ServiceTitan (TTAN) Valuation Revisited After Strong Earnings Beat and Upgraded Full-Year Guidance

ServiceTitan (TTAN) just delivered another upside surprise, topping Wall Street on both revenue and earnings, then backing it up with higher full year guidance that signals management sees this momentum as durable, not accidental.

See our latest analysis for ServiceTitan.

The market has started to notice, with a 7 day share price return of 16.8 percent and a 30 day share price return of 14.7 percent. However, the 90 day share price return is still negative, suggesting momentum is rebuilding as execution and new customer wins like TIMEPROOFUSA and Master Roofing Solutions reinforce the growth story.

If this kind of rebound has your attention, it could be a good moment to explore other high growth tech and AI stocks that are also seeing sentiment and growth expectations shift.

With shares still about 25 percent below the average analyst target despite accelerating growth and repeated earnings beats, are investors looking at an overlooked compounder here, or has the market already priced in ServiceTitan’s next leg of expansion?

Price-to-Sales of 11.1x: Is it justified?

On a price-to-sales basis, ServiceTitan trades at 11.1 times revenue, a clear premium to both peers and the broader US software universe at the last close of $109.02.

The price-to-sales ratio compares a company’s market value to its revenue, a common yardstick for high growth, often unprofitable, software platforms where earnings are not yet a reliable guide.

In this case, the premium is steep, with ServiceTitan valued more richly than the peer average of 9.1 times sales, and more than double the wider US software industry at 4.9 times. Relative to the estimated fair price-to-sales ratio of 6.3 times that our models suggest the market could gravitate toward, the current multiple indicates that investors are paying up aggressively for future growth that is not yet flowing through to profits.

Explore the SWS fair ratio for ServiceTitan

Result: Price-to-Sales of 11.1x (OVERVALUED)

However, sustained net losses and premium valuation leave little room for error if growth slows or competition intensifies in core contractor end markets.

Find out about the key risks to this ServiceTitan narrative.

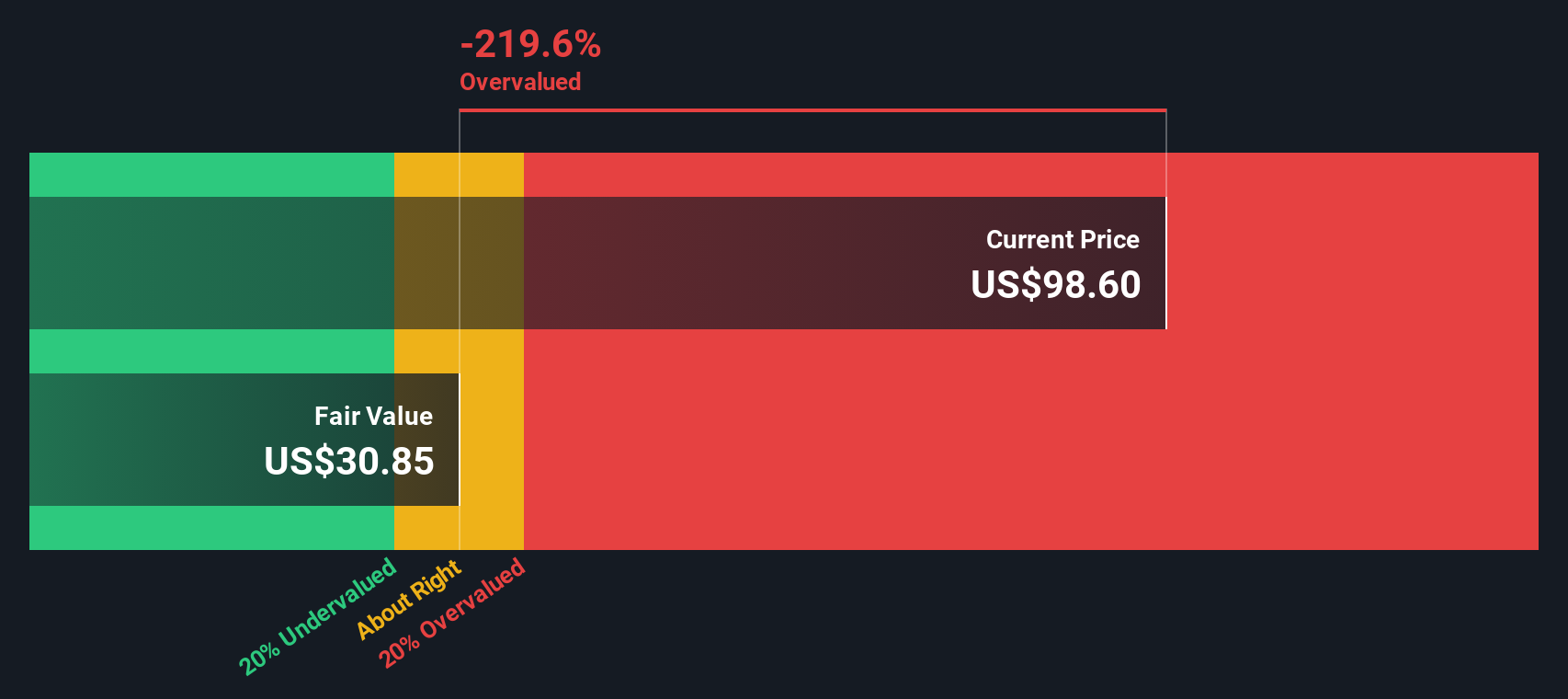

Another View: Our DCF Take

Our DCF model presents a more cautious view, indicating a fair value of $83.12 compared with the current $109.02 share price. This suggests that ServiceTitan may be trading ahead of its discounted cash flow potential and raises the question of whether investors are paying a premium for growth that could be several years away.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ServiceTitan for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ServiceTitan Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your ServiceTitan research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before momentum moves on without you, put the Simply Wall Street Screener to work and uncover fresh opportunities that match your strategy, risk tolerance, and goals.

- Target reliable cash payouts by scanning these 15 dividend stocks with yields > 3% to balance income potential with solid business fundamentals and resilient balance sheets.

- Ride structural growth trends by zeroing in on these 30 healthcare AI stocks to blend medical innovation with scalable software style economics.

- Position ahead of the next digital finance wave by filtering these 80 cryptocurrency and blockchain stocks to build real businesses around blockchain and crypto infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal