Ross Stores (ROST) Q3 2026: Margin Slippage Tests Bullish Profitability Narrative

Ross Stores (ROST) has just posted Q3 2026 results with revenue of about $5.6 billion, basic EPS of $1.59 and net income of roughly $512 million, setting the stage for another closely watched update from the off price chain. The company has seen quarterly revenue move from around $5.1 billion in Q3 2025 to $5.6 billion in Q3 2026, while basic EPS stepped up from $1.49 to $1.59 over the same period, giving investors a clearer view of how sales scale is feeding into per share profitability. With net profit margin now sitting slightly below last year, the story this quarter focuses on how effectively Ross is converting its growing sales base into sustainable earnings power.

See our full analysis for Ross Stores.With the headline numbers on the table, the next step is to see how this latest earnings print lines up with the prevailing narratives around Ross, including growth durability and margin resilience.

See what the community is saying about Ross Stores

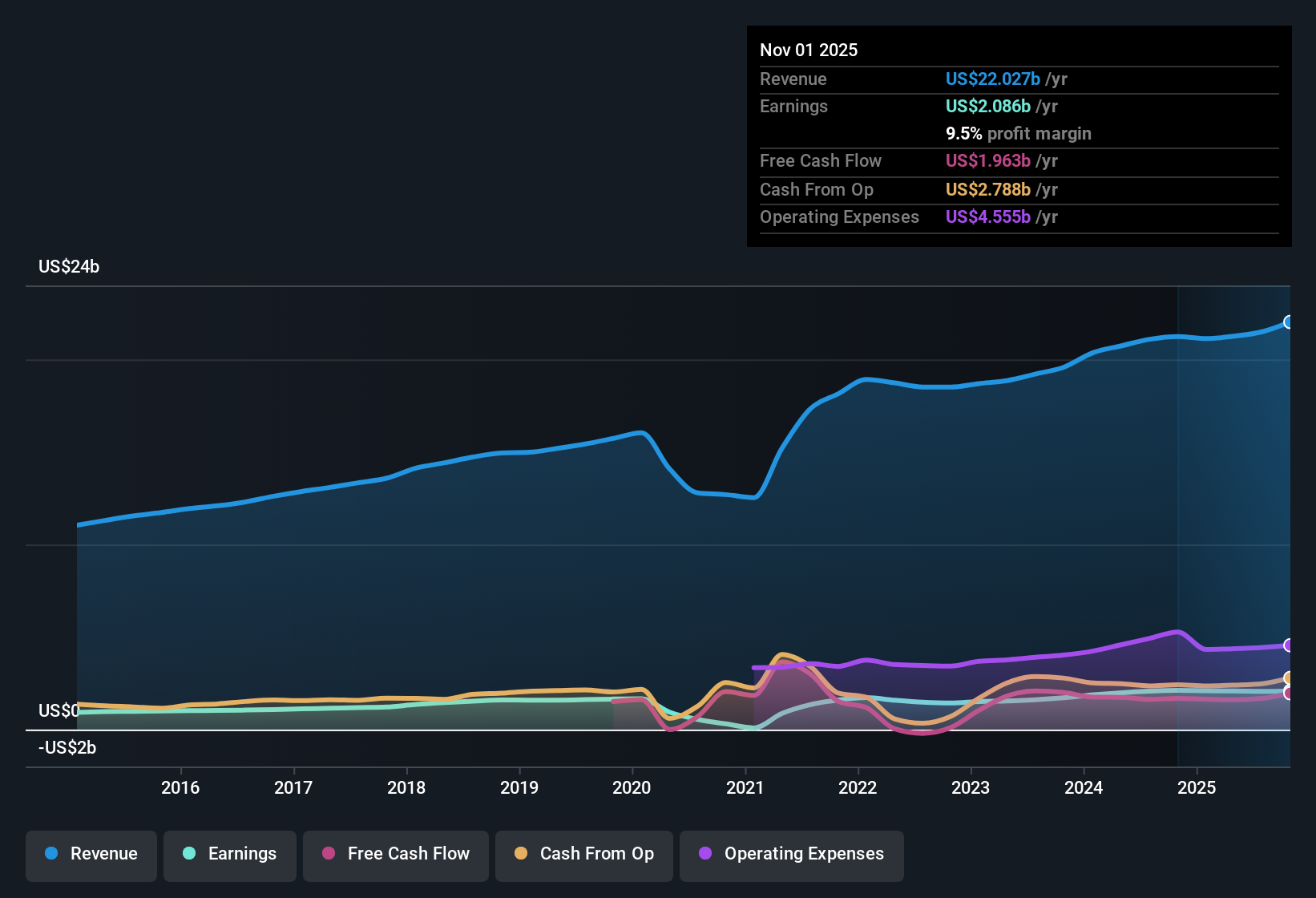

Margins Ease Back To 9.5 Percent

- Net profit margin over the last year sits at 9.5 percent, slightly lower than the 10.0 percent recorded a year earlier.

- Bears highlight that one year earnings have declined and margins slipped, and

- they point to the 50 basis point margin step down plus operating margin pressure of about 95 basis points in the latest period as signs that higher tariffs and distribution costs are biting into profitability,

- yet the longer term record of earnings growing about 19.4 percent annually over five years shows that profitability has held up across cycles even with these recent cost headwinds.

Five Year Earnings Growth Versus 6 Point 4 Percent Outlook

- Earnings have compounded at about 19.4 percent per year over the past five years, while analysts now expect a slower 6.4 percent annual increase going forward.

- Supporters of the bullish view see that five year growth record as evidence of durable earnings power, and

- they link it to Ross reaching trailing twelve month net income of roughly 2.1 billion dollars on revenue of about 22.0 billion dollars, which backs the idea that its off price model scales well,

- but the step down to a mid single digit earnings growth forecast forces bulls to argue that new store openings, merchandising improvements and supply chain projects can keep that growth engine running closer to its historical pace.

Premium Valuation Versus DCF Fair Value

- The stock trades at about 181.82 dollars, above the DCF fair value estimate of roughly 146.82 dollars and on a 28.2 times P E that exceeds peer 22.5 times and industry 19.4 times levels.

- Critics focus on this valuation gap as a key risk, and

- they argue that paying a premium P E multiple and a price above DCF fair value leaves little room for disappointment when revenue is only forecast to grow about 5.1 percent annually,

- while supporters counter that solid trailing earnings of around 2.1 billion dollars and expected 6.4 percent annual earnings growth justify some premium, especially given the absence of notable insider selling in the last three months.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ross Stores on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use your own lens on the latest figures, then quickly turn that view into a complete narrative in minutes, Do it your way.

A great starting point for your Ross Stores research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Ross’s softer margins, premium valuation versus DCF fair value, and slowing earnings outlook raise the risk that investors are overpaying for more modest growth.

If that rich pricing and decelerating momentum concern you, use our these 905 undervalued stocks based on cash flows today to quickly surface candidates where cash flow strength and valuation still look skewed in your favor.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal