Beiersdorf (XTRA:BEI) Valuation Check as NIVEA Nigeria Launches Major Loyalty and Rewards Campaign

Beiersdorf (XTRA:BEI) is turning heads after NIVEA Nigeria launched a N3 billion rewards campaign, mixing cash prizes, SUVs, and Real Madrid trips to fire up consumer loyalty in a tough macro backdrop.

See our latest analysis for Beiersdorf.

That push into Nigeria comes as Beiersdorf’s share price, now around $92.82, has seen a 1 day share price return of 1.44 percent but a much weaker year to date share price return of minus 24.96 percent, and a 1 year total shareholder return of minus 24.75 percent. This suggests sentiment is still rebuilding despite solid underlying growth.

If this kind of brand driven growth story interests you, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With the shares trading at a steep discount to analyst targets despite steady revenue and profit growth, investors now face a crucial question: Is Beiersdorf undervalued here, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 20.4% Undervalued

With Beiersdorf closing at €92.82 against a narrative fair value of €116.58, the gap reflects confident expectations for steady, compounding earnings power.

Analysts are assuming Beiersdorf's revenue will grow by 3.8 percent annually over the next 3 years.

Analysts assume that profit margins will increase from 8.9 percent today to 10.8 percent in 3 years time.

Want to see what happens when modest revenue growth meets rising margins and a richer earnings multiple, usually reserved for sector leaders and not staples like this?

Result: Fair Value of $116.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from local and private label brands, alongside persistent retailer pressure in Europe, could quickly undermine the current growth and margin narrative.

Find out about the key risks to this Beiersdorf narrative.

Another View: Earnings Multiple Sends a Different Signal

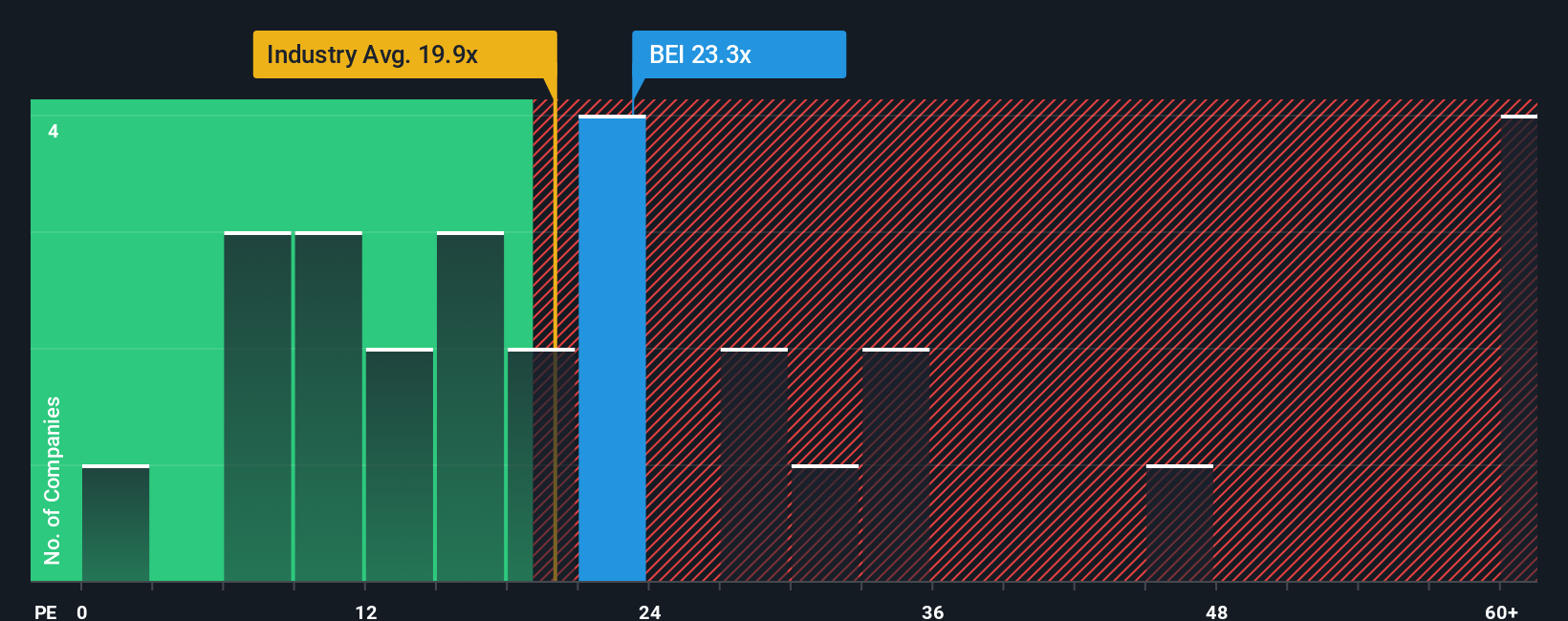

While the narrative fair value suggests upside, Beiersdorf’s 23x price to earnings ratio looks demanding against the European personal products industry at 18.9x, and even above its own 18.6x fair ratio. Peers average 30.8x, but if sentiment normalizes, could this premium compress rather than expand?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Beiersdorf Narrative

If you see the story differently or want to stress test the numbers yourself, you can craft a custom narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Beiersdorf.

Ready for more high conviction ideas?

Do not stop at a single opportunity when the market is full of mispriced potential. Use the Simply Wall Street Screener today to spot your next winning move.

- Catch powerful long term compounding potential early by scanning these 906 undervalued stocks based on cash flows that the market has not fully priced in yet.

- Capitalize on disruptive innovation trends by targeting these 26 AI penny stocks positioned at the heart of artificial intelligence adoption.

- Strengthen your income strategy by filtering for these 12 dividend stocks with yields > 3% that can support regular cash returns alongside capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal