UK Growth Companies With High Insider Ownership To Watch

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting concerns about global economic recovery. In such volatile conditions, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 16.3% | 57.8% |

| Metals Exploration (AIM:MTL) | 10.4% | 96.3% |

| Manolete Partners (AIM:MANO) | 35.6% | 38.1% |

| Kainos Group (LSE:KNOS) | 23.8% | 23% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Hochschild Mining (LSE:HOC) | 38.4% | 37.5% |

| Energean (LSE:ENOG) | 19% | 21.1% |

| B90 Holdings (AIM:B90) | 21.3% | 157.2% |

| Afentra (AIM:AET) | 37.7% | 38.2% |

| ActiveOps (AIM:AOM) | 19.5% | 102.9% |

Underneath we present a selection of stocks filtered out by our screen.

Fintel (AIM:FNTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fintel Plc provides intermediary services and distribution channels to the UK retail financial services sector, with a market cap of £211.51 million.

Operations: The company generates revenue through its intermediary services and distribution channels within the UK retail financial services industry.

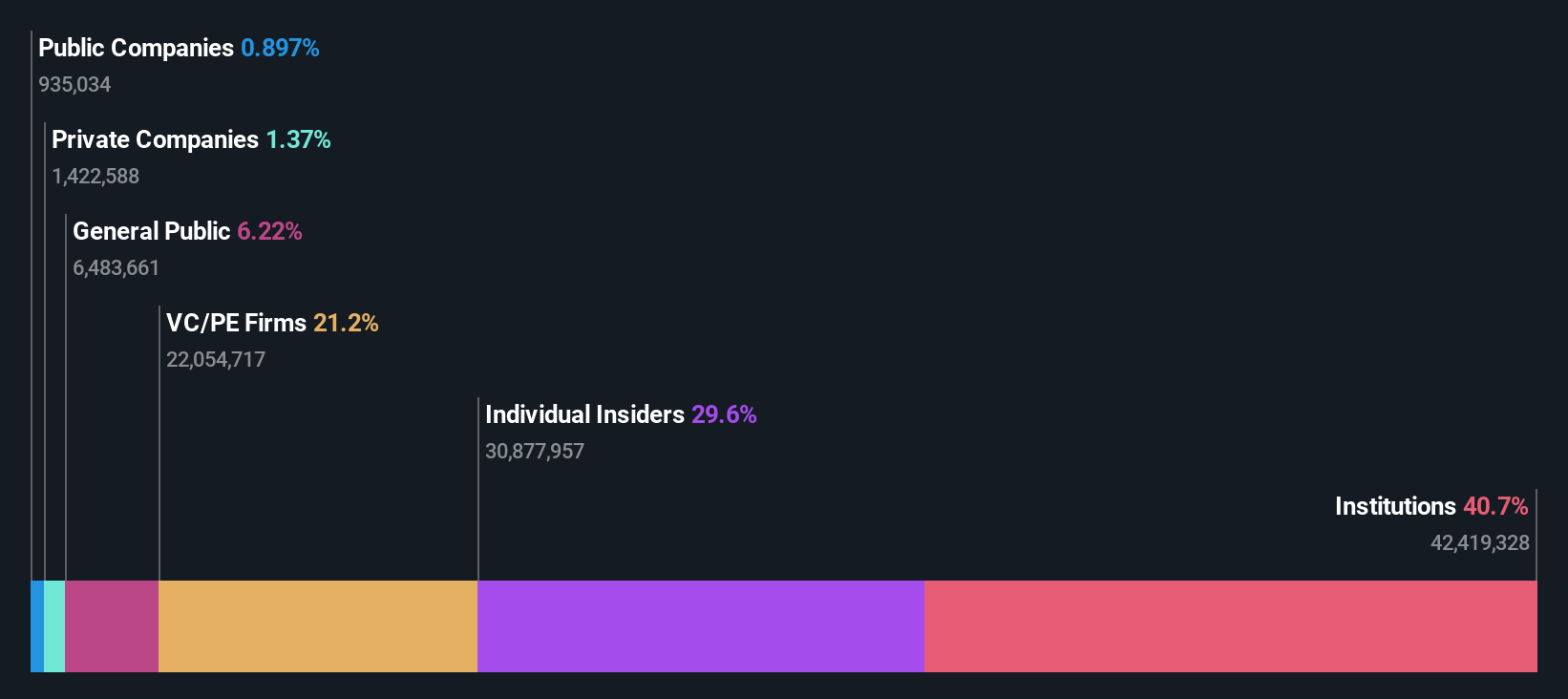

Insider Ownership: 26.8%

Earnings Growth Forecast: 31.2% p.a.

Fintel Plc's recent earnings report indicates solid growth, with sales increasing to £42.4 million and net income rising to £2.4 million for H1 2025. The company announced an interim dividend of 1.3 pence per share, reflecting its financial strength. Despite a forecasted low return on equity of 14.3% in three years, Fintel is trading at a significant discount to fair value and analysts expect substantial earnings growth of over 31% annually, outperforming the UK market average.

- Click to explore a detailed breakdown of our findings in Fintel's earnings growth report.

- Our valuation report unveils the possibility Fintel's shares may be trading at a discount.

Nichols (AIM:NICL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nichols plc, along with its subsidiaries, supplies soft drinks to various sectors including retail, wholesale, catering, licensed, and leisure industries across the United Kingdom and internationally in regions such as the Middle East and Africa; it has a market cap of £351.80 million.

Operations: The company's revenue is primarily derived from its Packaged segment, which accounts for £133.97 million, and its Out of Home segment, contributing £40.35 million.

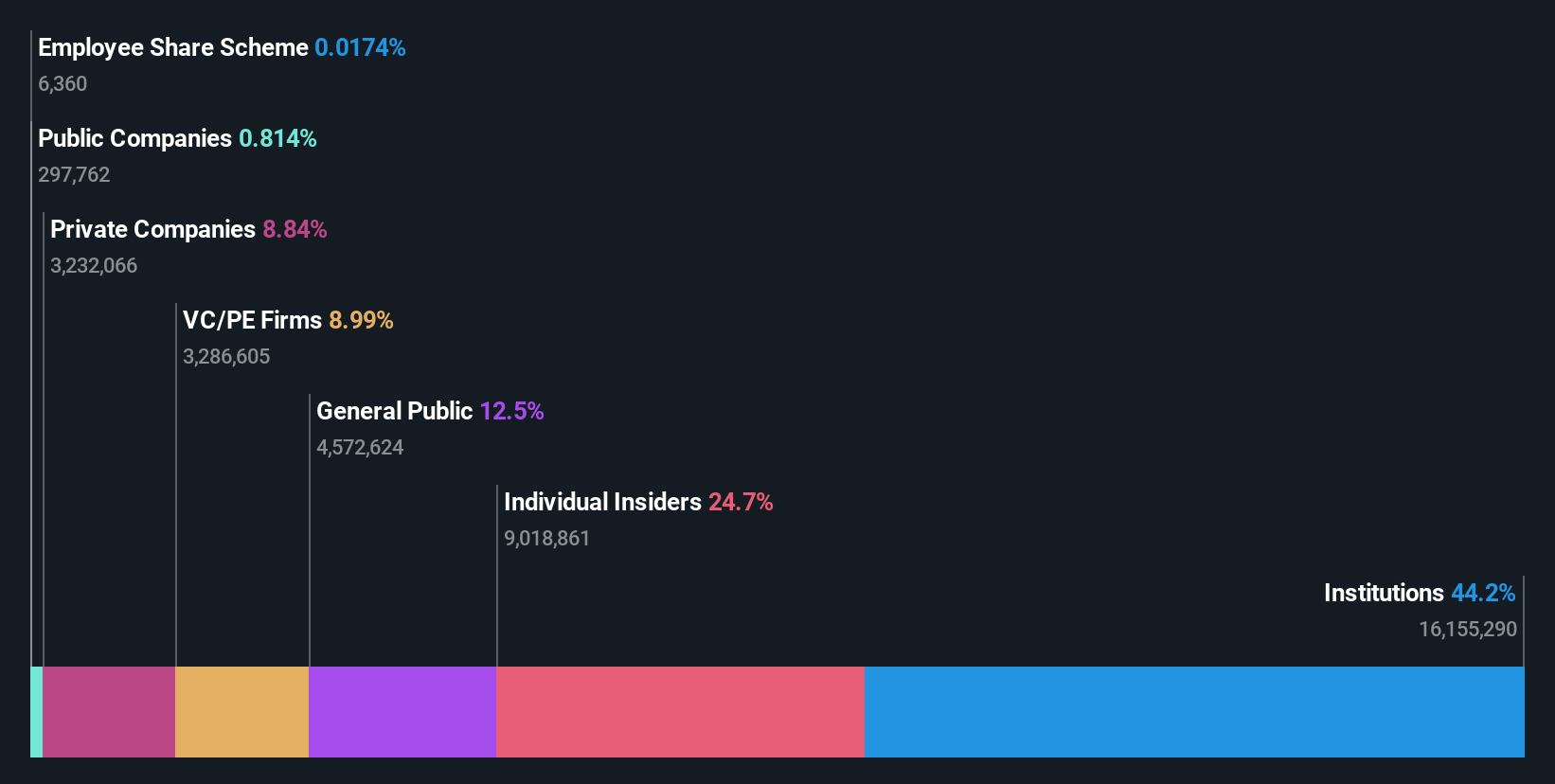

Insider Ownership: 26%

Earnings Growth Forecast: 16.4% p.a.

Nichols plc is poised for growth with expected annual earnings increasing by 16.4%, outpacing the UK market average. Despite trading at a significant 48.1% discount to its estimated fair value, analysts anticipate a potential stock price increase of 52.1%. The company's return on equity is forecast to reach a high of 28% in three years, although it faces challenges such as an unstable dividend history and large one-off items affecting financial results.

- Click here and access our complete growth analysis report to understand the dynamics of Nichols.

- Upon reviewing our latest valuation report, Nichols' share price might be too pessimistic.

Alphawave IP Group (LSE:AWE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alphawave IP Group plc develops and sells wired connectivity solutions across various global regions including North America, China, and Europe, with a market cap of £1.76 billion.

Operations: The company's revenue is primarily derived from its Communications Equipment segment, which generated $319.58 million.

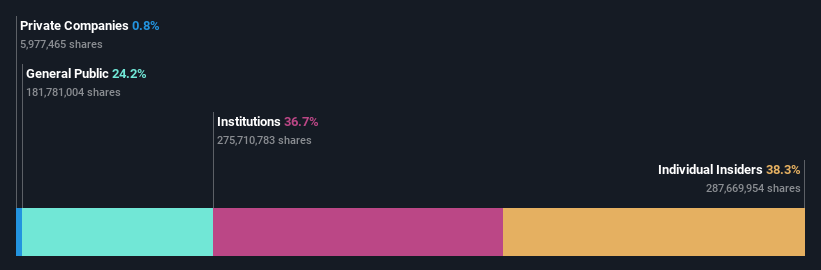

Insider Ownership: 33.9%

Earnings Growth Forecast: 129.1% p.a.

Alphawave IP Group is experiencing robust growth, with revenue expected to increase by 25.2% annually, surpassing the UK market average. The company is advancing its chiplet integration capabilities through innovative technology partnerships, such as leveraging TSMC's SoIC-X platform. Recent product developments include a 64 Gbps UCIe die-to-die IP subsystem on TSMC's 3nm process, enhancing performance for AI and data center applications. Despite these advancements, Alphawave remains unprofitable but aims for profitability within three years.

- Dive into the specifics of Alphawave IP Group here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Alphawave IP Group's current price could be inflated.

Next Steps

- Discover the full array of 53 Fast Growing UK Companies With High Insider Ownership right here.

- Curious About Other Options? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal