Georg Fischer (SWX:GF) Valuation Check After Kepler Cheuvreux Upgrade and Portfolio Reshaping

Georg Fischer (SWX:GF) just picked up an upgrade from Kepler Cheuvreux, a vote of confidence that leans heavily on its recent clean up of the portfolio and stronger balance sheet.

See our latest analysis for Georg Fischer.

That upgrade lands after a tough stretch, with the share price down sharply over the past quarter and a weaker one year total shareholder return, but it hints that sentiment may be turning as portfolio reshaping and integration synergies start to come through.

If this kind of repositioning story interests you, it is also worth exploring aerospace and defense stocks for more industrial and engineering names undergoing their own strategic shifts.

With the shares down about 25% over the past year but still trading at a hefty discount to analyst targets, the real debate now is simple: is Georg Fischer quietly undervalued, or is the market already baking in its recovery?

Most Popular Narrative Narrative: 28% Undervalued

With Georg Fischer last closing at CHF52.55 against a narrative fair value of CHF72.8, the valuation story leans firmly toward upside potential.

The ongoing transition to a pure play Flow Solutions business driven by the divestment of legacy segments and recent acquisitions like Uponor and VAG is expected to accelerate GF's exposure to resilient, higher margin markets such as water infrastructure, sustainability focused products, and smart building solutions. This should structurally enhance group EBIT margins and earnings quality. Integration of the Uponor acquisition, already ahead of schedule, is producing synergies (expected CHF 40 to 50 million run rate by 2027), commercial cross selling, and operational efficiencies. These factors support higher EBIT and net earnings visibility in the coming years.

Curious how modest revenue expectations, rising margins, and a richer future earnings multiple can still point to meaningful upside? The narrative’s math might surprise you.

Result: Fair Value of $72.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent end market softness and any stumble in integrating recent acquisitions could quickly sap confidence in the recovery narrative.

Find out about the key risks to this Georg Fischer narrative.

Another Way to Look at Value

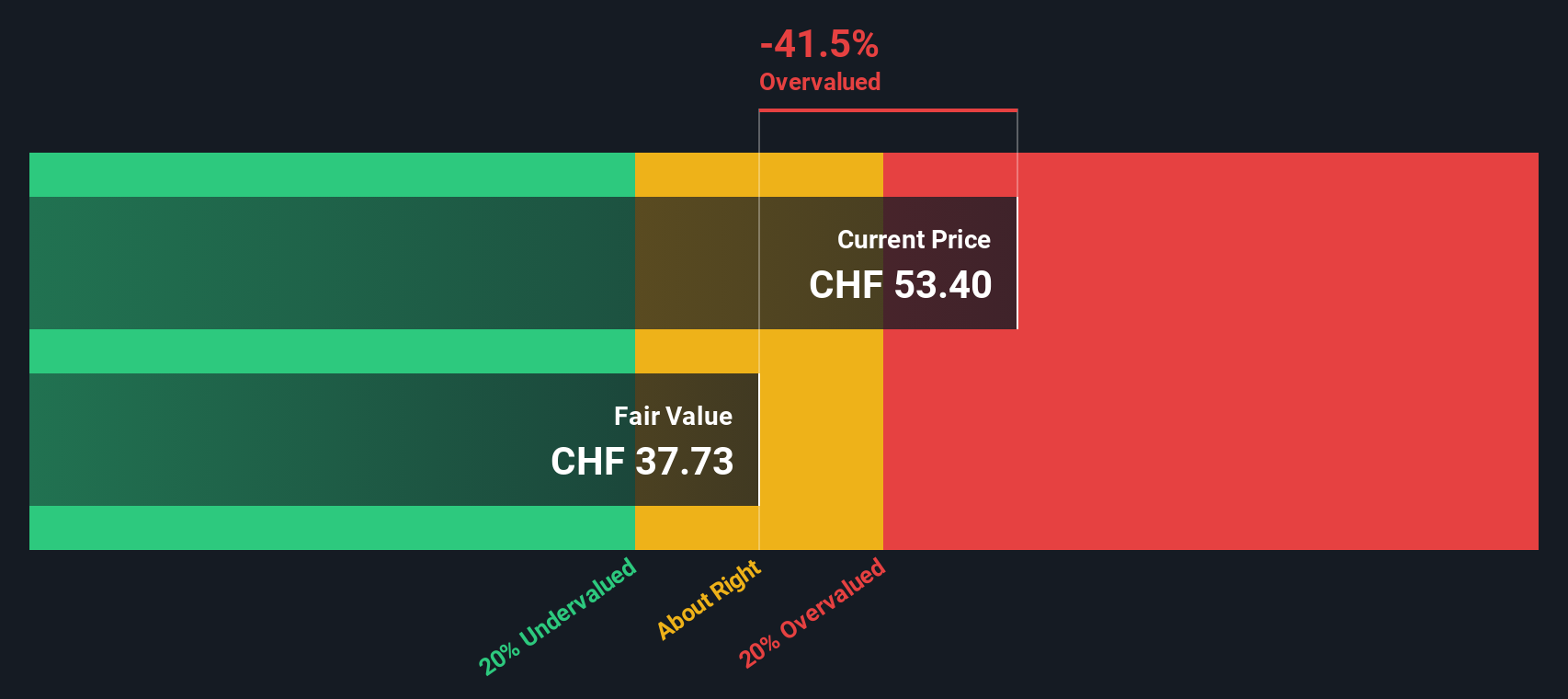

While the narrative fair value suggests Georg Fischer is undervalued, our DCF model paints a tougher picture, with fair value at CHF37.62, below the current CHF52.55. If cash flows are the guide, the shares screen as overvalued rather than cheap, so which story should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Georg Fischer for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Georg Fischer Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your Georg Fischer research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investment move?

Do not stop with Georg Fischer. Use the Simply Wall Street Screener to uncover targeted opportunities that match your style before the market catches on.

- Capture turnaround potential early by reviewing these 906 undervalued stocks based on cash flows that the market may be mispricing based on future cash flows.

- Position yourself for structural growth by scanning these 30 healthcare AI stocks harnessing intelligent tools to transform patient outcomes and operational efficiency.

- Tap into powerful income streams by focusing on these 12 dividend stocks with yields > 3% that aim to balance yield with sustainable payout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal