Reassessing ONE Gas (OGS) Valuation After Recent Share Price Pullback

ONE Gas (OGS) has been quietly slipping over the past week and month, even though its year to date and 1 year returns are still comfortably positive. That disconnect is worth unpacking.

See our latest analysis for ONE Gas.

With the share price now around $77.64, the recent 7 day and 30 day share price declines sit in sharp contrast to a double digit year to date share price return and solid 1 year total shareholder return. This suggests momentum has cooled, but the longer term trend remains constructive.

If ONE Gas has you reassessing where steady utilities fit in your portfolio, it might also be worth exploring healthcare stocks for a different mix of defensive growth ideas.

That mixed picture, plus a modest discount to analyst targets, raises the key question: Is ONE Gas a quietly undervalued compounder, or is the steady growth story already fully reflected in today’s price?

Most Popular Narrative: 9.8% Undervalued

With ONE Gas closing at $77.64 against a narrative fair value of about $86.07, the story frames current pricing as a modest opportunity, not excess.

Supportive Texas legislation and interest rate tailwinds are viewed as structural positives that can enhance cash flow durability and reduce perceived risk, which some analysts believe justifies higher price targets.

Want to see what kind of future earnings path supports this gap, and why a traditionally steady utility is getting premium style assumptions? The narrative unpacks growth, margin shifts, and a forward valuation multiple that might surprise anyone used to plain vanilla utility pricing.

Result: Fair Value of $86.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative depends on flawless regulatory support and disciplined capex, and any setback in those areas could quickly undermine the current valuation case.

Find out about the key risks to this ONE Gas narrative.

Another View on Value

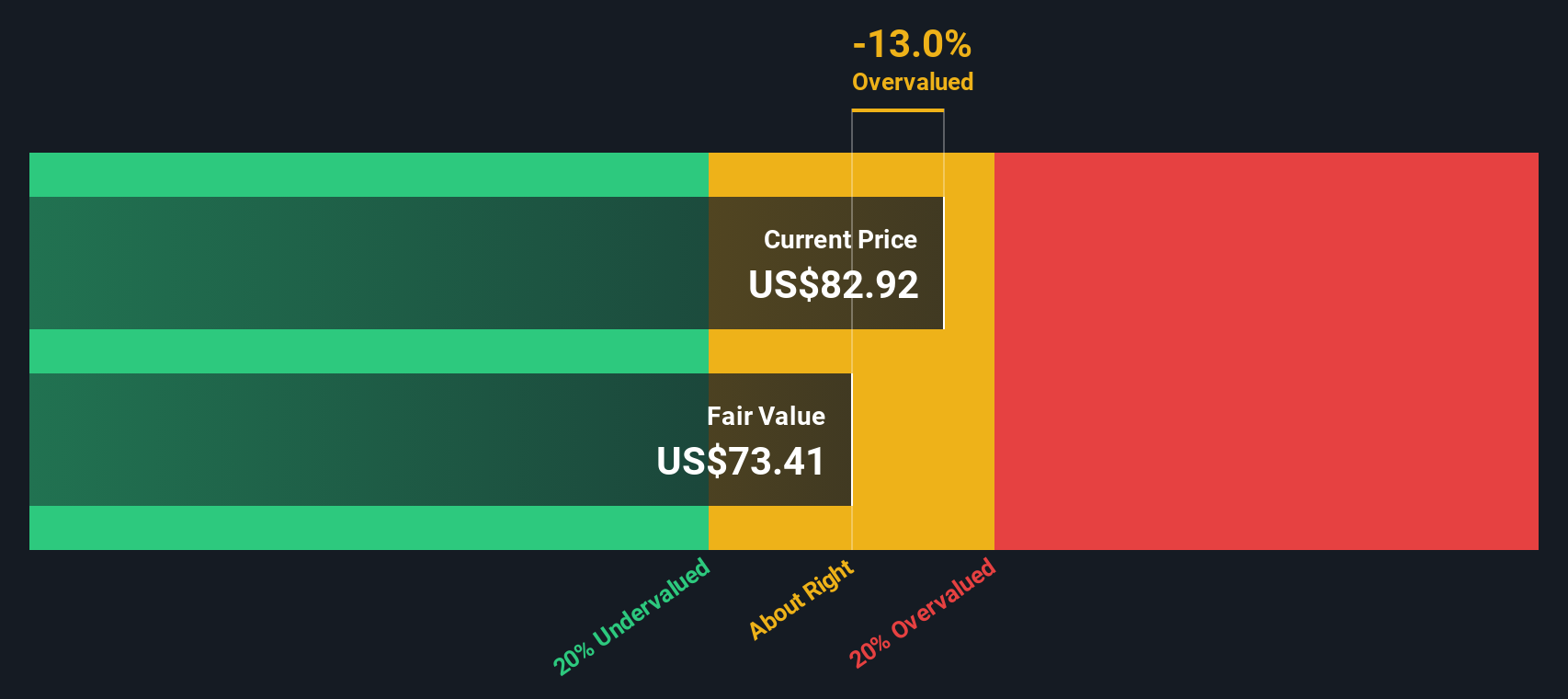

Our DCF model paints a cooler picture, with ONE Gas trading above an estimated fair value of about $73.92. That implies the stock might be slightly overvalued on cash flow terms, even as the narrative suggests upside. Which lens do you trust more for a regulated utility?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ONE Gas for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ONE Gas Narrative

If you see the story differently, or simply prefer hands on research, you can build a custom view in minutes: Do it your way.

A great starting point for your ONE Gas research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street to work finding fresh, data driven opportunities that could complement or even outperform a steady name like ONE Gas.

- Target asymmetric upside by scanning these 3594 penny stocks with strong financials that pair higher risk with strong fundamentals and the potential to move sharply on improving sentiment.

- Position ahead of structural growth by reviewing these 26 AI penny stocks that tap into accelerating demand for machine learning, automation, and intelligent infrastructure.

- Lock in quality at sensible prices by focusing on these 900 undervalued stocks based on cash flows where discounted cash flows hint at upside the broader market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal