CarGurus (CARG): Reassessing Valuation After a Recent Rebound in Share Price

CarGurus (CARG) has quietly climbed about 5% over the past week and nearly 5% this month, catching investors attention as they weigh what the move says about expectations for its online auto marketplace business.

See our latest analysis for CarGurus.

Zooming out, that recent pop in the share price comes after a more muted year to date share price return and a slightly negative one year total shareholder return. At the same time, the three year total shareholder return is still very strong. Together, these dynamics suggest momentum is tentatively rebuilding as investors reassess CarGurus growth and execution.

If CarGurus has you rethinking the auto space, this could be a good moment to explore other auto manufacturers that might fit a similar thesis or offer a complementary angle.

With solid revenue and profit growth, a modest pullback over the past year, and only a small gap to analyst targets, the key question now is whether CarGurus is quietly undervalued or if the market already reflects its next leg of growth.

Most Popular Narrative Narrative: 7.9% Undervalued

With CarGurus last closing at $37.12 against an implied fair value near $40, the most followed narrative points to modest upside grounded in fundamentals.

Leveraging brand trust, scale, and consumer engagement through personalized, AI enhanced shopping experiences and omni channel dealer integration increases user stickiness and differentiation in a consolidating digital automotive marketplace, supporting long term growth in revenue, market share, and profitability.

Curious what kind of revenue path and margin uplift could justify that higher price tag? The narrative leans on bold earnings expansion and a future valuation multiple that may surprise you. Want to see which specific financial levers have to fire perfectly for this upside case to hold? Dive into the full narrative to unpack the assumptions behind that fair value.

Result: Fair Value of $40.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside view could be challenged by intensifying competition from Amazon Autos and peers, as well as CarGurus slower progress expanding beyond North America.

Find out about the key risks to this CarGurus narrative.

Another Angle on Valuation

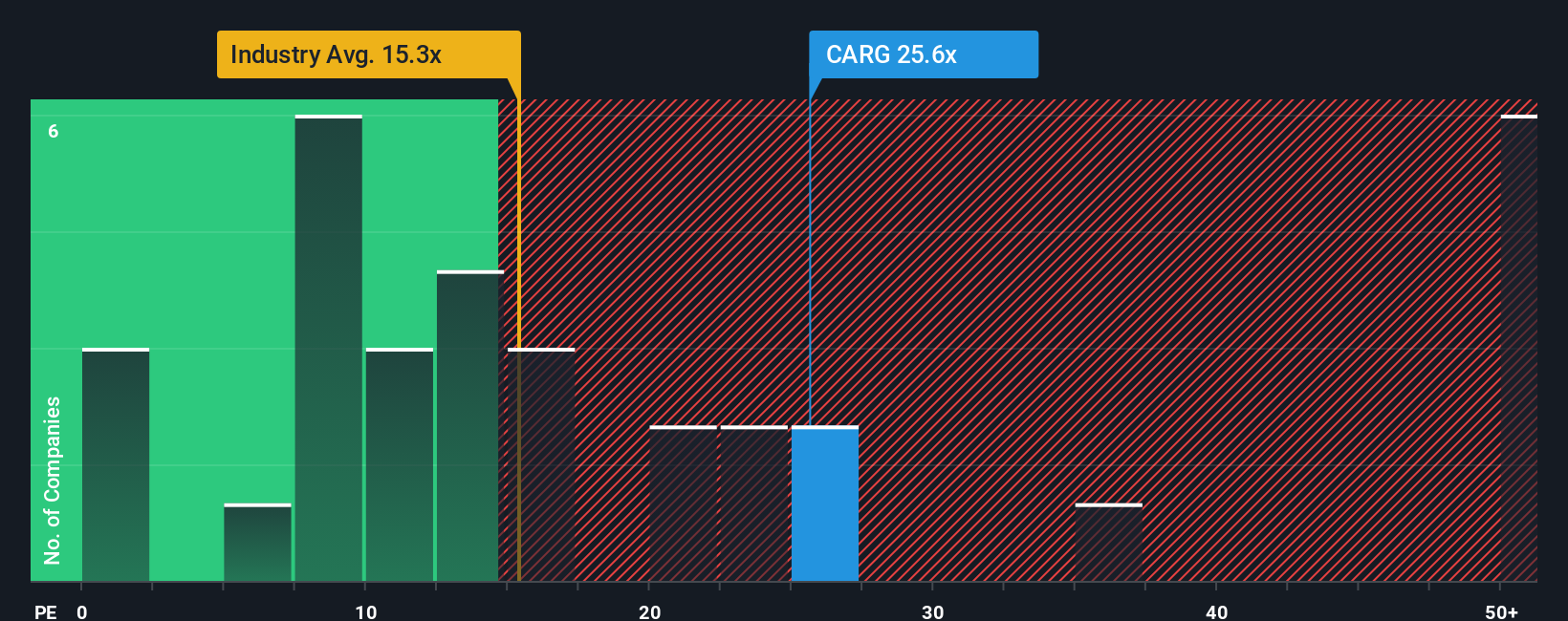

On a simple earnings lens, CarGurus looks far less forgiving. The current P E of 23.3 times sits above both the industry average of 17.1 times and a fair ratio of 21.3 times, which hints at valuation risk if growth or margins wobble from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CarGurus Narrative

If you see the story playing out differently, or prefer to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding CarGurus.

Looking for more investment ideas?

Before you move on, consider your next move by scanning fresh opportunities in the Simply Wall St Screener so potential winners do not slip past you.

- Explore mispriced quality by targeting companies that could be trading below intrinsic value with these 897 undervalued stocks based on cash flows tailored to cash flow strength.

- Focus on innovation trends by reviewing these 26 AI penny stocks that blend rapid growth with transformative technology adoption.

- Review these 15 dividend stocks with yields > 3% that aim to balance yield, stability, and long term payout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal