Telefónica’s Long-Term LaLiga Rights Deal Might Change The Case For Investing In Telefónica (BME:TEF)

- In November 2025, Telefónica Audiovisual Digital, S.A.U. was provisionally awarded exclusive pay-TV rights in Spain to five LaLiga matches per matchday through the 2031–32 season, including first pick in 19 matchdays each year, for a total fee of €2.64 billion (about €527.17 million per season).

- The award underpins Telefónica’s plan to keep Movistar Plus+ customers accessing all LaLiga fixtures alongside its recently secured European football competitions, reinforcing its position as a key premium sports content provider in Spain.

- We’ll now examine how locking in exclusive LaLiga matches through 2032 could influence Telefónica’s broader investment narrative and long-term positioning.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Telefónica Investment Narrative Recap

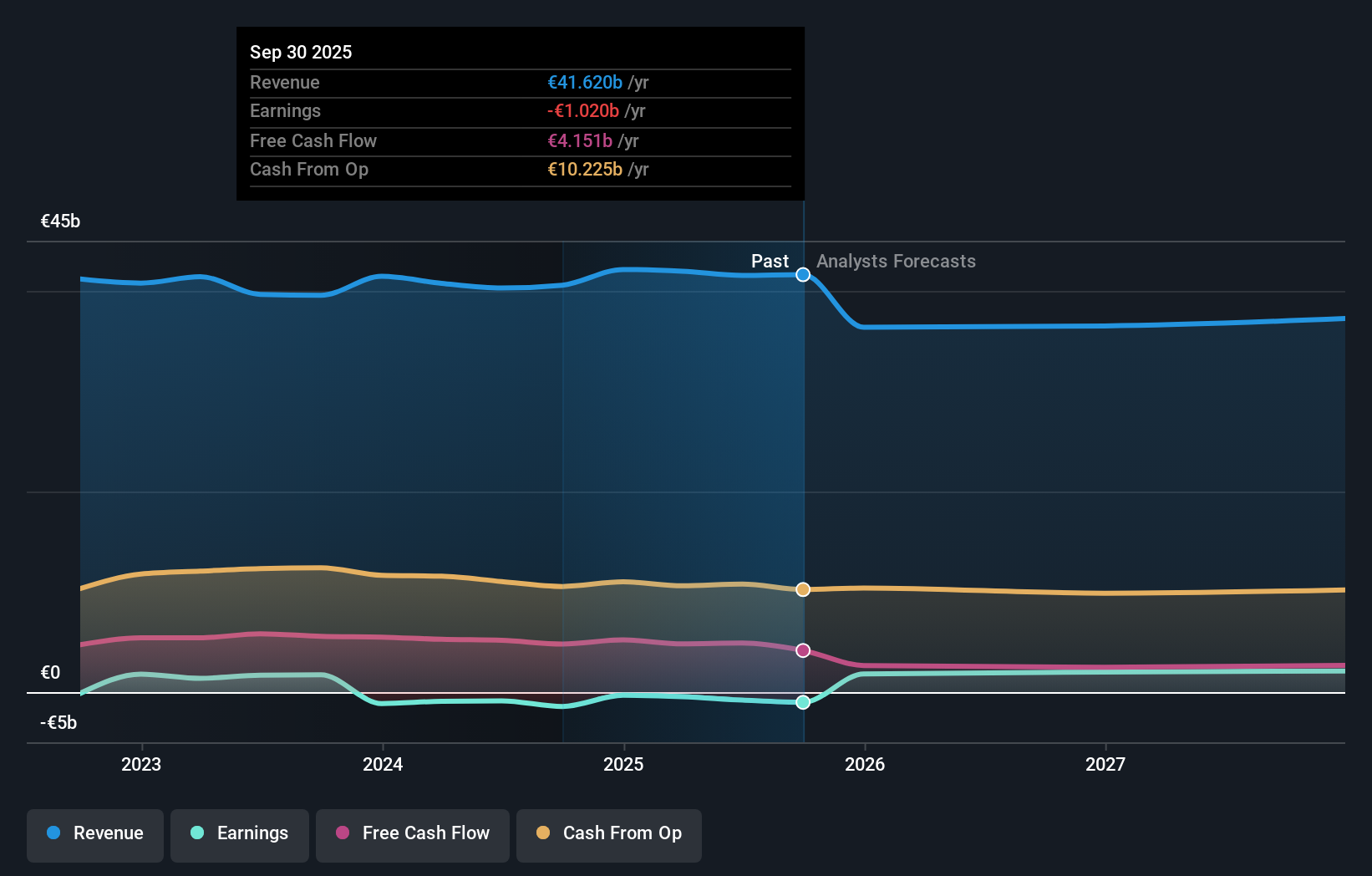

To own Telefónica, you need to believe it can turn high-quality networks and premium content into stable cash flow while managing its sizeable debt and muted growth in core markets. The provisional €2.64 billion LaLiga rights award tightens the link between Movistar Plus+ and Spanish football, potentially supporting customer stickiness, but it also adds to capital commitments at a time when high leverage and weaker earnings are key near term concerns.

This LaLiga deal sits alongside Telefónica’s recent win of UEFA Champions League and other European competition rights for 2027 to 2031, extending its premium sports portfolio across domestic and international football. Together, these rights could reinforce the pay TV and convergent bundle proposition just as the company seeks margin gains from network modernization and portfolio simplification in its core markets.

However, against this backdrop of premium content investment, the scale of Telefónica’s existing debt load is something investors should be aware of...

Read the full narrative on Telefónica (it's free!)

Telefónica’s narrative projects €38.3 billion revenue and €2.2 billion earnings by 2028.

Uncover how Telefónica's forecasts yield a €4.51 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community value Telefónica between €4.51 and €9.24 per share, highlighting very different expectations for upside. Some of that gap reflects how differently people weigh the benefits of premium sports rights against the constraints of Telefónica’s high leverage and recent losses.

Explore 5 other fair value estimates on Telefónica - why the stock might be worth over 2x more than the current price!

Build Your Own Telefónica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telefónica research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Telefónica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telefónica's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal