Assessing Acadian Asset Management’s Valuation After Its Recent Debt Refinancing and Capital Structure Reset

Acadian Asset Management (AAMI) just overhauled its balance sheet, redeeming all $275 million of its 4.8% senior notes due 2026 using a new $200 million term loan and existing cash.

See our latest analysis for Acadian Asset Management.

That balance sheet clean up lands against a backdrop of strong momentum, with an 80.1% year to date share price return and a 137.0% three year total shareholder return suggesting investors see improving growth and risk dynamics.

If this kind of capital structure reset has you rethinking where the next leaders might come from, it could be worth exploring fast growing stocks with high insider ownership.

With leverage pushed out and growth running hot, the shares now sit just below analyst targets but above many traditional valuation markers. Is Acadian Asset Management still mispriced, or is the market already baking in its next leg of growth?

Price-to-Earnings of 18.9x: Is it justified?

On a last close of $46.44, Acadian Asset Management trades at a price-to-earnings ratio of 18.9 times, which signals mixed messages when stacked against different benchmarks.

The price-to-earnings multiple compares the company’s share price with its per share earnings, a key yardstick for capital markets businesses where profitability and fee stability often drive valuation. For AAMI, this lens helps investors judge whether recent profit growth and balance sheet moves warrant paying a richer price for each dollar of earnings.

Relative to the broader US Capital Markets industry average of 25 times earnings, AAMI screens as good value on this measure and suggests the market is not fully pricing in its stronger recent earnings growth and expanding net margins. However, when the same 18.9 times earnings is compared to a peer group average of just 12.8 times, the stock looks expensive, implying investors are already granting a premium for its faster growth profile and exceptionally high return on equity.

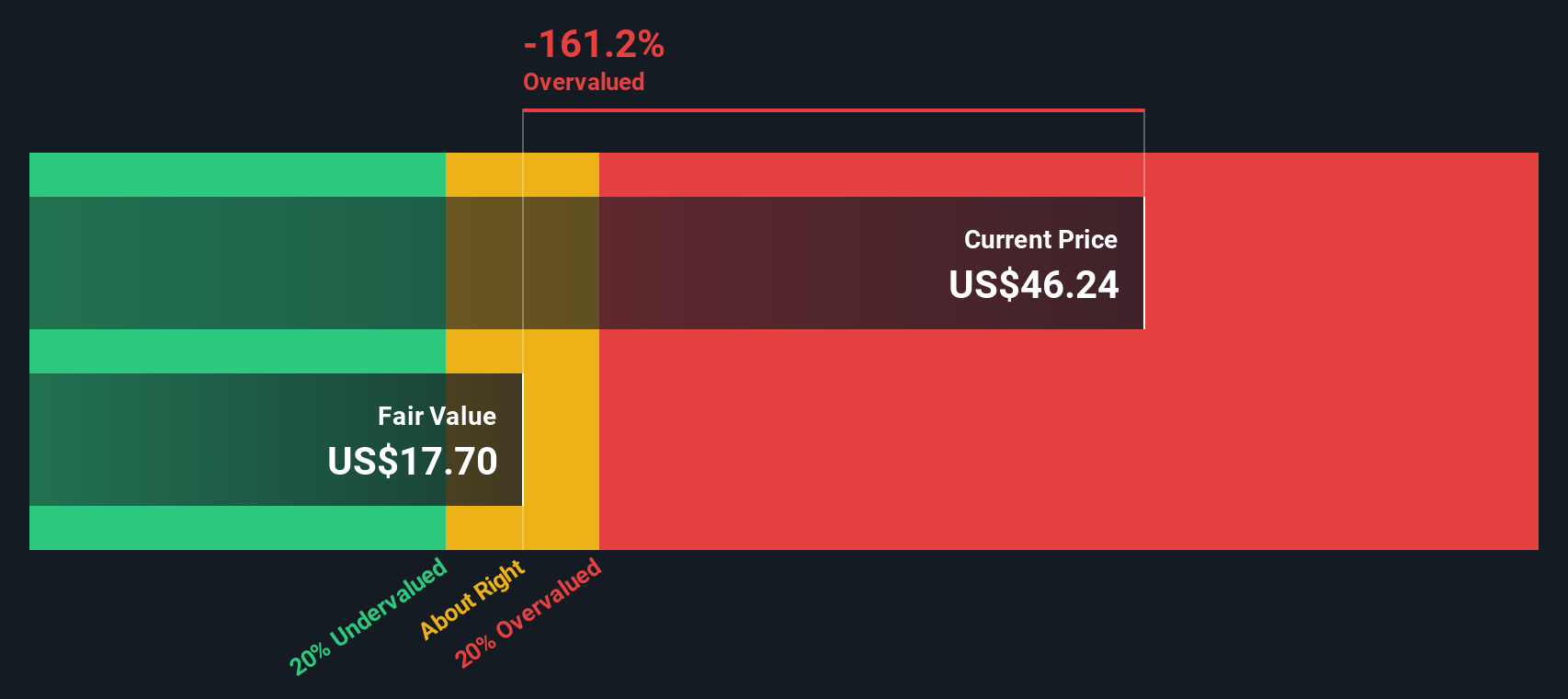

That tension is sharpened by our SWS DCF model, which estimates a fair value of $19.65 per share, far below the $46.44 market price and indicating the cash flow outlook does not yet justify today’s earnings multiple if projections prove conservative. Investors weighing this gap need to decide whether AAMI’s upbeat revenue trajectory and profitability acceleration can close the distance the model currently highlights.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 18.9x (OVERVALUED)

However, the stretched valuation leaves little room for error, and any slowdown in revenue growth or market volatility could quickly challenge today’s bullish expectations.

Find out about the key risks to this Acadian Asset Management narrative.

Another Lens, Same Warning?

Our SWS DCF model paints a starker picture, pointing to a fair value of $19.65 per share, well below the current $46.44 price. This implies AAMI is materially overvalued. Is the market rightly looking past cautious cash flow assumptions, or simply stretching too far ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Acadian Asset Management for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Acadian Asset Management Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Acadian Asset Management research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for your next smart move?

Before sentiment shifts again, lock in a watchlist of high conviction ideas using the Simply Wall Street Screener so you are not chasing the market later.

- Target steady income by scanning for these 15 dividend stocks with yields > 3% that can help anchor your portfolio when markets turn choppy.

- Capitalize on mispriced opportunities by hunting through these 900 undervalued stocks based on cash flows that the market has not fully recognised yet.

- Position yourself ahead of the next computing revolution by focusing on these 28 quantum computing stocks building real-world applications today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal