Asian Penny Stocks: Design Capital And 2 Other Promising Picks

As the Asian markets navigate through a period of economic fluctuations, investors are keeping a close eye on opportunities that align with evolving market dynamics. Penny stocks, while often considered niche investments, continue to offer intriguing possibilities for growth, especially when they exhibit strong financial health. This article will explore several such stocks in the Asian market that combine affordability with potential resilience and opportunity.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Oiltek International (SGX:HQU) | SGD0.675 | SGD289.57M | ✅ 4 ⚠️ 2 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.70 | HK$2.21B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.47 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.56 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.02 | SGD413.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.104 | SGD54.45M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.39 | SGD13.34B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.21 | ₱843.44M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$3.12 | NZ$258.17M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 963 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Design Capital (SEHK:1545)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Design Capital Limited, with a market cap of HK$248 million, operates in the furniture business across Singapore, the United States, and Malaysia.

Operations: The company's revenue is derived from Furniture Sales amounting to SGD 15 million, Interior Design contributing SGD 6.20 million, and U.S. Furniture Sales totaling SGD 32.47 million.

Market Cap: HK$248M

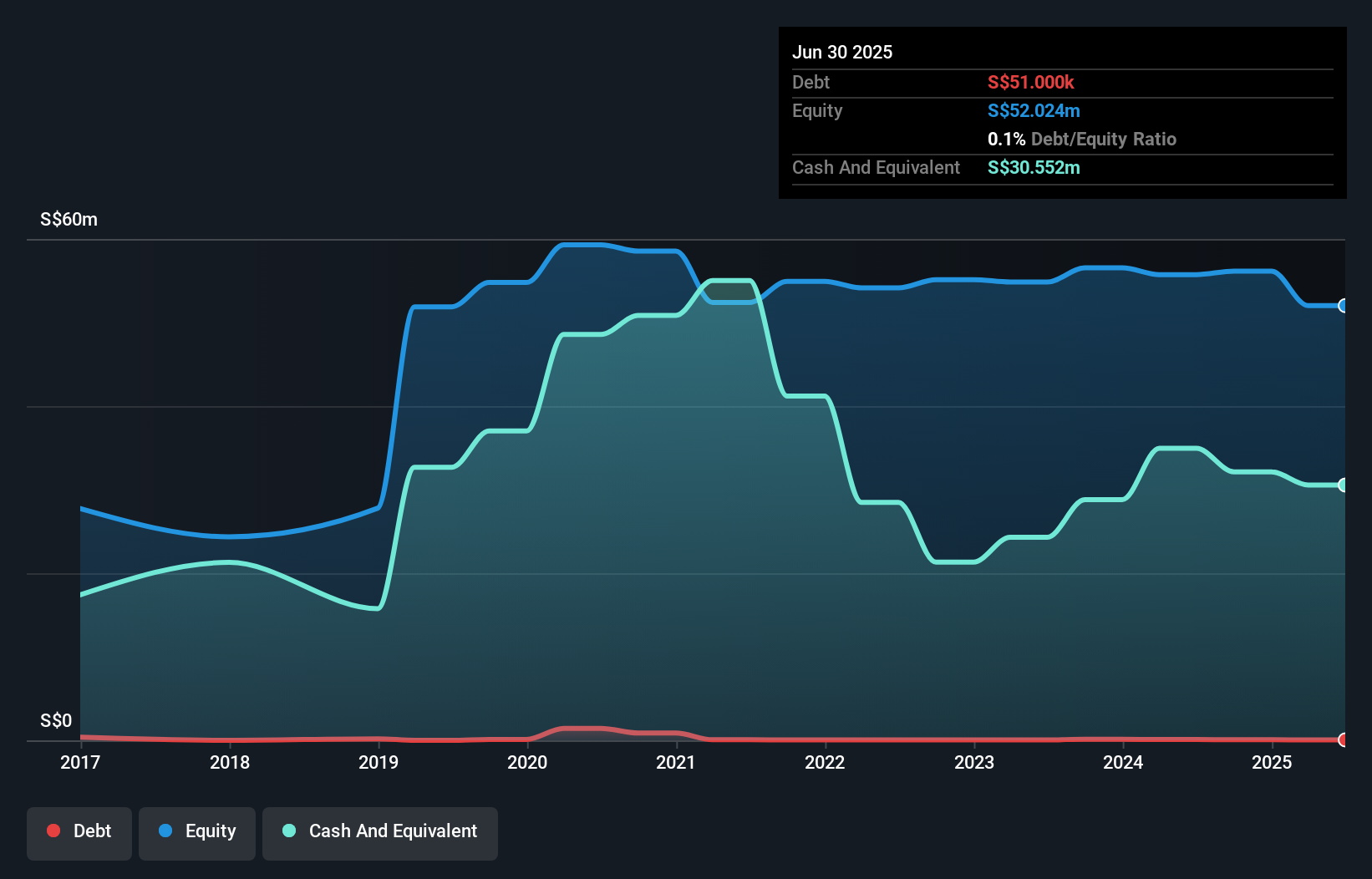

Design Capital Limited, with a market cap of HK$248 million, operates in the furniture sector across multiple regions. Despite being unprofitable and experiencing increased losses over the past five years, the company maintains a strong balance sheet with short-term assets exceeding both short and long-term liabilities. Its debt is well-covered by operating cash flow, and it has significantly reduced its debt-to-equity ratio over time. The recent appointment of Mr. Dillon Kho as a non-executive director may bring fresh perspectives to strategic planning. However, the share price remains highly volatile compared to other Hong Kong stocks.

- Click to explore a detailed breakdown of our findings in Design Capital's financial health report.

- Gain insights into Design Capital's past trends and performance with our report on the company's historical track record.

Uju Holding (SEHK:1948)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Uju Holding Limited is an investment holding company that offers digital marketing services and live-streaming e-commerce in the People’s Republic of China, with a market cap of HK$2.45 billion.

Operations: The company generated CN¥10.30 billion from its All-In-One Online Marketing Solutions Services segment.

Market Cap: HK$2.45B

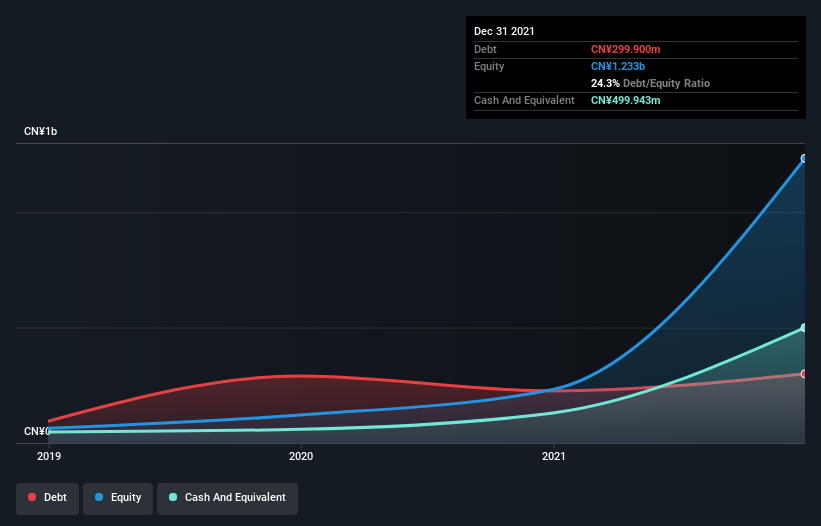

Uju Holding Limited, with a market cap of HK$2.45 billion, has shown resilience in the digital marketing sector in China. The company reported significant gross billing growth of RMB 11.86 billion for the first nine months of 2025, driven by strengthened customer relationships and expanded media channels. Despite past earnings volatility and a low return on equity at 7.7%, Uju's debt is well-managed with more cash than total debt and strong interest coverage by EBIT (17.7x). Recent board changes may impact strategic direction as Mr. Peng Liang resigned to focus on other commitments, signaling potential shifts in leadership dynamics.

- Click here and access our complete financial health analysis report to understand the dynamics of Uju Holding.

- Learn about Uju Holding's historical performance here.

Antengene (SEHK:6996)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Antengene Corporation Limited is a clinical-stage APAC biopharmaceutical company focused on developing novel oncology therapies in Greater China and internationally, with a market cap of HK$3.04 billion.

Operations: The company generated CN¥84.35 million from its research, development, and commercialization of pharmaceutical products segment.

Market Cap: HK$3.04B

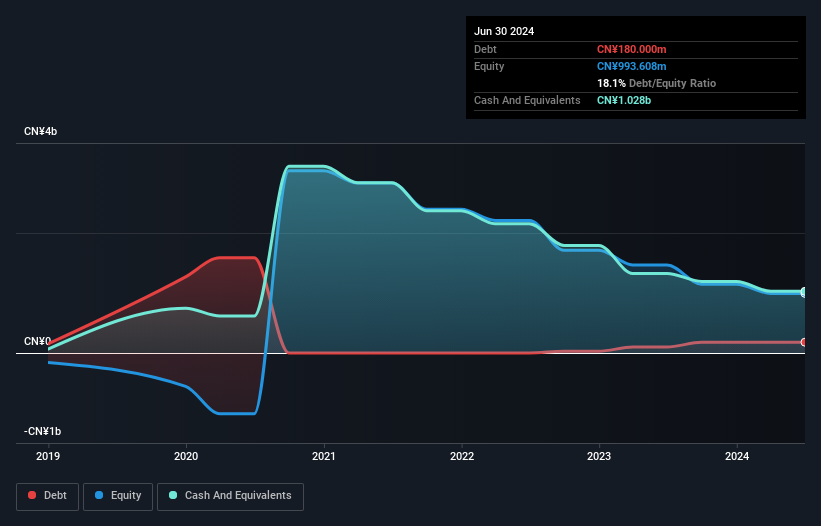

Antengene Corporation Limited, with a market cap of HK$3.04 billion, is navigating the biopharmaceutical landscape by focusing on innovative oncology therapies. Despite being unprofitable and having a negative return on equity of -29.83%, the company has not diluted shareholders over the past year and maintains a sufficient cash runway for more than two years under current conditions. Recent developments include approvals in Hong Kong for XPOVIO® combinations targeting multiple myeloma and lymphoma, as well as progress in clinical trials like CLINCH-2 evaluating ATG-022 with promising early results, indicating potential expansion into broader therapeutic areas beyond gastric cancer.

- Click here to discover the nuances of Antengene with our detailed analytical financial health report.

- Evaluate Antengene's prospects by accessing our earnings growth report.

Summing It All Up

- Access the full spectrum of 963 Asian Penny Stocks by clicking on this link.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal