Is Royal Caribbean (RCL) Turning Private Islands Into Its Key Competitive Moat in the Caribbean?

- Royal Caribbean recently outlined an expanded 2027–28 Caribbean program, featuring 3- to 9-night itineraries on 13 ships, including the new Legend of the Seas and an updated Allure of the Seas, plus calls to private destinations like Perfect Day at CocoCay and future Perfect Day Mexico.

- This long-range schedule, combined with early booking access for loyalty members, highlights how the company is leaning on exclusive destinations and repeat cruisers to fill a larger Caribbean footprint.

- We’ll now examine how this expanded 2027–28 Caribbean lineup, anchored by 13 ships and new destinations, influences Royal Caribbean’s investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Royal Caribbean Cruises Investment Narrative Recap

To own Royal Caribbean, you need to believe that demand for cruising and onboard spending can remain resilient enough to support yields despite a choppy macro backdrop and sector volatility. Recent stock weakness tied to weather disruptions, legal headlines, and cautious broker commentary does not materially change the near term catalyst, which is continued evidence that pricing and booking trends can offset capacity growth. The biggest risk remains a pullback in consumer discretionary spending that hits close in bookings and pricing power.

The expanded 2027–28 Caribbean program, with 13 ships and access to private destinations like Perfect Day at CocoCay and the future Perfect Day Mexico, is highly relevant here because it ties directly to Royal Caribbean’s key catalyst of monetizing exclusive destinations and loyalty members. By leaning into differentiated products and repeat guests, the company is trying to support yields and per passenger spend even if broader vacation demand becomes more uneven.

Yet while these long dated expansion plans are appealing, investors should also be aware of the risk that a consumer slowdown could weaken close in bookings and...

Read the full narrative on Royal Caribbean Cruises (it's free!)

Royal Caribbean Cruises' narrative projects $22.4 billion revenue and $5.9 billion earnings by 2028. This requires 9.2% yearly revenue growth and a roughly $2.3 billion earnings increase from $3.6 billion today.

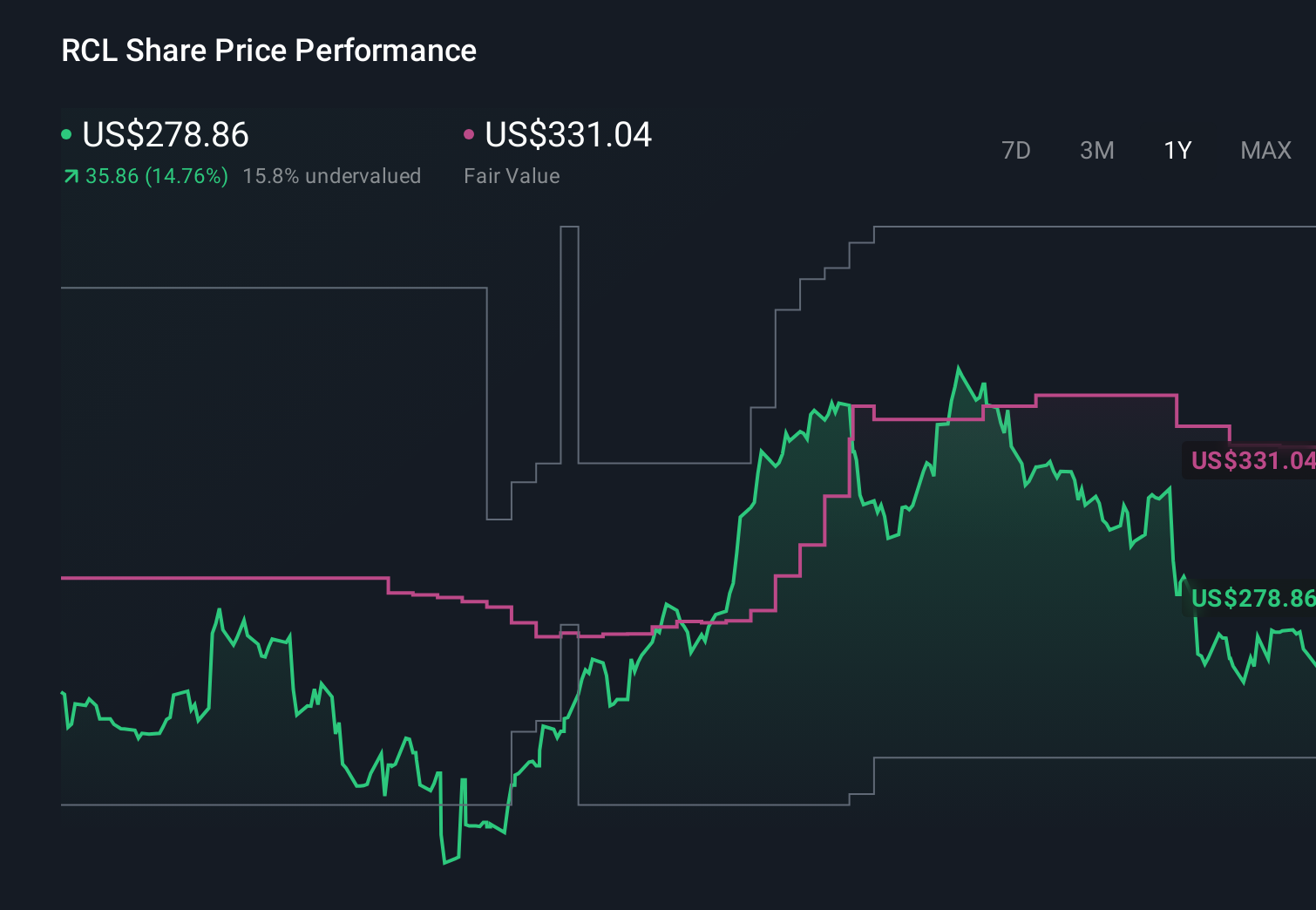

Uncover how Royal Caribbean Cruises' forecasts yield a $336.08 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Ten members of the Simply Wall St Community currently estimate Royal Caribbean’s fair value between US$214 and US$440.34, so you can compare these views with the possibility that softer discretionary spending could pressure pricing and near term earnings, then weigh how that might influence the company’s longer term performance.

Explore 10 other fair value estimates on Royal Caribbean Cruises - why the stock might be worth as much as 77% more than the current price!

Build Your Own Royal Caribbean Cruises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royal Caribbean Cruises research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Royal Caribbean Cruises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royal Caribbean Cruises' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal