3 Asian Penny Stocks With Market Caps Up To US$500M

As global markets keep a close watch on the Federal Reserve's final meeting of the year, Asian markets are also navigating their own set of economic signals, such as manufacturing slowdowns and service sector expansions. In this context, penny stocks—often smaller or newer companies—continue to hold relevance as potential growth opportunities. Despite being an outdated term for some, these stocks can offer significant upside when backed by strong financial health and fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Oiltek International (SGX:HQU) | SGD0.675 | SGD289.57M | ✅ 4 ⚠️ 2 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.70 | HK$2.21B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.47 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.56 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.02 | SGD413.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.104 | SGD54.45M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.39 | SGD13.34B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.21 | ₱843.44M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$3.12 | NZ$258.17M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 963 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Uni-Bio Science Group (SEHK:690)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Uni-Bio Science Group Limited is an investment holding company that focuses on researching, developing, manufacturing, and selling biological and chemical pharmaceutical products for treating human diseases in the People’s Republic of China, with a market cap of HK$722.52 million.

Operations: The company's revenue is derived from Chemical Pharmaceutical Products, contributing HK$220.01 million, and Biological Pharmaceutical Products, generating HK$369.58 million.

Market Cap: HK$722.52M

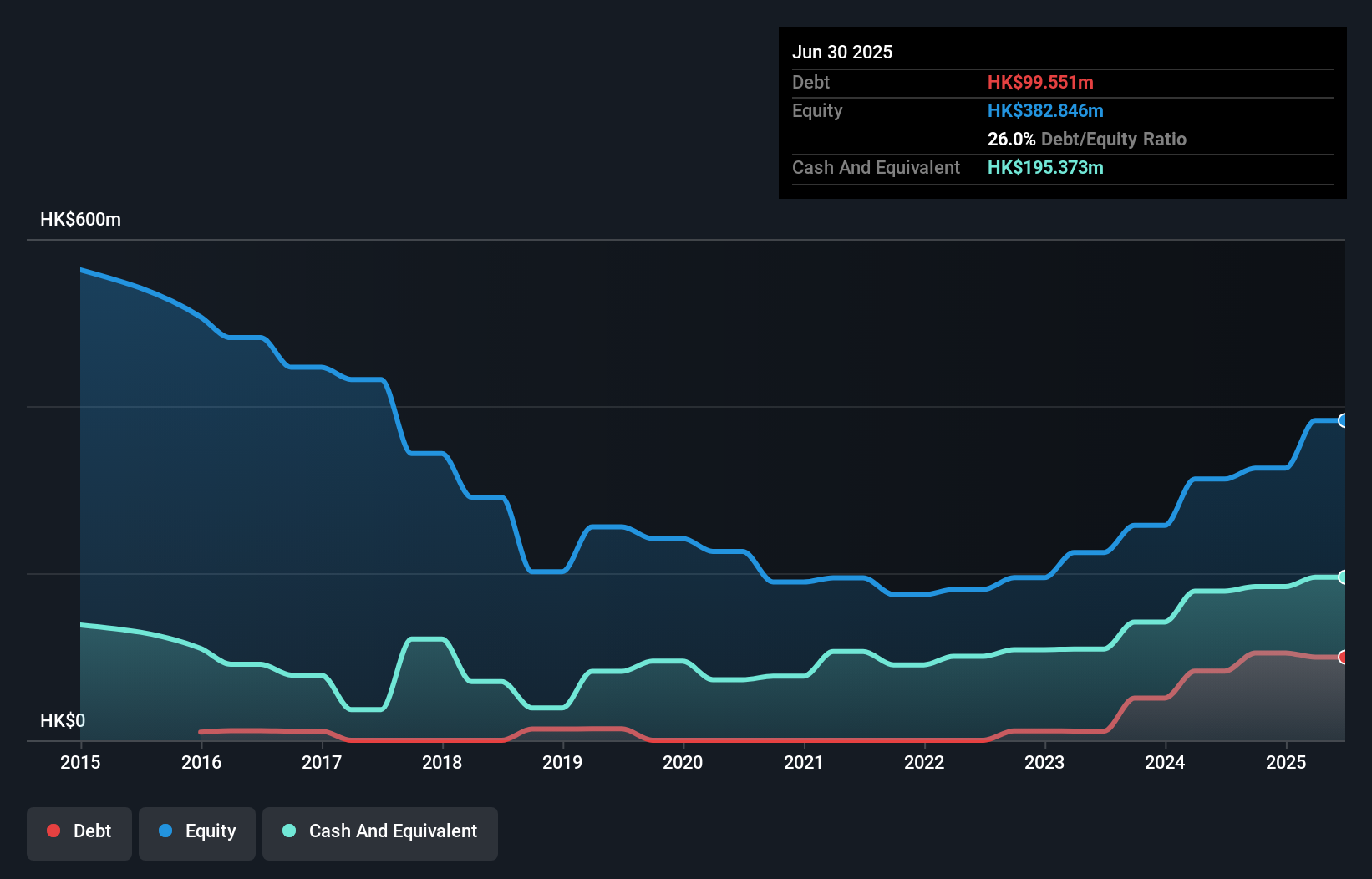

Uni-Bio Science Group's market cap stands at HK$722.52 million, with revenues from chemical and biological pharmaceutical products totaling HK$589.59 million. The company trades at a favorable price-to-earnings ratio of 7.9x compared to the Hong Kong market average of 12.3x, suggesting good value for investors seeking penny stocks in Asia. Financially robust, its short-term assets significantly exceed liabilities, and it maintains more cash than total debt, ensuring strong liquidity positions. Despite recent negative earnings growth and declining profit margins from last year, its return on equity remains high at 23.9%, indicating efficient management of shareholder funds.

- Navigate through the intricacies of Uni-Bio Science Group with our comprehensive balance sheet health report here.

- Understand Uni-Bio Science Group's track record by examining our performance history report.

Pizu Group Holdings (SEHK:9893)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pizu Group Holdings Limited is an investment holding company involved in the manufacturing, trading, and sales of civil explosives in the People's Republic of China and Tajikistan, with a market cap of HK$3.42 billion.

Operations: The company generates revenue from two main segments: Mining Operation, contributing CN¥965.07 million, and Explosives Trading and Blasting Services, which accounts for CN¥619.40 million.

Market Cap: HK$3.42B

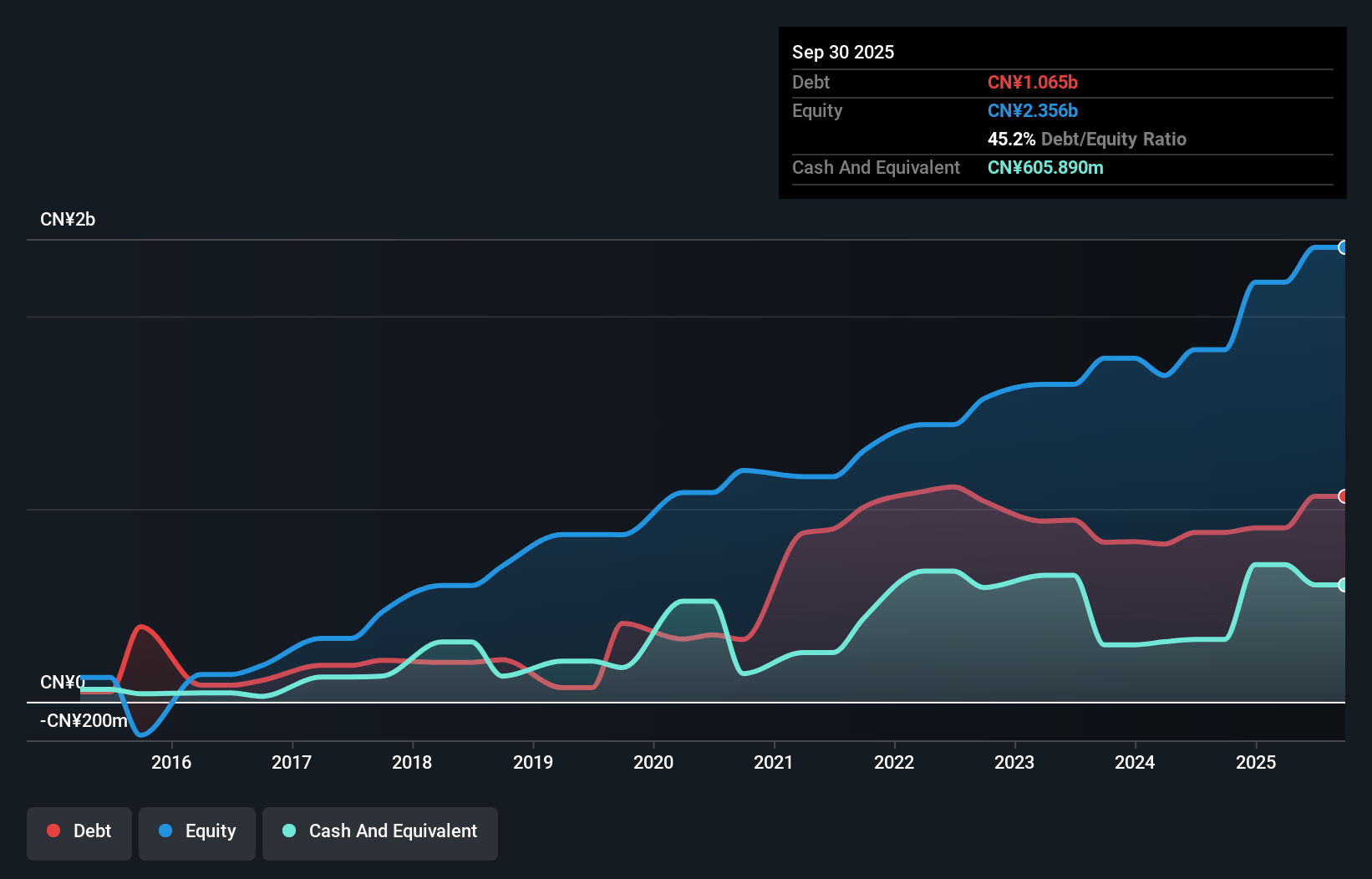

Pizu Group Holdings, with a market cap of HK$3.42 billion, shows potential within the penny stock segment despite some challenges. The company has experienced significant earnings growth over the past year at 57.5%, surpassing its 5-year average decline of 3.1%. However, it faces volatility with a highly fluctuating share price in recent months and significant insider selling. Pizu's financials reveal short-term assets of CN¥1.3 billion that don't fully cover short-term liabilities of CN¥1.4 billion, though its debt is well-covered by operating cash flow (47.2%). Recent earnings reports indicate improved net income and profit margins compared to last year.

- Take a closer look at Pizu Group Holdings' potential here in our financial health report.

- Learn about Pizu Group Holdings' historical performance here.

CnlightLtd (SZSE:002076)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cnlight Co., Ltd is a company that manufactures and sells lighting products in China, with a market cap of CN¥2.37 billion.

Operations: Cnlight Co., Ltd does not report specific revenue segments.

Market Cap: CN¥2.37B

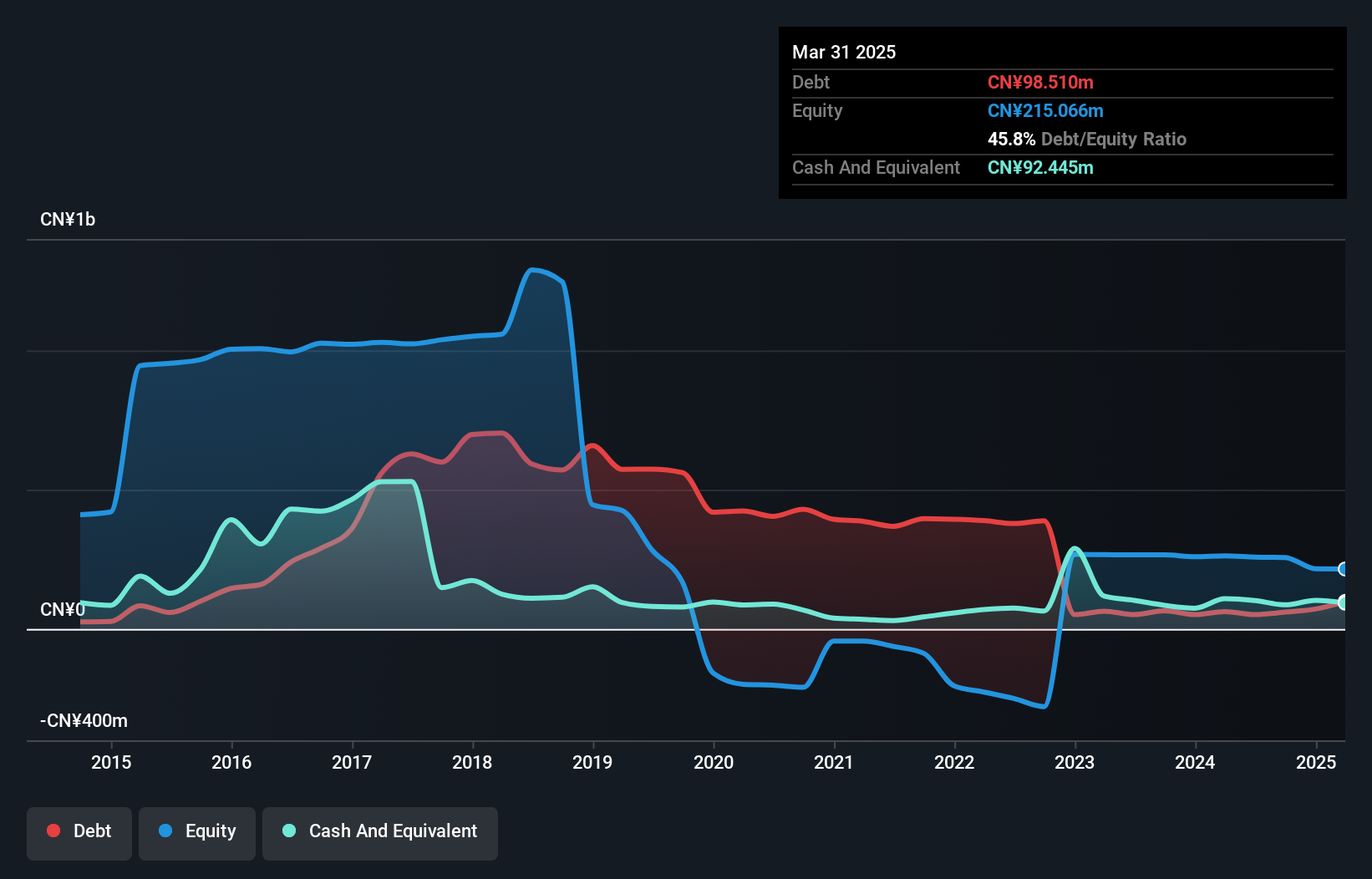

Cnlight Co., Ltd, with a market cap of CN¥2.37 billion, has shown progress in its financial performance despite being unprofitable. The company reported sales of CN¥168.65 million for the first nine months of 2025, up from CN¥123.98 million the previous year, and achieved a net income of CN¥3.2 million compared to a loss last year. Cnlight's short-term assets (CN¥380.7M) exceed both its short-term and long-term liabilities, indicating solid liquidity management. The company's debt levels are satisfactory with a net debt to equity ratio of 2.7%, and it boasts an experienced board and management team.

- Click here to discover the nuances of CnlightLtd with our detailed analytical financial health report.

- Gain insights into CnlightLtd's historical outcomes by reviewing our past performance report.

Taking Advantage

- Get an in-depth perspective on all 963 Asian Penny Stocks by using our screener here.

- Curious About Other Options? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal