3 Global Growth Companies With High Insider Ownership Growing Earnings Up To 70%

As global markets navigate the complexities of potential interest rate cuts and mixed economic signals, investors are keenly observing growth opportunities amid fluctuating indices. In such an environment, companies with high insider ownership can offer unique insights into growth potential, as insiders often have a vested interest in the company's success and may be better positioned to capitalize on favorable market conditions.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's uncover some gems from our specialized screener.

BIWIN Storage Technology (SHSE:688525)

Simply Wall St Growth Rating: ★★★★★☆

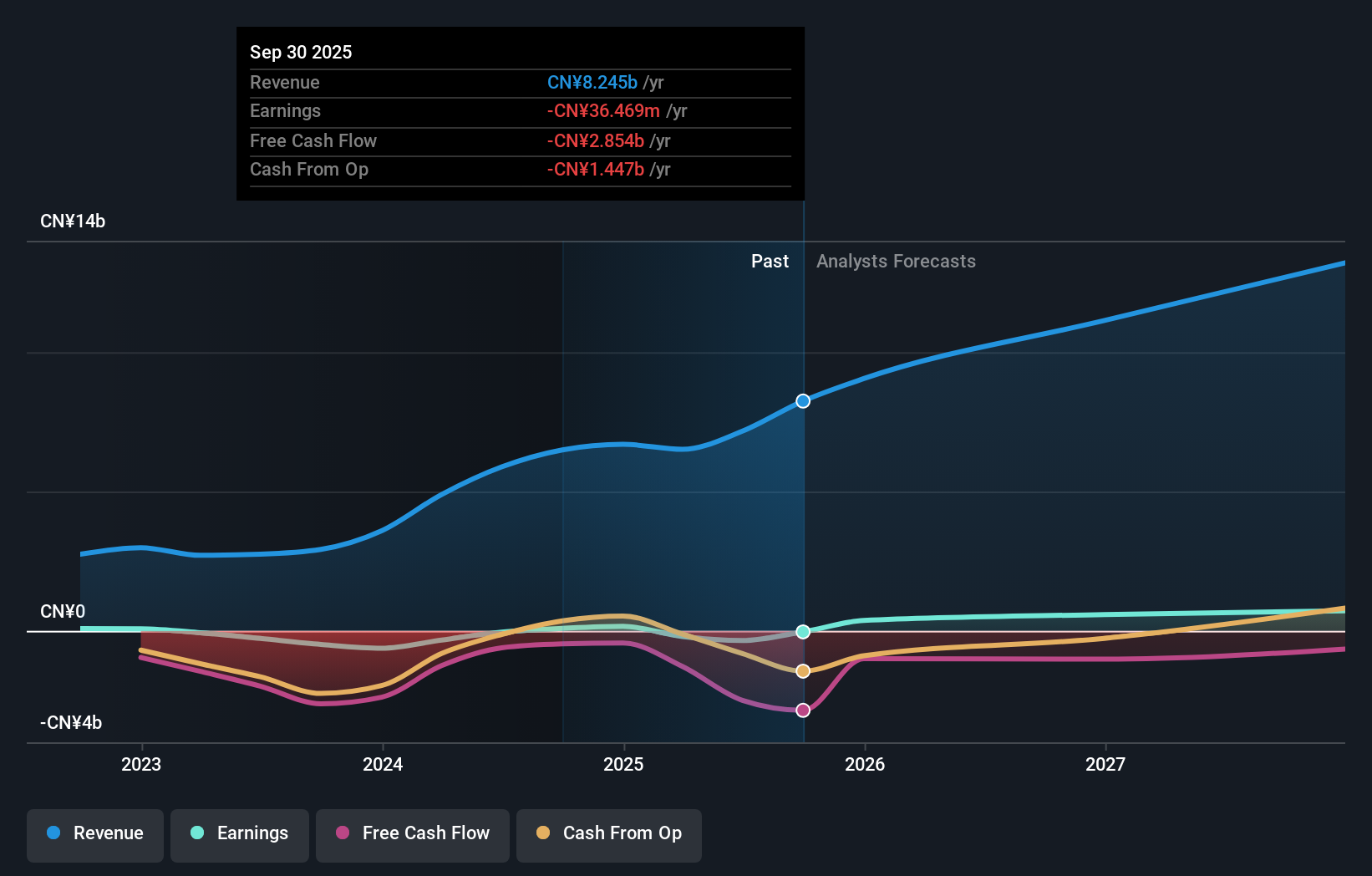

Overview: BIWIN Storage Technology Co., Ltd. engages in the research, development, design, packaging, testing, production, and sale of semiconductor memory products and has a market cap of CN¥52.85 billion.

Operations: The company generates revenue primarily from its semiconductor segment, amounting to CN¥8.25 billion.

Insider Ownership: 17.4%

Earnings Growth Forecast: 69.7% p.a.

BIWIN Storage Technology is poised for significant growth, with expected revenue increases of 20.9% annually, outpacing the Chinese market. Despite a volatile share price and low forecasted return on equity, the company aims to become profitable within three years. Recent adjustments to its equity buyback plan, increasing authorization to CNY 150 million and repurchase price to CNY 182.07 per share, indicate strategic financial maneuvers amid declining net income and earnings per share compared to last year.

- Unlock comprehensive insights into our analysis of BIWIN Storage Technology stock in this growth report.

- Our valuation report unveils the possibility BIWIN Storage Technology's shares may be trading at a premium.

Shanjin International Gold (SZSE:000975)

Simply Wall St Growth Rating: ★★★★☆☆

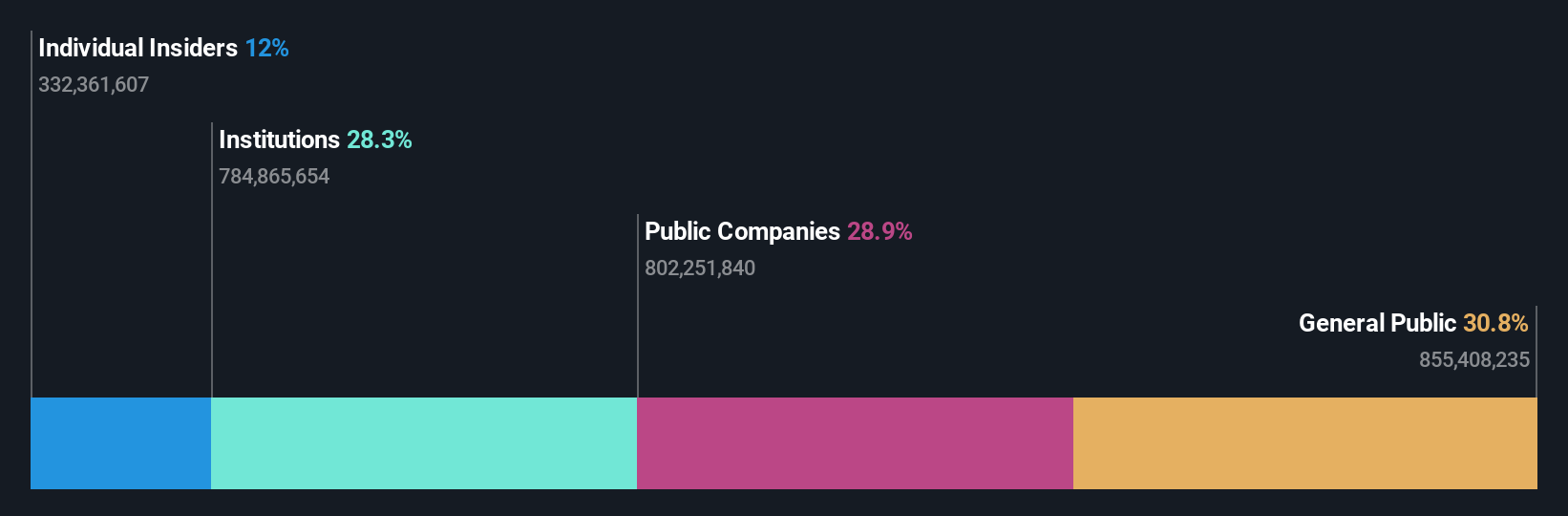

Overview: Shanjin International Gold Co., Ltd. engages in the exploration, mining, and trading of precious and non-ferrous metal ores in China, with a market cap of CN¥61.85 billion.

Operations: The company generates revenue through the exploration, mining, and trading of precious and non-ferrous metal ores within China.

Insider Ownership: 12%

Earnings Growth Forecast: 27.4% p.a.

Shanjin International Gold demonstrates potential for growth, with earnings projected to increase by 27.42% annually, surpassing the Chinese market. Despite revenue growth trailing the market average, the company trades at a significant discount to its fair value and shows strong recent performance with net income rising from CNY 1.73 billion to CNY 2.46 billion year-over-year. The completion of a share buyback program worth CNY 34.09 million suggests strategic capital allocation efforts without substantial insider trading activity recently noted.

- Get an in-depth perspective on Shanjin International Gold's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Shanjin International Gold's shares may be trading at a discount.

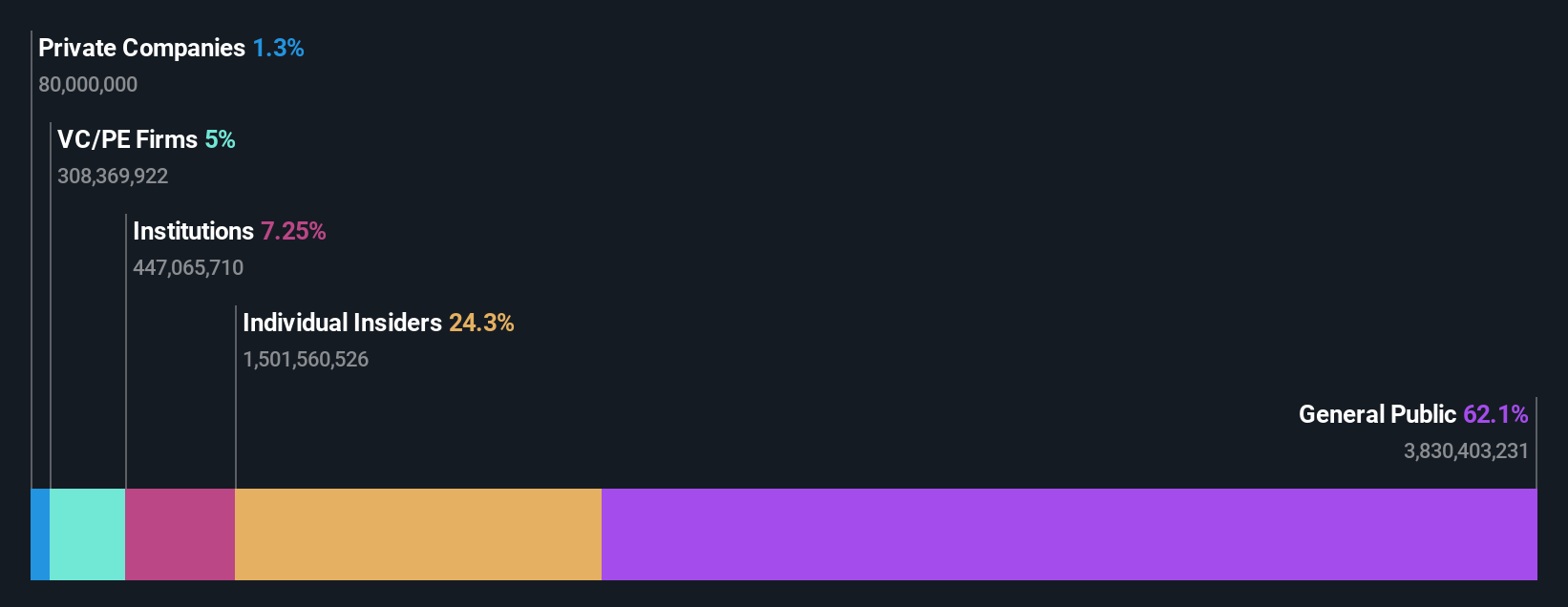

Offcn Education Technology (SZSE:002607)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Offcn Education Technology Co., Ltd. is a vocational education institution in China offering various educational services, with a market cap of CN¥16.34 billion.

Operations: Offcn Education Technology Co., Ltd. generates revenue primarily from its Education and Training segment, amounting to CN¥2.12 billion.

Insider Ownership: 22.8%

Earnings Growth Forecast: 70% p.a.

Offcn Education Technology shows growth potential with earnings forecasted to rise significantly by 70% annually, outpacing the Chinese market. Despite revenue growth lagging behind the market average, it trades at a 30% discount to its estimated fair value. Recent amendments to company bylaws may influence governance and strategic decisions. The company became profitable this year, though recent earnings reported a decline in net income from CNY 168.16 million to CNY 91.97 million year-over-year without substantial insider trading activity noted recently.

- Click here and access our complete growth analysis report to understand the dynamics of Offcn Education Technology.

- Insights from our recent valuation report point to the potential undervaluation of Offcn Education Technology shares in the market.

Taking Advantage

- Discover the full array of 858 Fast Growing Global Companies With High Insider Ownership right here.

- Curious About Other Options? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal