Assessing Black Stone Minerals’ Valuation After New Long-Term Gulf Coast Drilling Agreement With Caturus

Black Stone Minerals (BSM) just signed a 220,000 gross acre development agreement with Caturus Energy, setting up a six year drilling runway that directly targets rising Gulf Coast natural gas demand.

See our latest analysis for Black Stone Minerals.

The deal lands at a time when momentum is quietly turning in BSM’s favor, with an 18.6% 3 month share price return and a hefty 5 year total shareholder return above 200%, hinting that investors see durable cash flow ahead.

If this kind of long term income story appeals, it is worth broadening your search and discovering fast growing stocks with high insider ownership for other potentially compelling ideas beyond the energy patch.

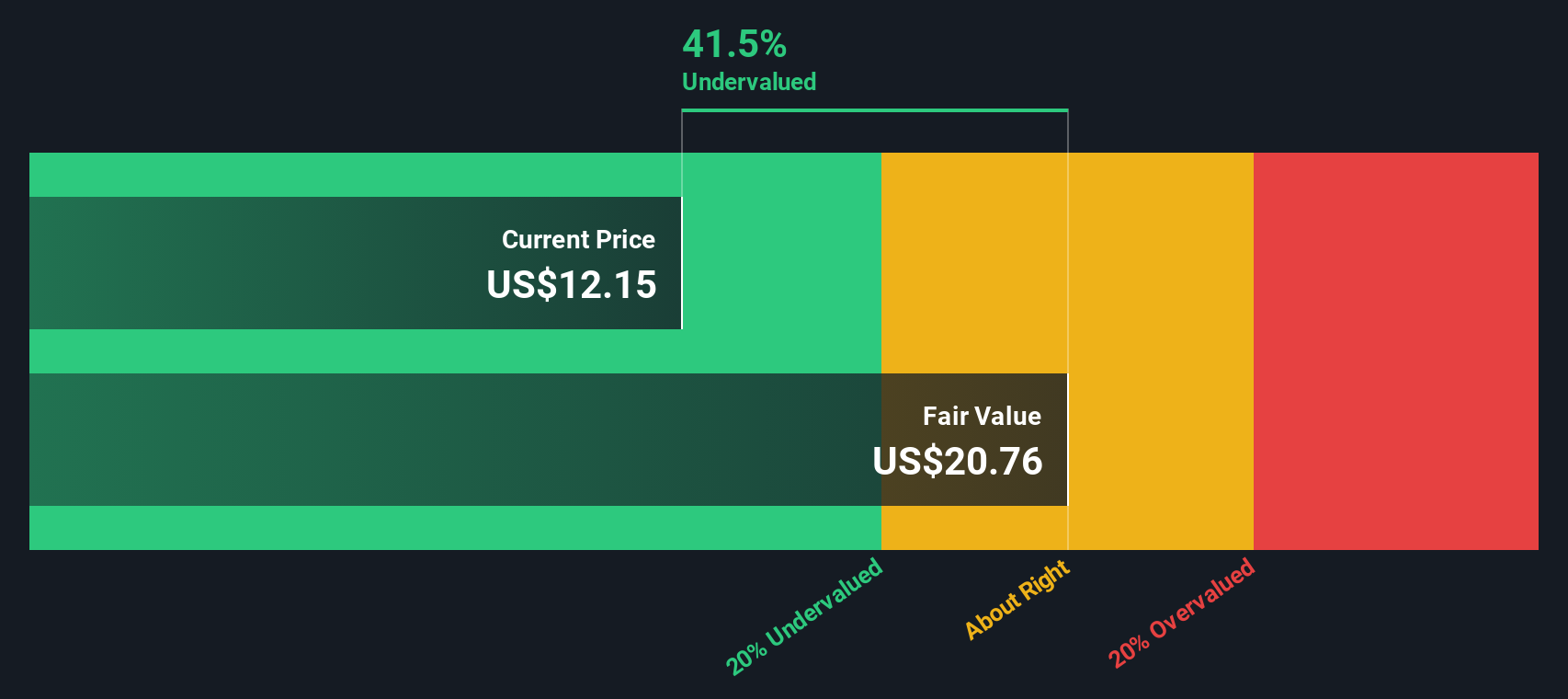

Yet with the units trading slightly above the average analyst target but still showing a sizable intrinsic value discount, investors face a key question: is this a fresh buying opportunity or is the market already pricing in future growth?

Most Popular Narrative: 12.4% Overvalued

With Black Stone Minerals last closing at $14.61 against a narrative fair value of $13.00, expectations for future cash flows are already running high.

The analysts have a consensus price target of $13.0 for Black Stone Minerals based on their expectations of its future earnings growth, profit margins and other risk factors. In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $530.3 million, earnings will come to $283.0 million, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 6.8%.

Want to see how moderate growth, slimmer margins, and a higher future earnings multiple still add up to a richer valuation than today? The narrative lays out a tight set of assumptions, where even small shifts in revenue trajectory or profitability could swing that fair value meaningfully. Curious which levers do the heavy lifting in this calculation, and how sensitive the outcome is to each one?

Result: Fair Value of $13.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower than expected Shelby Trough gas growth and dependence on third party operators could still derail those neatly balanced valuation assumptions.

Find out about the key risks to this Black Stone Minerals narrative.

Another Lens on Value

While the analyst narrative says Black Stone Minerals looks 12.4% overvalued, our DCF model presents a different perspective, suggesting fair value closer to $19.74, about 26% above the current $14.61 price. If cash flows matter more than sentiment, is the real risk missing a potential upside rerating?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Black Stone Minerals Narrative

If you would rather challenge these assumptions, dig into the numbers yourself and shape a personal view of BSM’s future, you can Do it your way in under three minutes.

A great starting point for your Black Stone Minerals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may wish to explore additional stock ideas on Simply Wall St that you might find useful.

- Explore total return potential with these 15 dividend stocks with yields > 3% that may help keep cash flowing into your account over time.

- Consider the next major technological wave by reviewing innovators featured in these 26 AI penny stocks at the forefront of machine learning and automation.

- Review opportunities in emerging finance trends with these 80 cryptocurrency and blockchain stocks involved in payments, digital assets, and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal