Radware (RDWR) Valuation Check as It Expands AI Security with New LLM Firewall and Japan Partnership

Radware (RDWR) is stepping deeper into AI security, launching its LLM Firewall to shield generative AI workflows from prompt attacks and data leaks, while extending its cloud protection footprint in Japan through Hitachi Solutions.

See our latest analysis for Radware.

Those AI focused launches come as Radware’s $24.12 share price has delivered an 8.11% year to date share price return and a 2.38% one year total shareholder return, suggesting improving sentiment but not yet runaway momentum.

If this kind of AI driven story has your attention, it could be worth scanning other names in high growth tech and AI stocks to see what else is gaining traction.

With revenue growing, a fresh AI security product, and shares still trading well below analyst targets, is Radware a quietly undervalued cyber play, or has the market already priced in its next leg of growth?

Price-to-Earnings of 62.9x: Is it justified?

Radware trades at $24.12 per share on a 62.9x price-to-earnings ratio, indicating the market is paying a premium versus peers and the wider software space.

The price-to-earnings multiple compares what investors pay today with the company’s current earnings. It is a common yardstick for profitable software and cybersecurity companies where recurring revenue and growth potential matter.

In Radware’s case, the stock’s 62.9x multiple is almost double the 32x US software industry average and well above the 25.1x peer average. This suggests investors are pricing in stronger profitability or more durable growth than its history of declining five-year earnings and modest revenue expansion might otherwise indicate.

Relative to sector norms, that premium stands out. The stock now sits at a valuation level more typical of faster-growing or higher-margin software platforms than a business with mid single-digit revenue growth forecasts and low current returns on equity.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 62.9x (OVERVALUED)

However, slower than expected revenue growth, or a de-rating from its rich valuation if AI security uptake disappoints, could quickly cap further upside.

Find out about the key risks to this Radware narrative.

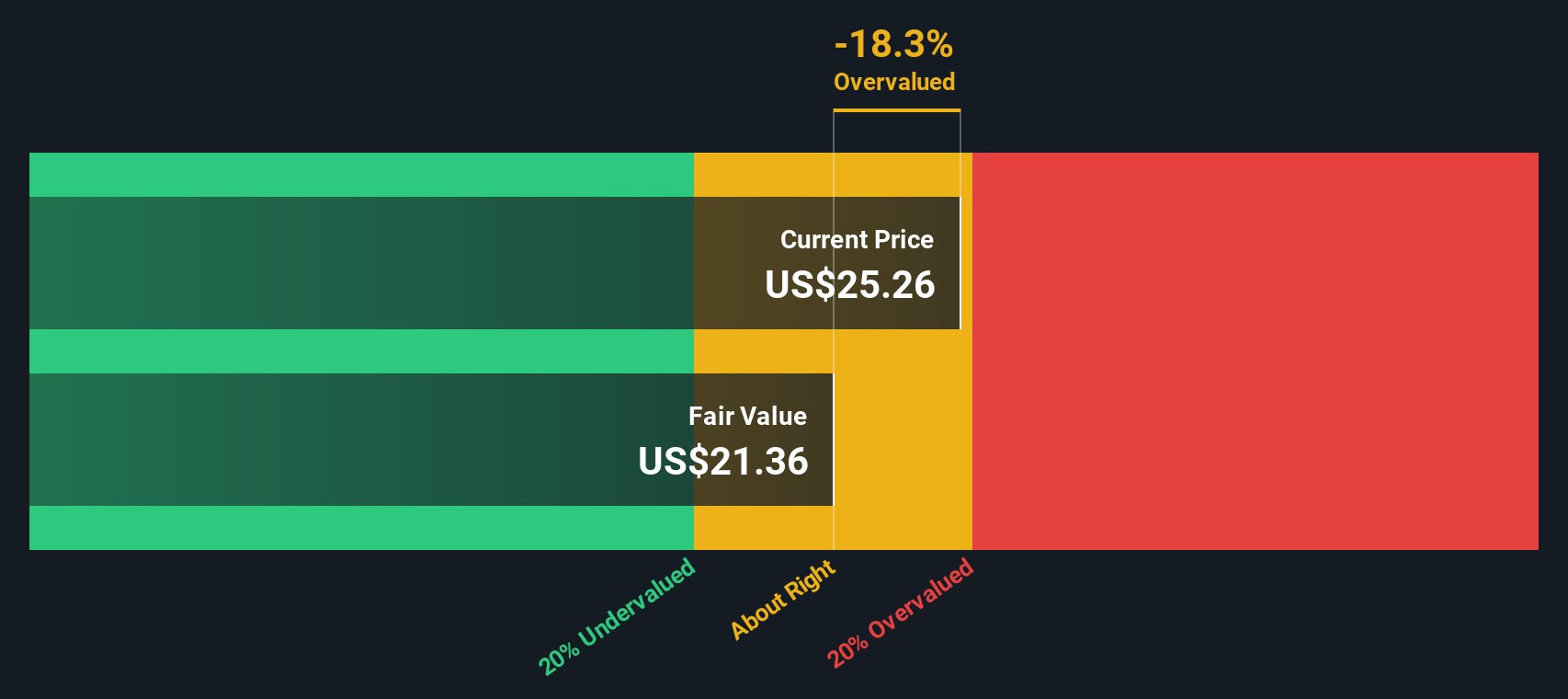

Another View: Our DCF Model Suggests a Different Story

While the earnings multiple points to a rich valuation, our DCF model is more cautious. It puts Radware’s fair value at $22.59 versus the $24.12 market price, implying the shares are slightly overvalued rather than a bargain.

Look into how the SWS DCF model arrives at its fair value.

If the SWS DCF model is right and growth or margins fall short of expectations, could today’s premium price leave less room for error than the AI narrative suggests?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Radware for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Radware Narrative

If you see the numbers differently, or simply prefer to test your own assumptions, you can build a custom view in just minutes: Do it your way.

A great starting point for your Radware research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at one opportunity. Use the Simply Wall St Screener now to spot other stocks that could reshape your portfolio before the crowd notices.

- Capture potential mispricings by targeting quality companies trading below their estimated worth with these 900 undervalued stocks based on cash flows before the market corrects.

- Ride powerful innovation trends by focusing on businesses harnessing next generation algorithms and infrastructure across these 26 AI penny stocks.

- Strengthen your income stream by zeroing in on reliable payers within these 15 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal