Warner Bros. Discovery (WBD): Reassessing Valuation After a 160% Year-to-Date Share Price Rebound

Recent Stock Performance and Investor Interest

Warner Bros. Discovery (WBD) has quietly turned into a comeback story, with the stock up roughly 4% in the past day, 15% over the past week, and nearly 75% in the past 3 months.

See our latest analysis for Warner Bros. Discovery.

That recent surge fits into a much bigger turnaround, with Warner Bros. Discovery’s year-to-date share price return above 160% and multi-year total shareholder returns again firmly positive, signaling that momentum is rebuilding as investors reassess its risk and growth profile.

If this rebound has you rethinking the media landscape, it could be a good moment to compare it with other fast growing stocks with high insider ownership.

But with the share price now above many analyst targets and only modest underlying revenue growth, is Warner Bros. Discovery still trading at a discount, or is the market already pricing in its next chapter of growth?

Most Popular Narrative Narrative: 26% Overvalued

With Warner Bros. Discovery’s last close at $28.26 versus a narrative fair value near $22.47, the story leans toward optimism about future cash generation and deal-driven upside.

The fair value estimate for Warner Bros. Discovery has been raised from $21.42 to $22.47 as analysts cite increased acquisition interest, higher price targets, and the potential for multiple bidders contributing to additional valuation upside for the company.

Want to see what justifies paying up for a slow growing media giant? This narrative leans on transformative margins, revamped cash flows, and a bold earnings reset. Curious which assumptions make that math work, even as traditional businesses strain and streaming economics shift beneath the surface?

Result: Fair Value of $22.47 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this setup could unravel if franchise fatigue hits key IP or if international streaming expansion stalls and undercuts the earnings and valuation story.

Find out about the key risks to this Warner Bros. Discovery narrative.

Another View: Cash Flows Tell a Different Story

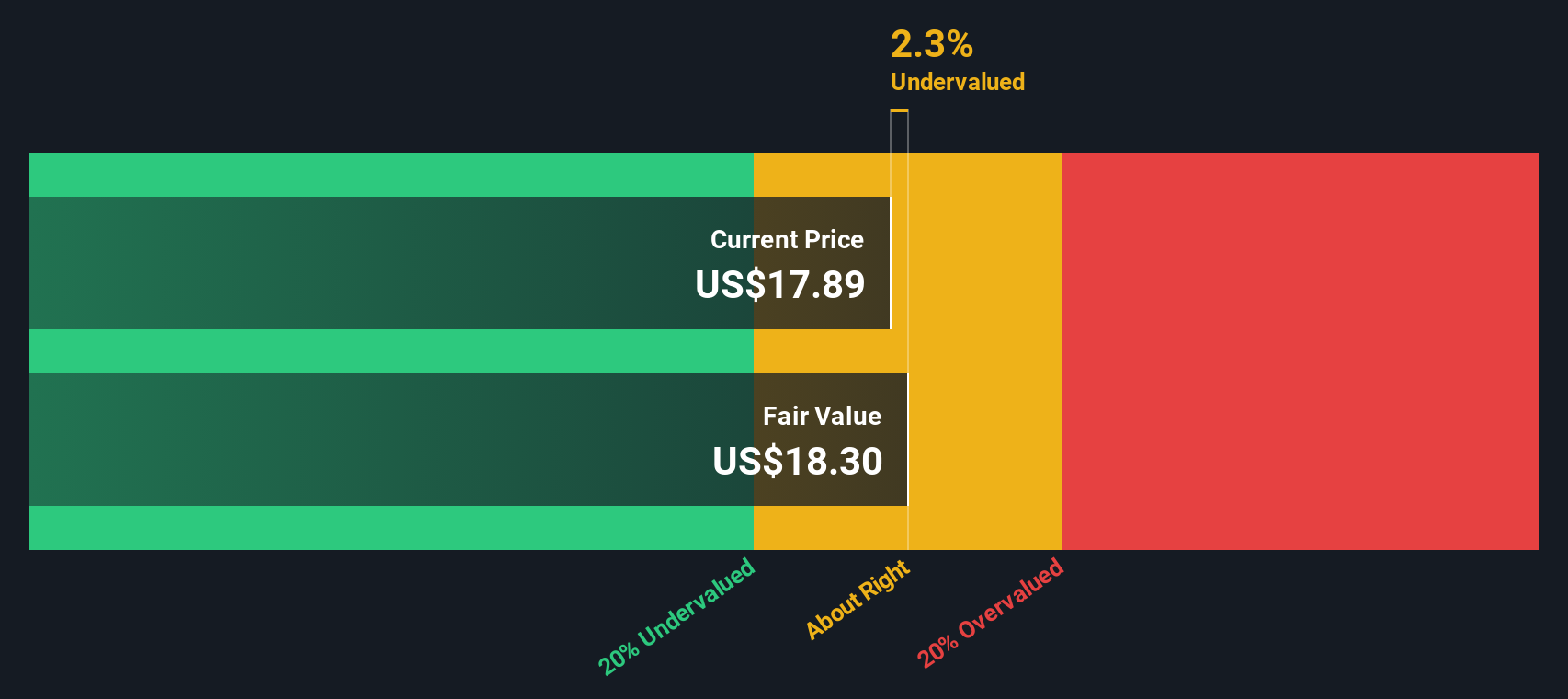

While the narrative-based fair value suggests Warner Bros. Discovery is 26% overvalued, our DCF model paints a milder picture, with the shares trading only about 3% below fair value at $29.15. If cash flows are roughly in line with price, is sentiment getting ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Warner Bros. Discovery for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 895 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Warner Bros. Discovery Narrative

If you see the setup differently or want to dig into the numbers yourself, you can easily build a personalized thesis in minutes: Do it your way.

A great starting point for your Warner Bros. Discovery research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Ready for more investment ideas that match your strategy?

Before you move on, make sure you are not leaving potential winners on the table. Use the Simply Wall Street Screener to pinpoint your next high conviction idea.

- Capitalize on underpriced quality by reviewing these 895 undervalued stocks based on cash flows that strong cash flow analysis suggests the market may be mispricing.

- Signal proof of concept in healthcare innovation by assessing these 30 healthcare AI stocks harnessing data driven tools to reshape patient outcomes and margins.

- Lock in reliable income potential by targeting these 15 dividend stocks with yields > 3% offering yields above 3 percent that can support a steadier total return profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal