Asian Growth Stocks With Strong Insider Ownership

As global markets grapple with economic uncertainties and interest rate speculations, Asia's stock markets have shown resilience, particularly in sectors like technology and artificial intelligence. In this environment, growth companies with high insider ownership often stand out as they can signal confidence in a company's future prospects.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| Suzhou Sunmun Technology (SZSE:300522) | 33.2% | 93.1% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's review some notable picks from our screened stocks.

Sichuan Yahua Industrial Group (SZSE:002497)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sichuan Yahua Industrial Group Co., Ltd. engages in the research, production, and sale of civil explosive equipment and blasting engineering services both in China and internationally, with a market cap of CN¥25.12 billion.

Operations: The company's revenue segments include the research, production, and sale of civil explosive equipment and blasting engineering services in both domestic and international markets.

Insider Ownership: 16.1%

Revenue Growth Forecast: 20.9% p.a.

Sichuan Yahua Industrial Group's revenue is forecast to grow over 20% annually, outpacing the Chinese market. Despite recent high volatility in share price, earnings are expected to increase significantly at 40% per year. The company recently reported a substantial rise in net income for the first nine months of 2025, with sales reaching CNY 6.05 billion. However, its Return on Equity is projected to be low at 10.3%, and there have been no significant insider trading activities recently.

- Click here to discover the nuances of Sichuan Yahua Industrial Group with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Sichuan Yahua Industrial Group's current price could be quite moderate.

Hubei Feilihua Quartz Glass (SZSE:300395)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hubei Feilihua Quartz Glass Co., Ltd. specializes in the research, development, and production of quartz material and quartz fiber products for both domestic and international markets, with a market cap of CN¥46.99 billion.

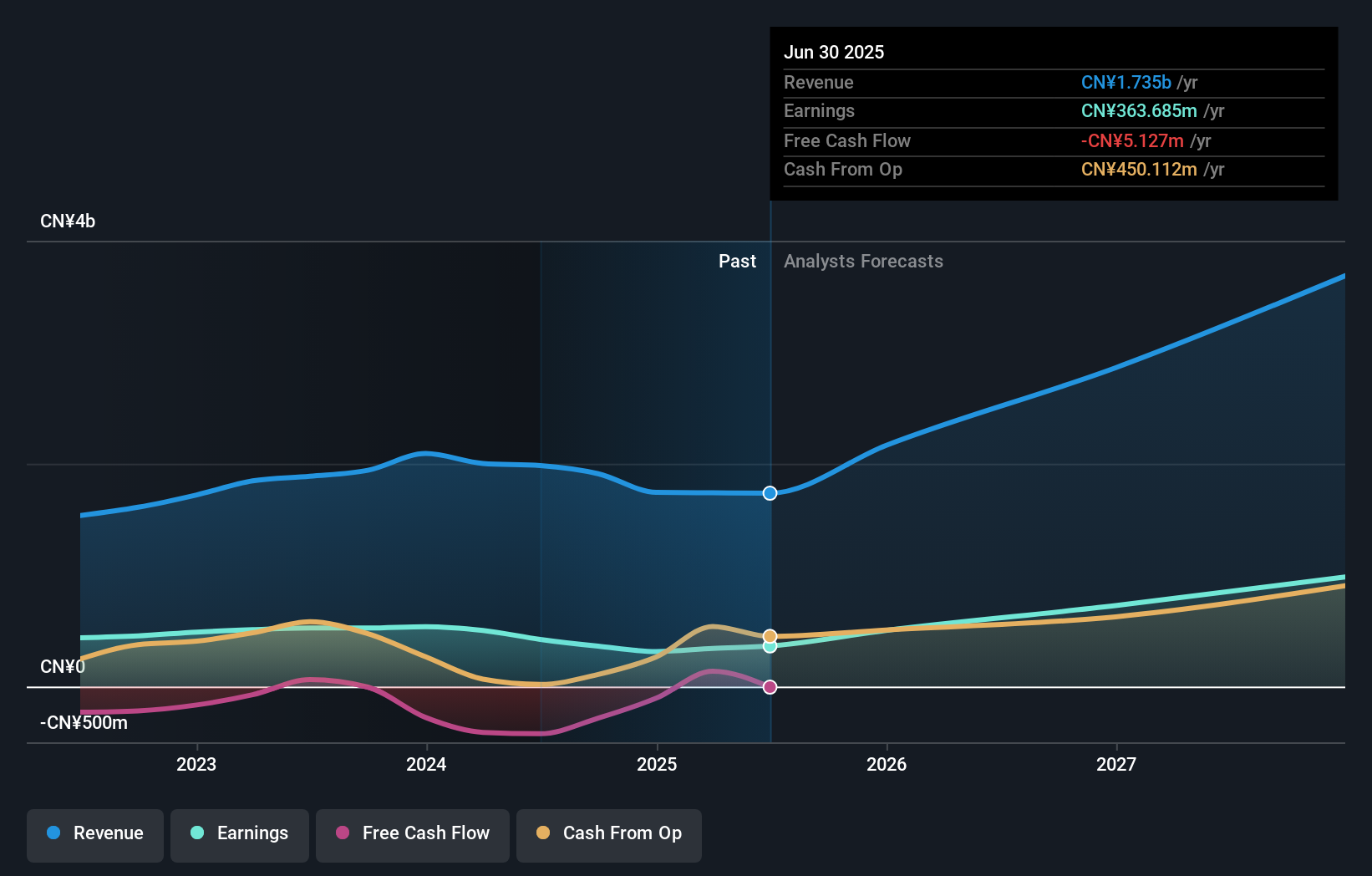

Operations: The company generates its revenue primarily from the Non-Metallic Mineral Products Industry, amounting to CN¥1.77 billion.

Insider Ownership: 17.6%

Revenue Growth Forecast: 30.9% p.a.

Hubei Feilihua Quartz Glass is expected to see revenue growth of 30.9% annually, surpassing the Chinese market average. Earnings are forecasted to grow significantly at 37.3% per year, although Return on Equity is projected to be modest at 15.5%. Recent earnings showed net income rising to CNY 333.73 million for the first nine months of 2025, up from CNY 234.65 million a year earlier, despite high share price volatility and no recent substantial insider trading activities.

- Get an in-depth perspective on Hubei Feilihua Quartz Glass' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Hubei Feilihua Quartz Glass' share price might be on the expensive side.

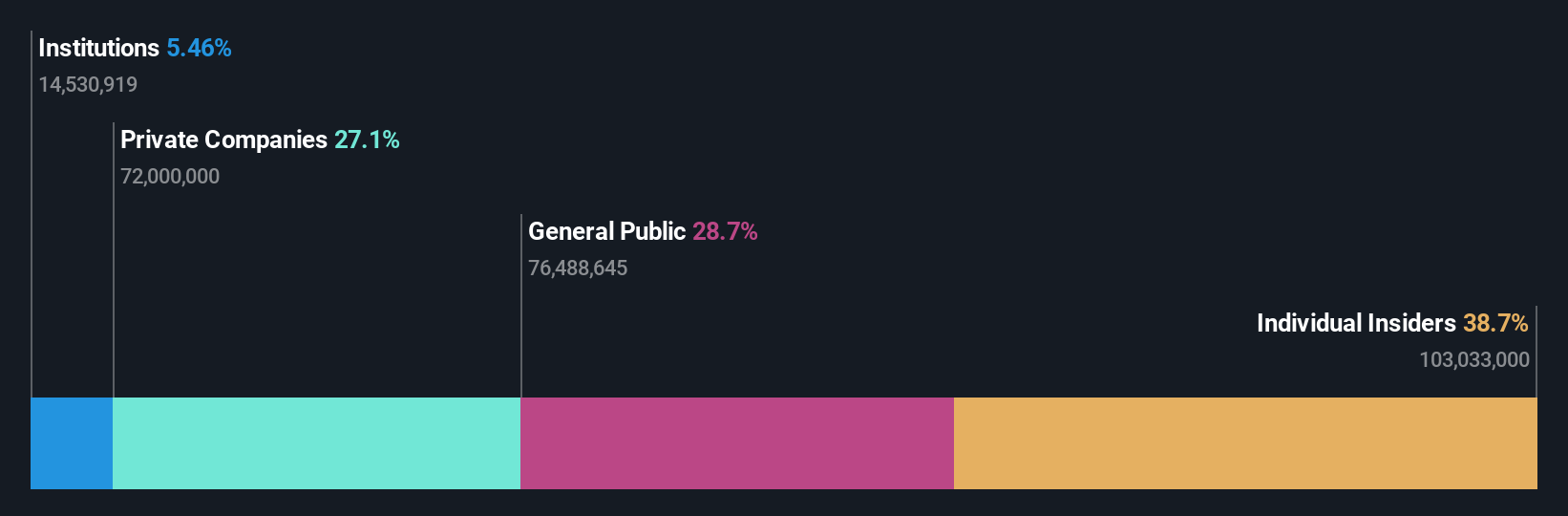

Guangdong Shenling Environmental Systems (SZSE:301018)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Shenling Environmental Systems Co., Ltd. operates in the environmental systems industry and has a market cap of CN¥14.75 billion.

Operations: Guangdong Shenling Environmental Systems Co., Ltd. generates its revenue from various segments within the environmental systems industry, contributing to its market cap of CN¥14.75 billion.

Insider Ownership: 38.7%

Revenue Growth Forecast: 26% p.a.

Guangdong Shenling Environmental Systems shows promising growth potential, with revenue expected to increase by 26% annually, outpacing the Chinese market. Earnings are forecasted to grow significantly at 68.5% per year. Recent earnings for the first nine months of 2025 indicated a rise in net income to CNY 150.09 million from CNY 142.87 million last year, despite experiencing high share price volatility and no substantial insider trading activity recently.

- Click to explore a detailed breakdown of our findings in Guangdong Shenling Environmental Systems' earnings growth report.

- Our expertly prepared valuation report Guangdong Shenling Environmental Systems implies its share price may be too high.

Taking Advantage

- Access the full spectrum of 637 Fast Growing Asian Companies With High Insider Ownership by clicking on this link.

- Searching for a Fresh Perspective? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal