Despite shrinking by HK$95m in the past week, China Success Finance Group Holdings (HKG:3623) shareholders are still up 35% over 3 years

While China Success Finance Group Holdings Limited (HKG:3623) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 23% in the last quarter. In contrast the stock is up over the last three years. However, it's unlikely many shareholders are elated with the share price gain of 35% over that time, given the rising market.

Although China Success Finance Group Holdings has shed HK$95m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

China Success Finance Group Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years China Success Finance Group Holdings saw its revenue shrink by 22% per year. The falling revenue is arguably somewhat reflected in the lacklustre return of 11% per year over three years, which falls short of the market return. Profit focussed investors would generally avoid a company with falling revenue and zero profits, since it's hard to imagine when profit might come.

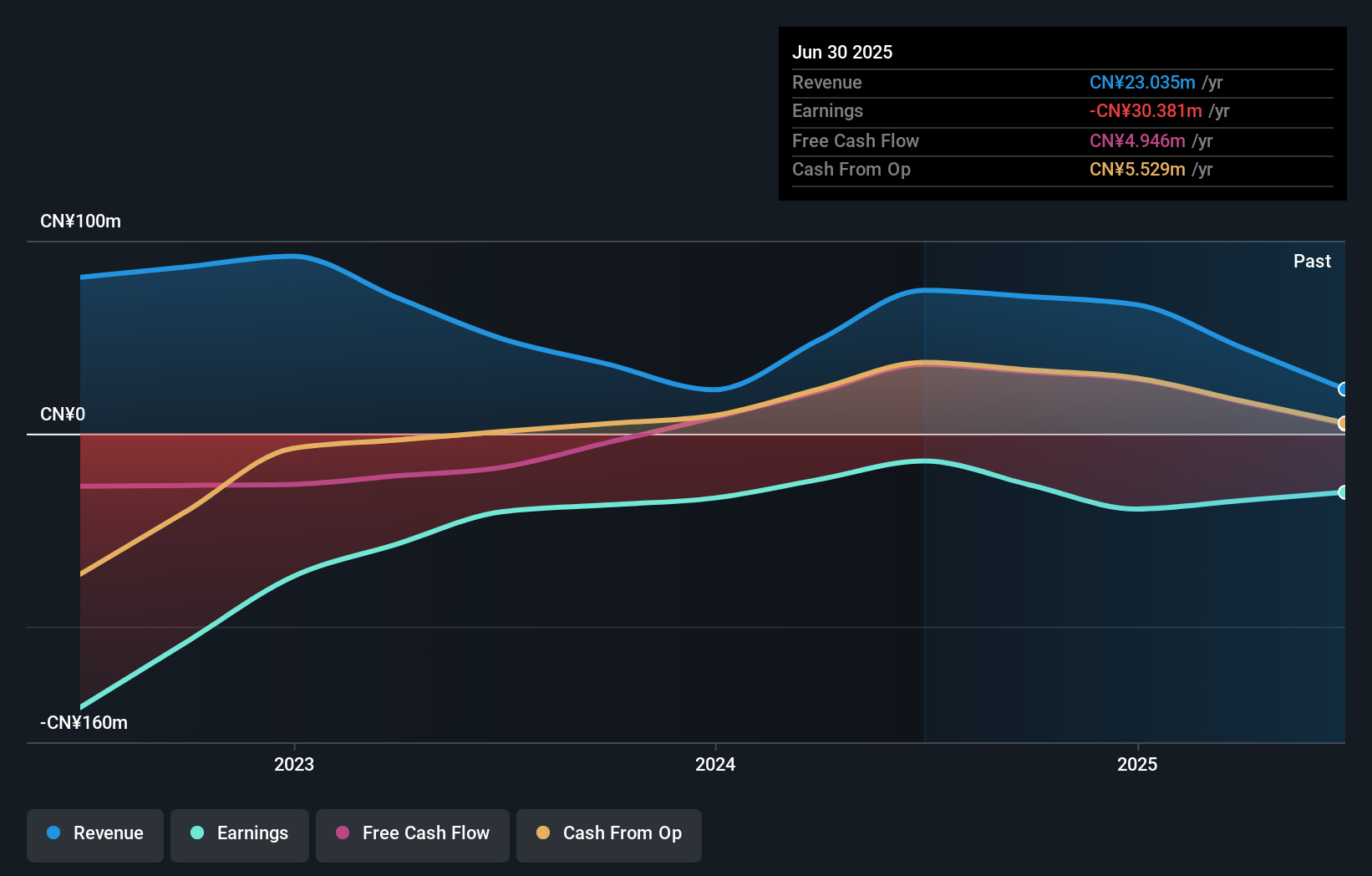

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

China Success Finance Group Holdings shareholders are up 26% for the year. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 1.6% per year over five year. This suggests the company might be improving over time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for China Success Finance Group Holdings that you should be aware of.

Of course China Success Finance Group Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal