Powell's Hawk fell short of expectations + “mini QE” detonated the market! The dollar plummeted, and US debt and precious metals went hand in hand

The Zhitong Finance App learned that since Federal Reserve Chairman Powell's speech at the press conference was not as hawkish as the market expected, and the Federal Reserve announced that it would buy 40 billion US dollars of short-term treasury bonds every month starting December 12, the US dollar fell, while US debt and precious metals rose in response.

According to the data, the US dollar index (DXY) fell 0.59% to 98.64; the Bloomberg US dollar spot index closed down 0.4%, the biggest one-day decline since September 16. In terms of US bonds, US bond yields fell across the board, falling from a multi-month high. As of press release, the 2-year US Treasury yield, which is sensitive to the Federal Reserve's policy, fell to 3.524%, while the 10-year US Treasury yield fell to 4.14%. Precious metals rose as the dollar and US Treasury yields declined. As of press release, spot gold rose slightly to 4232.90 US dollars/ounce, and spot silver rose to 61.90 US dollars/ounce.

The Federal Open Market Committee of the Federal Reserve cut interest rates as scheduled on Wednesday and decided to lower the federal funds rate by 25 basis points to the 3.5%-3.75% range with a 9-3 vote. The committee also fine-tuned the wording in the statement, implying that there is greater uncertainty about when to cut interest rates in the future.

Powell said at a press conference after the interest rate decision was announced that the current policy adjustments will help stabilize the weakening labor market while maintaining sufficient austerity conditions to suppress inflation. He said, “As the impact of tariffs gradually subsides, this further policy normalization should support employment and reduce inflation back to the 2% target.”

Regarding inflation, Powell stressed that the current inflation rate exceeds the Fed's 2% target mainly due to the Trump administration's increase in import tariffs. He reiterated that the impact of tariffs on inflation may only be a “one-time increase in prices.”

Powell said that since September, the adjustment of the Commission's policy position has kept it within neutral expectations, which enables them to better determine the extent and timing of further policy interest rate adjustments based on the latest data, changing economic prospects, and risk balance.

Powell pointed out that in the Federal Open Market Committee's economic forecast summary, participants separately assessed the appropriate path for the federal funds rate in the most likely economic scenario. The median forecast for the federal funds rate at the end of 2026 is 3.4%, and the end of 2027 is 3.1%, in line with the September forecast. However, these predictions are uncertain and are not the Committee's plans or decisions. Monetary policy is not a predetermined course; they will make decisions based on the specific circumstances of each meeting.

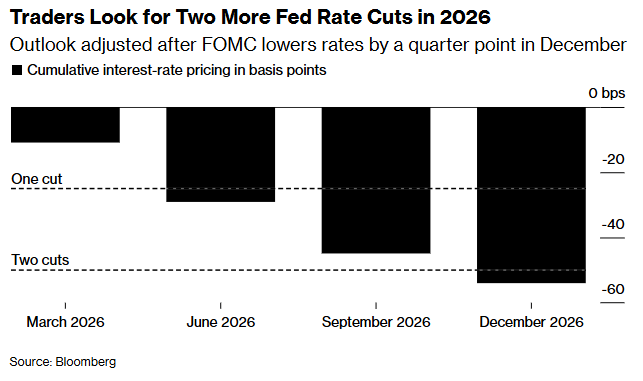

Although the Fed's forecast for 2026 interest rates means that it will cut interest rates once by 25 basis points, traders are still betting that the Fed will cut interest rates twice next year. Currently, the Fed is expected to cut interest rates once each in June and the fourth quarter of next year.

Traders bet the Fed will cut interest rates twice in 2026

The market believes that the tone of Powell's speech at the press conference was not as hawkish as previously anticipated. Economist Anna Wong (Anna Wong) said, “Overall, the tone of the statement and updated predictions are dovish.” Bank of America strategist Alex Cohen (Alex Cohen) said, “Compared to what we saw in previous predictions, Powell's view of the labor market is less optimistic.” He added that Powell's remarks about jobs and inflation triggered a fall in the dollar. Nathan Thooft (Nathan Thooft), senior portfolio manager at Manulife Investment Management, also pointed out that the market expected the Fed to adopt a rather hawkish tone, “but Powell is more dovish.”

Priya Misra (Priya Misra), portfolio manager at J.P. Morgan Chase Investment Management, said: “The overall message of the press conference is that even if the federal funds rate is within the range of most neutral estimates, the Federal Reserve will remain flexible and dependent on data.” “Powell seems concerned about the weakness of the labor market, which shows that the trend towards easing policies still exists.”

Wells Fargo strategist Aroop Chatterjee (Aroop Chatterjee) stressed that the latest labor market and inflation readings will be “more critical” than Wednesday's policy decisions for the dollar.

Jack McIntyre (Jack McIntyre), portfolio manager at Brandywine Global Investment Management, said: “At the end of the day, everyone was expecting a hawkish interest rate cut, but the results fell short of expectations, so the US debt may have rebounded with relief.”

Furthermore, more importantly, the Federal Reserve announced a key liquidity management measure, purchasing 40 billion US dollars of treasury bonds every month starting December 12 to rebuild banking system reserves that declined sharply during the downsizing period. The statement pointed out that as balance sheet (QT) reductions have progressed previously, reserves have fallen to the “lower limit of an adequate level”, so it is necessary to “continue to maintain an adequate supply of reserves” in the future by purchasing short-term US bonds. The volume of purchases is expected to remain high for a few months before shrinking significantly.

The Federal Reserve stressed that this move is entirely reserve management and does not mean restarting quantitative easing (QE). Unlike the nature of policies that depress long-term interest rates and stimulate the economy during the crisis, this round of operations mainly targets the stable needs of the capital market.

Although the Federal Reserve stated that this move was not quantitative easing, for the market, the Fed's re-becoming a “net buyer” of bonds is a sign of improved liquidity, and improved liquidity is the “fuel” driving asset prices.

Gennadiy Goldberg (Gennadiy Goldberg), head of interest rate strategy at TD Securities, said: “We had expected an announcement in January, but it looks like the Federal Reserve decided to start reserve management purchases earlier. This announcement is even more dovish for the market.”

Bart Melek (Bart Melek), head of global commodity strategy at TD Securities, said the move was “similar to mini quantitative easing, although these are liquidity measures.” He added that overall, this interest rate decision date should be positive for gold in the short term. He also pointed out that the market expects the new chairman of the Federal Reserve that the Trump administration will appoint in May next year is likely to be a “dovish” figure, which means that “gold will have good support until the beginning of 2026.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal