Gentherm (THRM): Reassessing Valuation After a Multiyear Share Price Slide and Growing Earnings

Gentherm (THRM) has quietly drifted lower this year, leaving the stock down about 8% year to date and roughly 17% over the past year, even as earnings have grown.

See our latest analysis for Gentherm.

That slide reflects fading momentum more than a broken story, with a modestly negative 90 day share price return and a three year total shareholder return that has been deeply underwater as investors reassess execution risk versus Gentherm's growth potential.

If Gentherm's recent drift has you rethinking your positioning in autos, this could be a good moment to explore auto manufacturers for other ideas across the space.

With earnings climbing, a double digit discount to analyst targets, and a bruising multiyear return profile, is Gentherm quietly setting up as an overlooked value, or is the market correctly pricing in its future growth?

Most Popular Narrative: 20.7% Undervalued

With Gentherm last closing at $36.14 against a narrative fair value of $45.60, the valuation case leans firmly toward upside potential grounded in earnings expansion.

Operational efficiency initiatives and global footprint realignment, including automation and standardized business processes, are driving ongoing improvements in gross margins and operating margin, with anticipated margin expansion particularly visible in the fourth quarter and beyond.

Want to see what kind of margin reset could justify this gap? The narrative leans on powerful earnings compounding and a surprisingly restrained future valuation multiple. Curious which assumptions do the heavy lifting? Dive in to see the full roadmap behind that fair value target.

Result: Fair Value of $45.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure and slower than expected traction in Asia could easily derail those earnings upgrades and keep the multiple capped.

Find out about the key risks to this Gentherm narrative.

Another Lens on Value

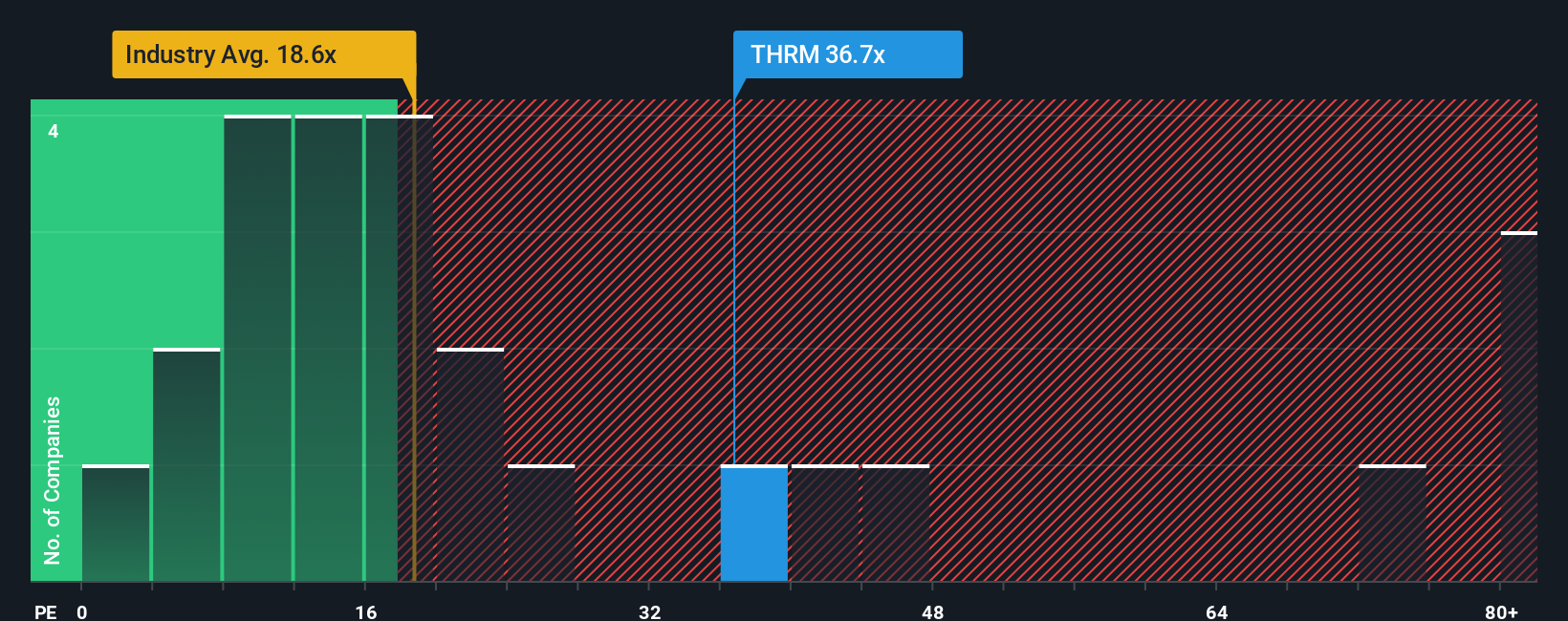

Analysts see upside, but our valuation work using the price to earnings ratio paints a tougher picture. At 36 times earnings, Gentherm trades at a hefty premium to the US Auto Components industry on 18.1 times and peers on 20.5 times, and even above our fair ratio of 22.6 times. Is the market overpaying for that future growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gentherm Narrative

If you see Gentherm differently or want to stress test the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Gentherm research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, put Simply Wall St to work and let curated stock shortlists point you toward opportunities you might otherwise overlook.

- Capture potential mispricings by scanning these 897 undervalued stocks based on cash flows that combine solid fundamentals with attractive valuations.

- Position ahead of powerful themes by reviewing these 26 AI penny stocks targeting companies that are shaping the next wave of intelligent technology.

- Strengthen your income stream by assessing these 15 dividend stocks with yields > 3% offering resilient yields and consistent shareholder returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal