Strategy (MSTR.US) stock price plummeted 60% and was still supported by Wall Street! Analysts are betting on a Bitcoin rebound

If Wall Street analysts want to abandon the bullish positions they have always upheld, then an extremely impactful event must occur. Taking Strategy (MSTR.US) as an example, it can be seen that the company's stock price plummeted by as much as 60%, and the market capitalization also shrunk drastically, evaporating 73 billion US dollars. However, even after being hit hard, according to the Zhitong Finance App, out of 19 analysts covering the company, only 3 changed their positions and were bearish; the remaining 15 analysts still maintained ratings equivalent to “buy.”

Further focus on these 15 analysts who gave “buy” ratings. Of these, 12 clearly gave target prices; the median price of these targets points to a price of about $485, which implied room for growth of more than 150% compared to Monday's closing price of $189.

It's worth mentioning that President Capital Management Corp. analyst Jeffrey Yu and Cantor Fitzgerald's analyst Brett Knoblauch both predicted that the stock would fluctuate and consolidate in the $200 range; the lowest price target that followed was $425. On the other hand, Benchmark Co. Analyst Mark Palmer's price target is as high as $705, which means the share price will increase nearly four times.

This company, which once started in the software business, was the first to set off a “Bitcoin treasury” investment boom in the market. The bullish logic is clear and straightforward: Bitcoin will rebound strongly from the latest sharp decline, just like in 2022 and 2017, which in turn will drive the value of Strategy's cryptocurrency holdings to soar sharply.

In an interview, Palmer confessed, “As far as the cryptocurrency sector is concerned, the span of a year is like a long era, during which time it is enough for drastic changes to take place.”

This view profoundly highlights the difficulties faced in evaluating a “digital asset treasury” (DAT) such as Strategy. This type of analysis does not rely on discounting future cash flows or other bottom-up balance sheet derivation methods; it is simply a gamble on the price trend of an asset known for its sharp fluctuations.

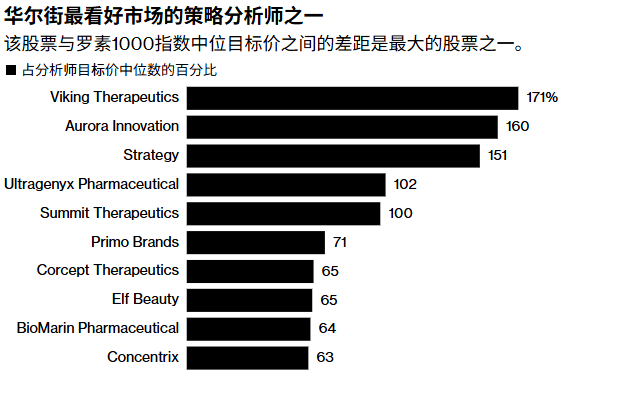

As a result, market optimism about Strategy is particularly prominent among large US companies compared to current stock prices. The increase corresponding to its median target price dominates the NASDAQ 100 index and ranks first; even in the Russell 1000 index, it only lags behind the biotech group Viking Therapeutics Inc. (VKTX.US) and the autonomous driving technology company Aurora Innovation Inc. (AUR.US), while the average gap between the current stock price of the Russell 1000 index constituents and the median analysts' target price is only 17%. It's worth mentioning that Strategy's maximum target price is nearly four times the minimum target price.

The bulls can also cite Strategy's brilliant record over the years since Michael Saylor's strategy switched to the crypto asset sector: within just six months after announcing the purchase of Bitcoin in August 2020, the company's stock price skyrocketed like a rocket, rising more than 600%. At the time, investors were enthusiastic about the company's shares, and the premium was even higher than Bitcoin itself—you know, the cryptocurrency's price didn't rise to an all-time peak of $126,000 until October of this year. In the process, the peak premium given by investors to the company's stock once exceeded 2.5 times the price of Bitcoin.

However, in a sense, Strategy has become a “victim” of its own brilliant achievements: as many imitators launch new digital asset treasury (DAT) products, the demand to obtain exposure to crypto assets through listed companies has been largely diverted. Today, Strategy's share price premium has shrunk drastically, only 1.2 times the value of Bitcoin.

In April of this year, Monness, Crespi, Hardt & Co. Fintech and crypto analyst Gus Gala downgraded Strategy's rating to “sell,” and fierce market competition was one of the key factors in his judgment. He anticipated that the company would be difficult either to rank among the S&P 500 constituents, or to receive an investment grade rating from S&P Global Ratings — in fact, the latter rated it a B-junk rating in October. However, following Strategy's latest sharp drop in stock prices, Gus Gala upgraded the company's rating to “neutral” in November.

Gala stated, “From an economic perspective, companies are extremely motivated to continue issuing shares, carrying out financing activities, or underwriting operations. However, after all, market demand exists objectively, and I think this is the reason behind the situation you are seeing right now.”

However, Gala has not completely ruled out the possibility that Strategy's share price premium will expand significantly again.

He said, “Will the stock price premium return to double its level? This possibility exists at some point in the future, especially as the peak of the next market cycle approaches. But can this state of high premiums be maintained for a long time? I personally don't think it's likely.”

Other analysts are still optimistic about the stock's target price: Bernstein cut the target price by 25% on Monday, and Cantor Fitzgerald also cut the target price by 59% last week. However, both companies predict that within the next 12 months, the stock price will rise from the current price.

Palmer predicts that by the end of 2026, the price of Bitcoin will skyrocket, rising more than 140% to a high level of $225,000. Driven by this advantage, Strategy's stock price will also soar. He also estimates that the market performance of those newer digital asset treasury (DAT) products will not be as good as expected, which will further stimulate market demand for Strategy shares.

Palmer admits, “Our optimism about Strategy is due in large part to our belief that Bitcoin's price has strong upside potential.”

As of press time, the price of Bitcoin is $92,188,59/piece.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal