trading below their estimated worth. In this environment, identifying undervalued stocks involves assessing companies that demonstrate strong fundamentals and potential for growth despite broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Stellantis (BIT:STLAM) | €10.17 | €20.10 | 49.4% |

| Sanoma Oyj (HLSE:SANOMA) | €9.19 | €18.32 | 49.8% |

| PVA TePla (XTRA:TPE) | €22.52 | €44.13 | 49% |

| Mo-BRUK (WSE:MBR) | PLN308.50 | PLN601.98 | 48.8% |

| Gentili Mosconi (BIT:GM) | €3.30 | €6.54 | 49.5% |

| Figeac Aero Société Anonyme (ENXTPA:FGA) | €10.90 | €21.62 | 49.6% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.393 | €0.78 | 49.4% |

| Digital Workforce Services Oyj (HLSE:DWF) | €2.57 | €5.09 | 49.5% |

| Allcore (BIT:CORE) | €1.355 | €2.66 | 49% |

| Aker BioMarine (OB:AKBM) | NOK90.00 | NOK177.13 | 49.2% |

Here's a peek at a few of the choices from the screener.

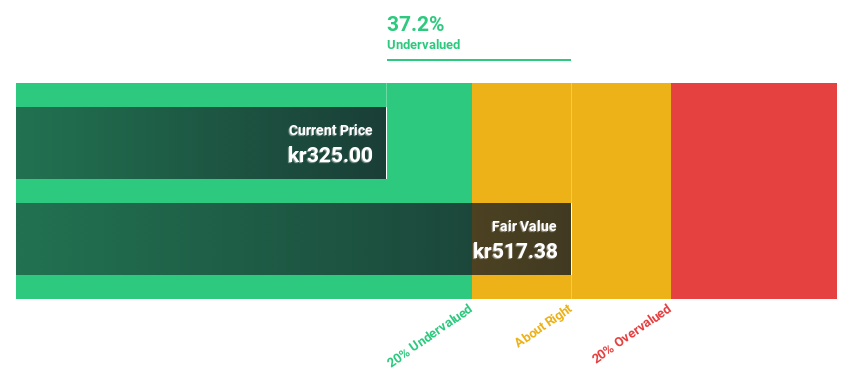

Revenio Group Oyj (HLSE:REG1V)

Overview: Revenio Group Oyj specializes in ophthalmological devices and software for diagnosing glaucoma, macular degeneration, and diabetic retinopathy across Finland, the United States, and globally, with a market cap of €587.93 million.

Operations: The company's revenue primarily comes from its Health Tech segment, which generated €109.32 million.

Estimated Discount To Fair Value: 28.4%

Revenio Group Oyj is trading at €22.1, significantly below its estimated fair value of €30.88, highlighting potential undervaluation based on cash flows. Recent earnings reports show steady growth with third-quarter sales rising to €25.9 million from €23.9 million year-on-year and net income increasing slightly to €4.6 million. The adoption of a Product Operating Model aims to enhance agility and customer focus, potentially supporting future growth as revenues are expected to outpace the Finnish market at 10.1% annually.

- Our comprehensive growth report raises the possibility that Revenio Group Oyj is poised for substantial financial growth.

- Dive into the specifics of Revenio Group Oyj here with our thorough financial health report.

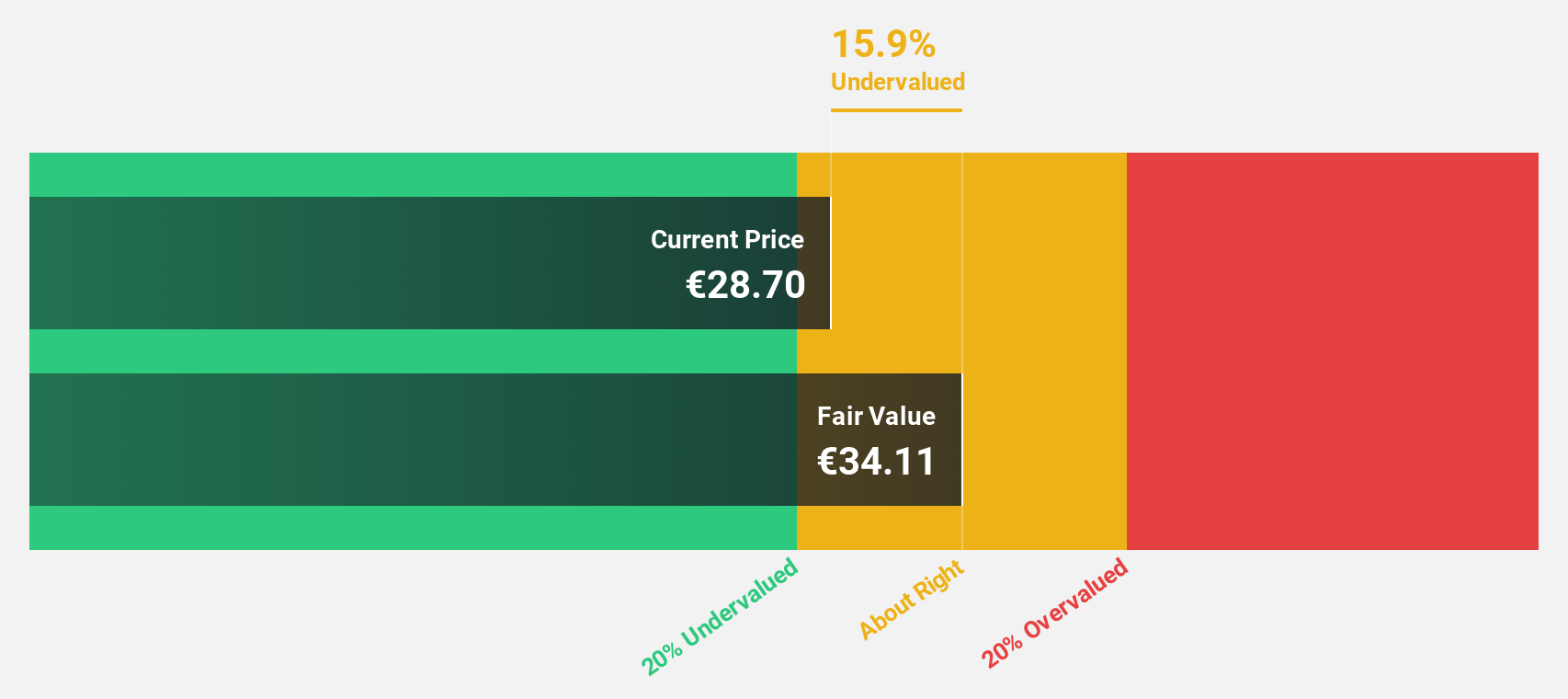

Absolent Air Care Group (OM:ABSO)

Overview: Absolent Air Care Group AB (publ) specializes in designing, developing, selling, installing, and maintaining air filtration units with a market capitalization of approximately SEK2.42 billion.

Operations: The company's revenue is primarily derived from its Industrial segment, generating SEK1029.08 million, and the Commercial Kitchen segment, contributing SEK243.58 million.

Estimated Discount To Fair Value: 43%

Absolent Air Care Group, trading at SEK214, is significantly undervalued with a fair value estimate of SEK375.41. Despite recent third-quarter sales declining to SEK301.35 million from last year's SEK331.02 million, net income saw a slight increase to SEK19.98 million from SEK19.74 million year-on-year. However, insider selling has been significant recently, which may be a concern for investors considering its strong earnings growth forecast of 42% annually compared to the Swedish market's 13.5%.

- The analysis detailed in our Absolent Air Care Group growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Absolent Air Care Group.

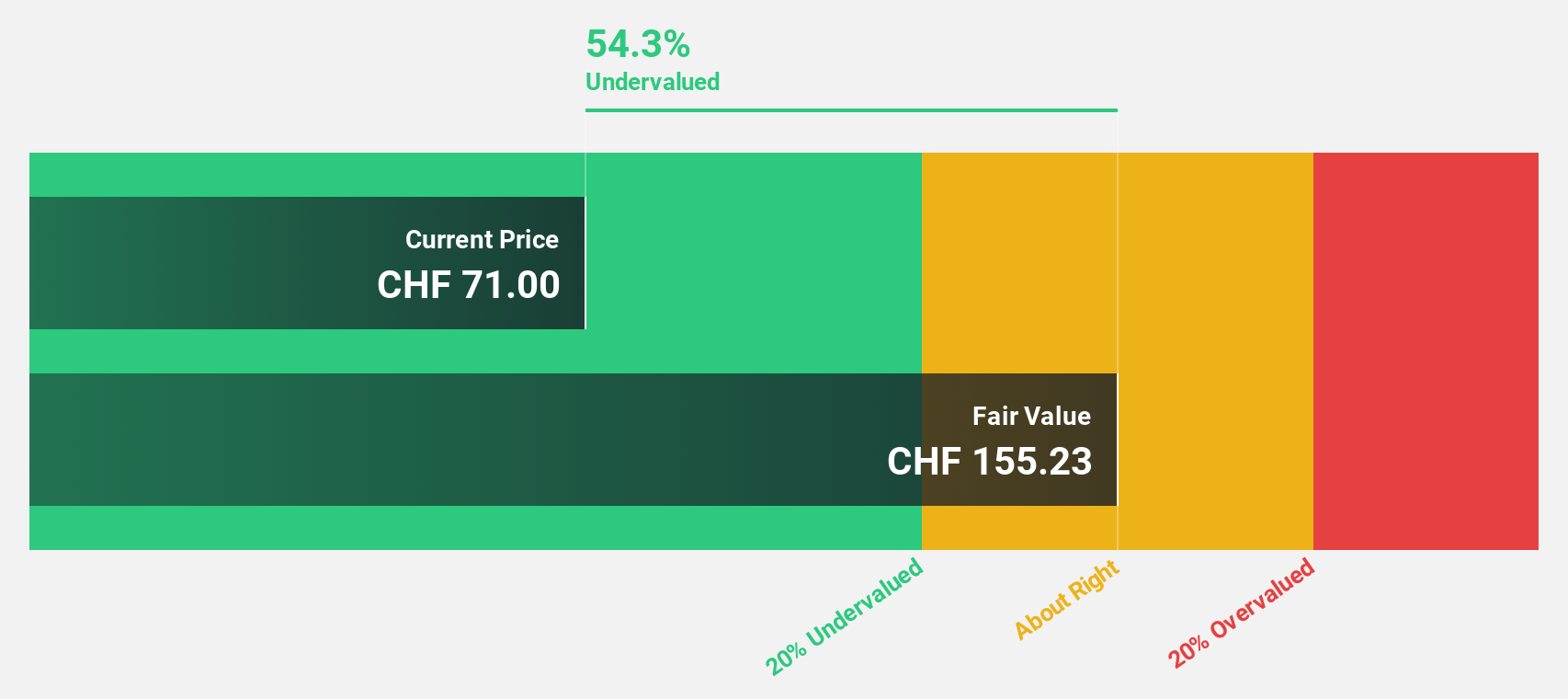

SKAN Group (SWX:SKAN)

Overview: SKAN Group AG, with a market cap of CHF1.11 billion, offers isolators, cleanroom devices, and decontamination processes for the pharmaceutical and chemical industries across Europe, the Americas, Asia, and internationally.

Operations: The company's revenue is primarily derived from its Equipment & Solutions segment, which generates CHF241.46 million, and its Services & Consumables segment, contributing CHF90.67 million.

Estimated Discount To Fair Value: 19.3%

SKAN Group, trading at CHF49.45, is undervalued with a fair value estimate of CHF61.31. Although recent guidance indicates lower 2025 sales and profit due to project delays, the company maintains strong medium-term growth targets supported by a robust project pipeline. Forecasted revenue growth of 15.8% annually outpaces the Swiss market, while earnings are expected to grow significantly at 31.6% per year despite current profit margin declines from last year's levels.

- In light of our recent growth report, it seems possible that SKAN Group's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of SKAN Group.

Taking Advantage

- Discover the full array of 193 Undervalued European Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal