IPO News | Kids King (301078.SZ) reports that the Hong Kong Stock Exchange ranks first in the Chinese Maternal and Child Products and Services Market

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 11, Kids King Kids Products Co., Ltd. (abbreviation: Kids King, 301078.SZ) submitted the Hong Kong Stock Exchange motherboard, and Huatai International is its sole sponsor. According to Frost & Sullivan, in 2024, the company ranked first in China's maternal and child products and services market with a GMV of RMB 13.8 billion, with a market share of 0.3%.

According to the prospectus, Kids King is a leading omni-channel integrated service provider in the new consumer market for parent-child families in China. It is mainly engaged in the mother, child and child business, including selling mother and child products and providing child development and childcare services.

In order to expand its products beyond the mother, baby and child business, Kids King acquired Silk Field Group in July 2025 to expand into the scalp and hair care market. According to Frost & Sullivan, Silk Field Group ranked first in this market according to GMV in 2024, with a market share of 3.3%.

Kids Wang has successfully created a business model that fully integrates products, services, social networking and sales channels around user needs. According to Frost & Sullivan, the company has become the new consumer preferred service brand for parents and children in China, and its “Kids King”, “Leyou” and “Silk Domain” brands enjoy high popularity in China. As of September 30, 2025, the company's offline sales and service network included a total of 3,710 stores, achieving full coverage of provincial administrative districts in mainland China, including 1,033 family-owned stores and 174 stores directly managed by high-tech hair care.

The picture below shows Kid Wang's business highlights:

Kids King's maternal and child business includes (i) selling mother and child products, covering food, footwear and clothing, consumables and durable goods, and (ii) providing child development and childcare services to parent-child families, mainly including interactive activities, membership services, childcare services and children's playground services. The company sells a wide range of products through a combination of third-party procurement and private brand development. As of September 30, 2025, Kids King provides products from more than 600 third-party brands, and the company's own brand portfolio includes more than 15 brands.

Kids King's scalp and hair care business includes (i) selling scalp and hair care products, and (ii) providing scalp and hair care services. The company's scalp and hair care products can be divided into professional salon products and household products according to consumption scenarios, covering scalp and hair care, styling care series, and bisporin black hair series, and provides professional scalp and hair care services in chain stores under the “Silk Domain” brand.

In terms of corporate strategy, Kids Wang will continue to follow the main context of parent-child family services and continue to advance the “triple expansion strategy” of “expanding categories, expanding the racetrack, and expanding the business format”, namely: continuously upgrading and expanding the store network to build a “thousands of stores” market layout; continue to deepen its own brand strategy to build a chain enterprise integrating R&D, supply and marketing services; vigorously promote business development in the same city and create a preferred portal for parent-child family services in the same city; comprehensively promote the application of artificial intelligence and build a new growth engine for the entire business chain; and accelerate overseas development and layout to shape a new growth engine for global consumer families pattern.

Financial data

revenue

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company recorded revenue of 8.52 billion yuan (RMB, same below), 8.753 billion yuan, 9.337 billion yuan, and 7.349 billion yuan respectively. During the track record period, the revenue from the mother, child and child business accounted for the vast majority of the company's total revenue.

Total profit and comprehensive revenue for the year/period

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company recorded total annual/period profit and overall revenue of 120 million yuan, 121 million yuan, 205 million yuan, and 229 million yuan respectively.

Gross profit and gross profit margin

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company recorded gross profit of 2,529 billion yuan, 2,557 billion yuan, 2.76 billion yuan, and 2,086 billion yuan, respectively, with corresponding gross margins of 29.7%, 29.2%, 29.6%, and 28.4%.

Industry Overview

The new consumer market for parent-child families in China is undergoing a transformation and upgrading from traditional mother and child retail to new consumption for parent-child families. New consumption refers to a comprehensive consumption ecosystem that meets the needs of integrated families through the deep integration of products, services, social networking and intelligence in the context of changes in population structure and the evolution of childcare concepts from basic nurturing to scientifically refined childcare, with full life cycle membership relationships as the core.

This huge market is huge in size and continues to grow. The total new consumer market for parent-child families in China increased from RMB 4611.8 billion in 2020 to RMB 5230.8 billion in 2024, with a compound annual growth rate of 3.2%, and is expected to reach RMB 65,72.2 billion by 2029. From a structural point of view, the market consists of a large-scale, high-demand core segment and multiple tracks with high growth potential. It mainly covers maternal and child products and services, scalp and hair care, and diversified value-added businesses.

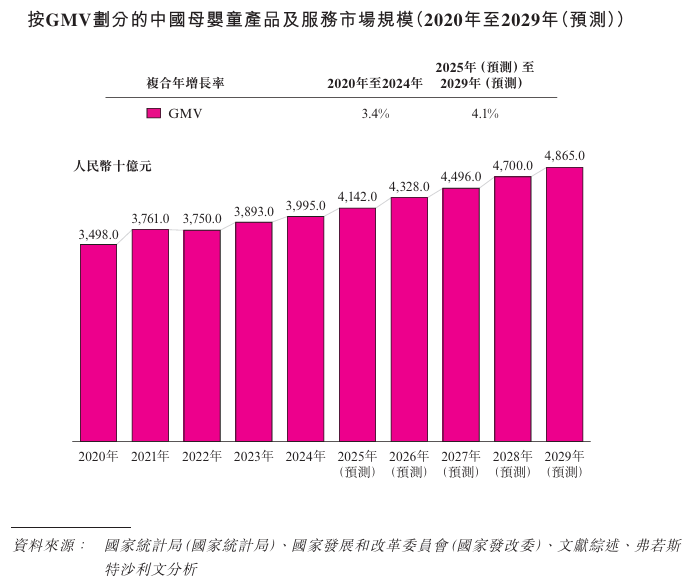

China's maternal and child products and services market is a comprehensive ecosystem serving families. It is characterized by the retail sale of essential products such as food, footwear, clothing, consumables and durable goods, as well as professional services such as childcare support, interactive activities, membership programs, and exclusive children's playgrounds. This market is the cornerstone of a new consumer ecosystem for parent-child families. Driven by the shift in childcare concepts to scientific and refined practices, favorable policies to encourage childbearing, and the upgrading of the consumption structure, the market is huge and has maintained steady growth. This increased from RMB 3,498 billion in 2020 to RMB 3,995 billion in 2024, with a CAGR of 3.4%. It is expected to reach RMB 4,865 billion by 2029, and is forecasted to grow at a CAGR of 4.1% between 2025 and 2029.

From a structural point of view, the market is undergoing a shift from being product-centered to placing equal emphasis on products and services. As consumer demand for professional guidance, parent-child interaction and growth companionship intensifies, the penetration rate of service-oriented consumption (such as childcare services, parent-child entertainment, and child development services) and individual customer consumption have steadily increased, becoming an important engine driving market value growth.

As far as the urban hierarchy is concerned, due to the mature retail penetration rate and relatively high consumption base, first-tier and second-tier cities are still the core components of the market. However, the incremental growth of the market is clearly shifting to third-tier cities and below.

As urbanization continues to advance, residents' disposable income increases, and brand channels sink in at an accelerated pace, the demand for parent-child families in third-tier cities and below is rapidly increasing. The growth rate of these markets has surpassed that of higher-tier cities. These markets have the characteristics of stable childcare needs and are highly sensitive to standardized stores, pricing systems and service experiences. They are expected to be the main source of growth in the Chinese mother and child market during the forecast period.

As an important extension of the parent-child household consumer market ecosystem, China's overall high-end hair service market is in a transition period of structural upgrading. High-end hair services point to providing consumers with high value-added services in areas other than washing and cutting, aimed at enhancing the beauty of the hair, changing the shape, or improving the health of the scalp and hair. According to GMV, the total market size grew moderately from RMB 248.2 billion in 2020 to RMB 285.9 billion in 2024, with a compound annual growth rate of 3.6%. However, under the overall steady growth trend, the market is showing a clear structural evolution: with a growth rate far exceeding the industry average, the scalp and hair care segment has become the absolute core engine driving the industry's growth.

Benefiting from consumers' awareness of scalp health and driven by the beauty economy, the focus of consumer spending is shifting from style-oriented traditional hairdressing services to efficient nursing and home care. From 2020 to 2024, the GMV of China's scalp and hair care market rapidly expanded from RMB 43.2 billion to RMB 61.1 billion, with a compound annual growth rate of 9.1%.

Looking ahead, the growth of the scalp and hair care market is expected to accelerate further as functional care becomes popular and solutions for specific groups such as postpartum mothers and workers mature. From 2025 to 2029, the compound annual growth rate of the scalp and hair care market is expected to increase to 11.0%, far higher than the 4.5% growth rate of the overall market; its market size is expected to rise from RMB 67.8 billion in 2025 to RMB 103 billion in 2029. Scalp and hair care will continue to reshape the value structure of the Chinese hair market over the next five years and become the main source of industry growth.

In addition to the core maternal and child products and services market and the scalp and hair care market, China's parent-child household consumption ecosystem continues to expand along the demand boundary between family decision makers and family caregivers, spawning two high-potential growth poles for beauty and skin care and AI-accompanied smart products. In the beauty and skincare market, functional skincare is becoming a core variable driving growth. Benefiting from the increased demand for ingredient safety and precise skincare among mothers, the market segment is expected to increase from RMB 235.9 billion in 2025 to RMB 413.7 billion in 2029, with a compound annual growth rate of 15.1%, which is significantly higher than the growth rate of the overall beauty and skin care market. At the same time, the AI companion smart product market is experiencing explosive growth driven by breakthroughs in edge AI technology and demand for edutainment and childcare. Its market size is expected to rapidly expand from RMB 201 billion in 2025 to RMB 64 billion in 2029, with a compound annual growth rate of 33.6%. Together, these two major extended markets form an important complement to the parent-child household consumption ecosystem, providing a broad space for future growth for enterprises with full-scenario service capabilities.

Board Information

Kids Wang's board of directors currently consists of eight directors, including five executive directors and three independent non-executive directors.

Shareholding structure

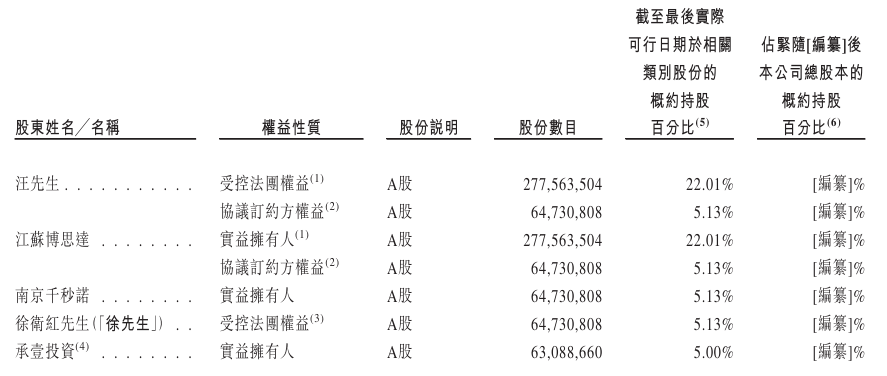

Nanjing Qianseconuo holds 5.13% of the shares, Mr. Wang Jianguo holds 22.01% of the shares through Jiangsu Bosda, and the other A-share shareholders hold a total of 72.86% of the shares.

Mr. Wang and Jiangsu Bostar form the company's single largest shareholder group. As of the last practical date, Mr. Wang controlled a total of 27.14% of the company's voting rights through (a) Jiangsu Bosda (accounting for 22.01%) and (b) its concerted actors, namely Nanjing Qianseconuo (5.13%).

Nanjing Qiansecnuo is a limited partnership established on March 7, 2016 in accordance with Chinese law as a shareholding platform for the company's senior management. As of the date of submission of this document, Mr. Xu Weihong, the company's executive director and general manager, is the sole general partner and the sole shareholder of its sole limited partner. Together, he holds 100% partnership interests in Nanjing Qianseconuo. Nanjing Qianseconuo has always acted in concert with Jiangsu Bostar. It is obligated to follow Jiangsu Bosda's voting decisions and vote unconditionally in accordance with Jiangsu Bosda's intentions.

As of the last practical date, with the exception of Shanghai Chengyi Private Equity Fund Management Co., Ltd. (“Chengyi Investment”), which holds approximately 5.002% of the company's shares for and on behalf of Yicun Xin Future Private Equity Investment Fund (“Xin Future Investment Fund”), none of these A-share shareholders held more than 5% of the company's interests. Xin Future Investment Fund is a fund registered with the China Securities Investment Fund Industry Association in November 2021. As of the last practical date, Chengyi Investment was held by eight individual shareholders, all of whom were independent third parties.

Intermediary team

Company Legal Adviser: Hong Kong Legislation: Tianyuan Law Firm (Limited Liability Partnership); Related Chinese Law: Han Kun Law Firm.

Sole Sponsor Legal Adviser: Relevant Hong Kong Legislation: Jingtian Gongcheng Law Firm Limited Liability Partnership; Related Chinese Law: Jingtian Gongcheng Law Firm.

Auditor and reporting accountant: Ernst & Young.

Industry consultant: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch.

Compliance Advisor: First Shanghai Finance Co., Ltd.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal