MetLife (MET) Valuation Check as Shares Drift Higher After a Patchy Year

MetLife (MET) has quietly outperformed the broader insurance group in recent sessions, with shares drifting higher as investors weigh its steady earnings growth, capital return profile, and how fairly the stock is currently priced.

See our latest analysis for MetLife.

That steady climb to around $79.82 comes after a patchy year for the share price, with short term share price returns recently turning positive even as the one year total shareholder return still hovers slightly negative. This hints that confidence is rebuilding.

If MetLife has you rethinking where dependable growth might come from next, it could be worth exploring insurance peers and other stable growth stocks screener (None results) to see how they stack up on quality and momentum.

With earnings rising faster than revenue and the shares still trading at a hefty discount to analyst targets and some intrinsic estimates, the key question now is whether MetLife is genuinely undervalued or whether the market is already pricing in that future growth.

Most Popular Narrative: 14.2% Undervalued

Compared to MetLife's last close at $79.82, the most widely followed narrative points to a meaningfully higher fair value anchored in long term earnings power.

Strategic expansion of asset light, fee generating businesses (like employee benefits, asset management, and longevity reinsurance), combined with disciplined capital management, supports higher return on equity and more consistent, less capital intensive earnings growth.

Want to see how steady revenue growth, rising margins, and a leaner share count combine into that upside view? The full narrative explains the underlying math step by step.

Result: Fair Value of $93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent interest rate volatility and credit losses on commercial mortgages could undermine the bullish earnings and valuation thesis if conditions materially deteriorate.

Find out about the key risks to this MetLife narrative.

Another Lens On Value

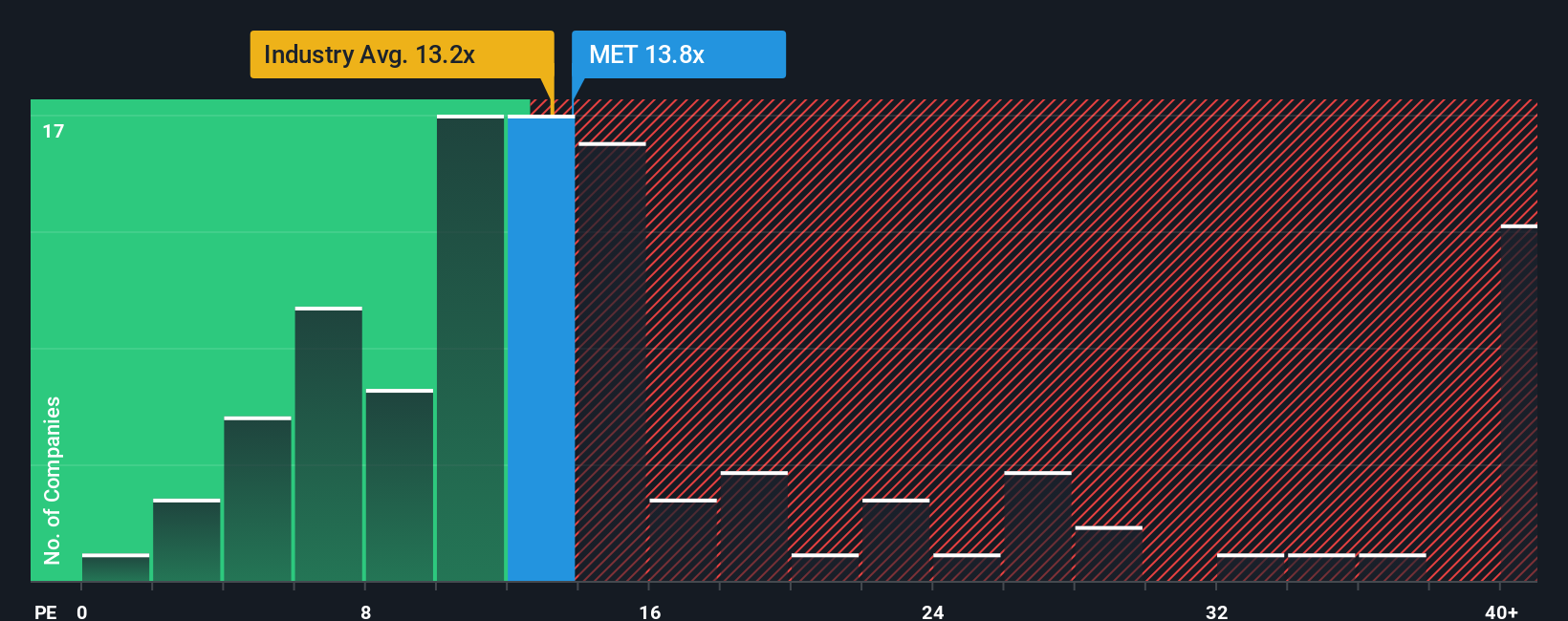

While the main narrative leans on long term earnings power, our ratio work paints a more cautious picture. MetLife trades on a 14.5x price to earnings ratio, richer than both the US insurance sector at 13x and peers at 13.8x, even though its fair ratio sits higher at 17x.

This gap suggests some upside if sentiment improves, but also leaves less room for disappointment if growth undershoots. Is the recent rerating the start of a longer catch up move, or is it close to what the market is willing to pay for now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MetLife Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way

A great starting point for your MetLife research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Do not stop at one opportunity. Use the Simply Wall Street Screener now to uncover stocks that match your strategy before the market moves without you.

- Identify potential value plays by scanning these 906 undervalued stocks based on cash flows that markets may be mispricing based on their long-term cash flows and fundamentals.

- Explore cutting edge innovation by targeting these 26 AI penny stocks positioned to benefit as artificial intelligence reshapes how businesses operate.

- Find income focused opportunities by reviewing these 12 dividend stocks with yields > 3% offering robust yields and the potential for reliable, recurring shareholder returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal