FUJIFILM Holdings Corporation's (TSE:4901) Earnings Haven't Escaped The Attention Of Investors

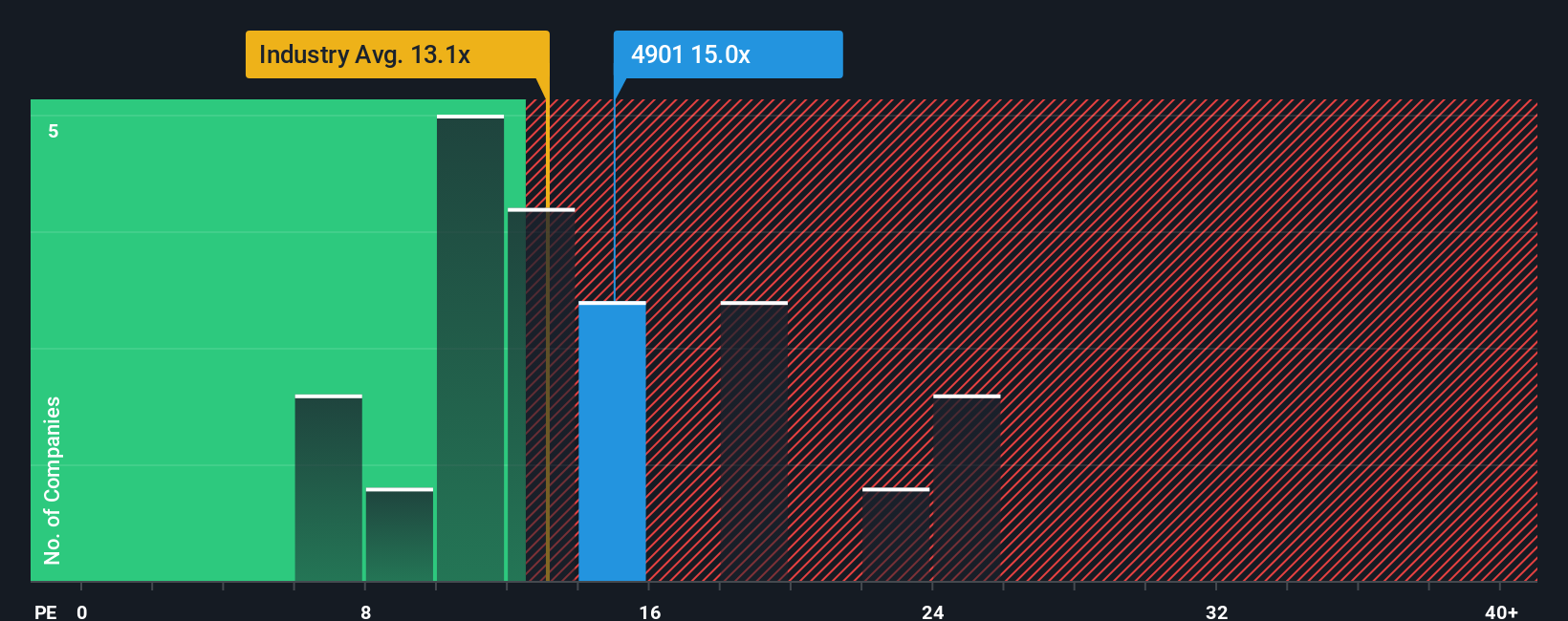

There wouldn't be many who think FUJIFILM Holdings Corporation's (TSE:4901) price-to-earnings (or "P/E") ratio of 15x is worth a mention when the median P/E in Japan is similar at about 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

There hasn't been much to differentiate FUJIFILM Holdings' and the market's earnings growth lately. The P/E is probably moderate because investors think this modest earnings performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

View our latest analysis for FUJIFILM Holdings

Does Growth Match The P/E?

In order to justify its P/E ratio, FUJIFILM Holdings would need to produce growth that's similar to the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 13% last year. The solid recent performance means it was also able to grow EPS by 29% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 7.8% each year during the coming three years according to the analysts following the company. With the market predicted to deliver 9.1% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's understandable that FUJIFILM Holdings' P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of FUJIFILM Holdings' analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for FUJIFILM Holdings that you should be aware of.

Of course, you might also be able to find a better stock than FUJIFILM Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal