3 Promising Penny Stocks With Market Caps Under $200M

Major stock indexes in the United States are currently exhibiting mixed performance as investors await the Federal Reserve's decision on interest rates, which could significantly impact market dynamics. In this context, penny stocks—an older term for shares of smaller or less-established companies—remain a relevant area for exploration. By focusing on those with strong financials and potential growth trajectories, investors can uncover opportunities that might offer both stability and upside potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.03 | $447.9M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.70 | $614.83M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8833 | $151.06M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.23 | $543.49M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.30 | $1.39B | ✅ 5 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.53 | $593.26M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.54 | $369.07M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.860255 | $6.25M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.62 | $104.67M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 337 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Ideal Power (IPWR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ideal Power Inc. is engaged in developing and commercializing its bidirectional bipolar junction transistor solid-state switch technology, with a market cap of $35.66 million.

Operations: The company's revenue is derived from its Electric Equipment segment, totaling $0.04 million.

Market Cap: $35.66M

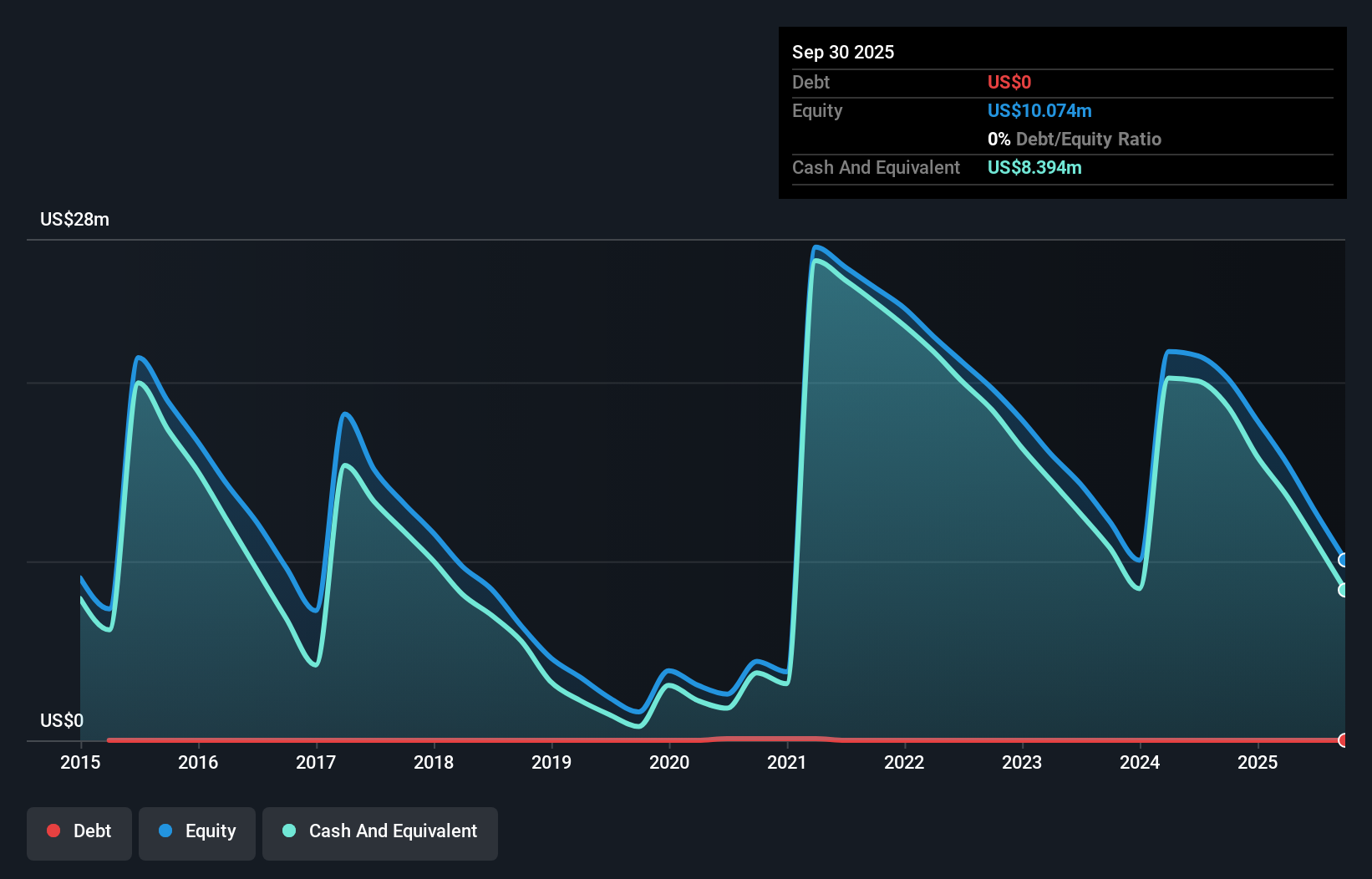

Ideal Power Inc., with a market cap of US$35.66 million, is pre-revenue, generating only US$43K from its Electric Equipment segment. The company recently reported a net loss of US$2.94 million for Q3 2025 and appointed David Somo as CEO, bringing extensive semiconductor industry experience. Despite being debt-free and having short-term assets exceeding liabilities, Ideal Power faces challenges with less than a year of cash runway and high share price volatility. However, the company's innovative B-TRAN technology shows promise in solid-state circuit breaker applications, potentially driving future revenue growth if successfully commercialized.

- Click here and access our complete financial health analysis report to understand the dynamics of Ideal Power.

- Examine Ideal Power's earnings growth report to understand how analysts expect it to perform.

Planet Image International (YIBO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Planet Image International Limited manufactures and sells compatible toner cartridges under both white-label and self-owned brands across North America, Europe, and internationally, with a market cap of $68.12 million.

Operations: The company generates revenue of $147.07 million from its Printers & Related Products segment.

Market Cap: $68.12M

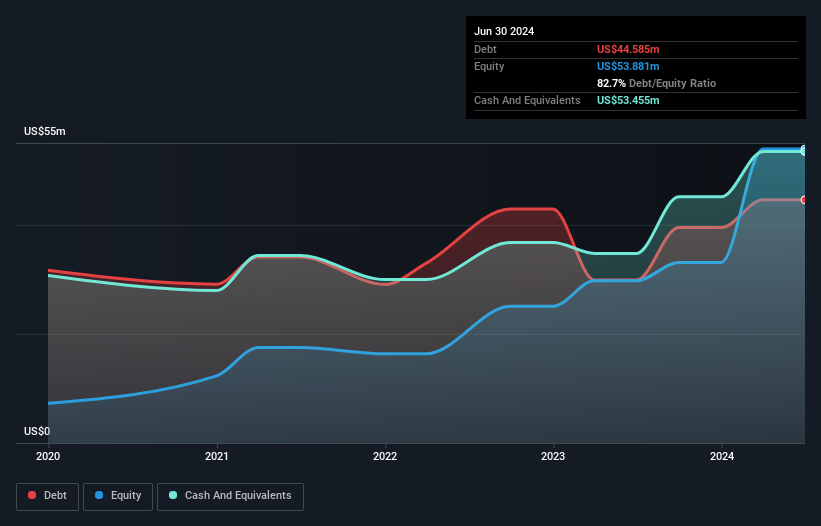

Planet Image International Limited, with a market cap of US$68.12 million, reported half-year sales of US$74.51 million but experienced a net loss of US$8.04 million, reversing from a net income the previous year. Despite its unprofitability and declining earnings over five years at 8.6% annually, it maintains strong short-term asset coverage over liabilities and has reduced its debt-to-equity ratio significantly in recent years. The company's board is seasoned with an average tenure of 4.5 years, although management experience data is insufficient. Recent amendments to company bylaws are expected following the upcoming AGM on December 26, 2025.

- Get an in-depth perspective on Planet Image International's performance by reading our balance sheet health report here.

- Explore historical data to track Planet Image International's performance over time in our past results report.

Coherus Oncology (CHRS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Coherus Oncology, Inc. is a biopharmaceutical company that focuses on researching, developing, and commercializing immunotherapies for cancer treatment in the United States, with a market cap of approximately $155.92 million.

Operations: The company generates revenue of $277.73 million from its segment focused on developing and commercializing biosimilar products.

Market Cap: $155.92M

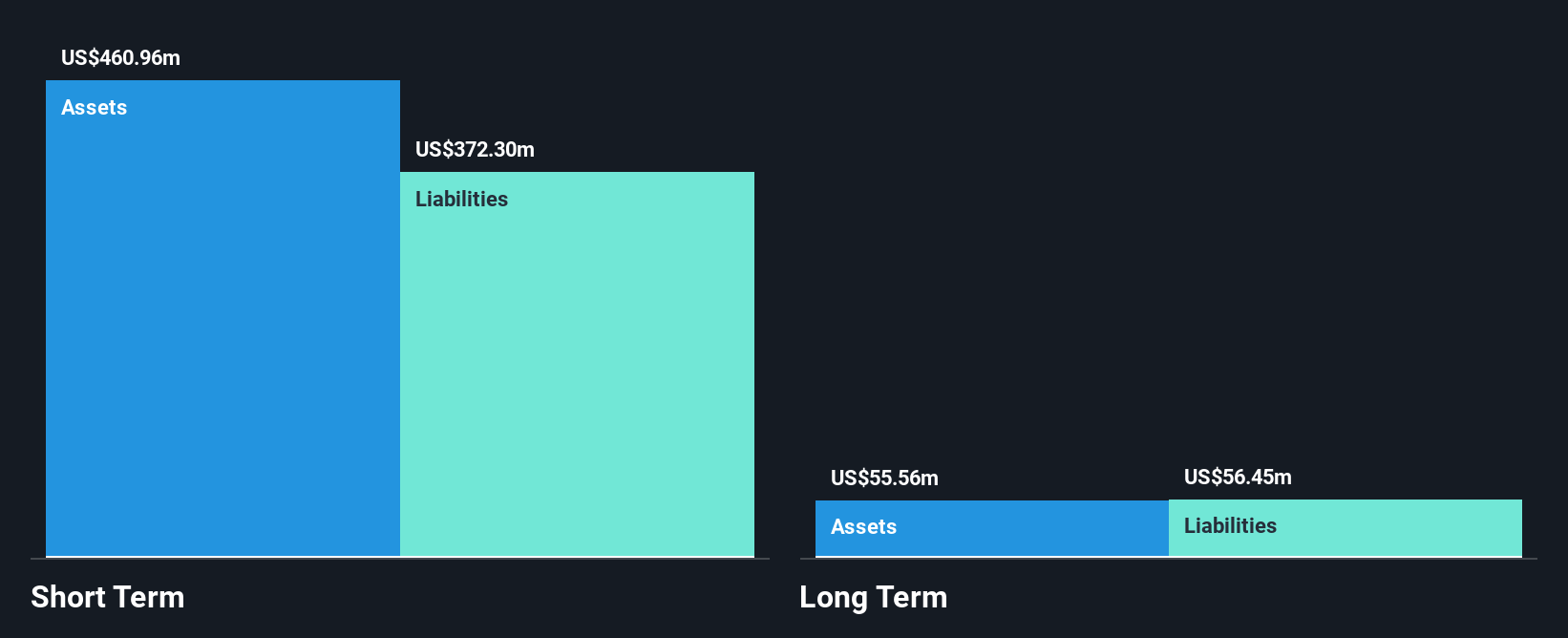

Coherus Oncology, Inc., with a market cap of US$155.92 million, has recently turned profitable after five years of growth and reported US$277.73 million in revenue from its biosimilar segment. Despite a volatile share price and negative operating cash flow, the company benefits from experienced management and board teams, reduced debt levels, and strong short-term asset coverage over liabilities. Recent clinical trial data for CHS-114 shows promising antitumor activity in combination therapies for cancer treatment. Coherus has also filed substantial shelf registrations totaling US$152.04 million to support future financing needs amidst ongoing product development efforts.

- Jump into the full analysis health report here for a deeper understanding of Coherus Oncology.

- Gain insights into Coherus Oncology's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Embark on your investment journey to our 337 US Penny Stocks selection here.

- Want To Explore Some Alternatives? These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal