Oracle (ORCL.US), which ignited fears of an AI bubble, urgently needs a copy comparable to Nvidia's “explosive growth performance 2023-2024”

The normalization of Oracle's (ORCL.US) growth performance exceeding expectations is insufficient to ease strong market concerns related to the accumulation of corporate debt and the imminent bursting of the AI bubble. A “explosive jump performance” comparable to Nvidia's 2023-2024 movement 100% +, and announcing more new cloud computing orders other than OpenAI in the performance outlook can fully mitigate the market's “negative AI bubble” about the company's fundamentals and global technology stocks closely linked to AI computing power infrastructure.

Oracle, which will announce its results after the close of trading on Wednesday EST, can be described as the main culprit in the recent round of AI bubble rhetoric sweeping the global stock market and causing the stock market to fall into adjustment. Today, Oracle's performance prospects and future prospects are deeply “bundled” with ChatGPT developer OpenAI's long-term, expensive, and far unfulfilled large-scale AI data center cloud computing infrastructure orders and cloud computing IaaS investment returns related to the “Stargate” AI infrastructure project.

To meet these far-flung, futuristic promises, Oracle is helping OpenAI expand or build large-scale AI data centers through large-scale borrowing and strong capital expenditure (capex); however, its free cash flow is turning negative, and the price of credit default swaps (CDS) has soared to multi-year highs. Oracle's increasingly high debt burden and debt repayment risk behind this incredibly strong cloud computing infrastructure order that is deeply tied to OpenAI cannot be ignored.

OpenAI, a global AI application leader with a valuation of up to 500 billion US dollars, reached AI computing power resource supply agreements with tech giants over the past few months. The overall scale is already very close to OpenAI CEO Sam Altman's huge spending plan on AI computing power infrastructure of up to 1.4 trillion US dollars. This series of exaggerated orders and the fact that Google Gemini3 has begun to encroach on the number of ChatGPT users has also made the market increasingly worried about whether OpenAI, which has been losing money for a long time and continues to burn money, can bear such a huge scale of expenses. If OpenAI's funds break down, it will undoubtedly have a severe impact on the stock prices of companies in the “OpenAI chain” led by Oracle.

As a result, current market sentiment about investment in the AI computing power industry chain linked to OpenAI has changed from being steadfastly bullish to questioning (as a comparison, the “Google AI Chain” bullish sentiment quickly became hot after Gemini 3 launched and quickly became popular around the world), and when uncertainty about Oracle's OpenAI future contract fulfillment intensifies, Oracle's valuation-debt-cash flow triangle structure appears weak.

Compared to the stable fundamentals of Oracle's image as a mature tech giant over a period of time, it is now more like a “high-leverage gambler” borrowing money to bet on future returns in this AI investment boom. If the revenue generation of OpenAI users or the growth and expansion of the AI computing power industry chain seriously slows down, Oracle is likely to become the core trigger for the collapse of the global technology company credit bond bubble and the bubble of overvaluation stocks, and even the “AI bubble burst” comparable to the bursting of the Internet bubble in 2000.

Oracle's normal profit exceeding expectations is insufficient to ease market concerns

Three months ago, Oracle's impressive performance expectations and huge cloud computing infrastructure orders caused the stock price to soar rapidly, setting the best performance in 30 years. However, after just a quarter, the outlook for this database software maker and the cloud service provider and the AI computing power industry in general looks very different.

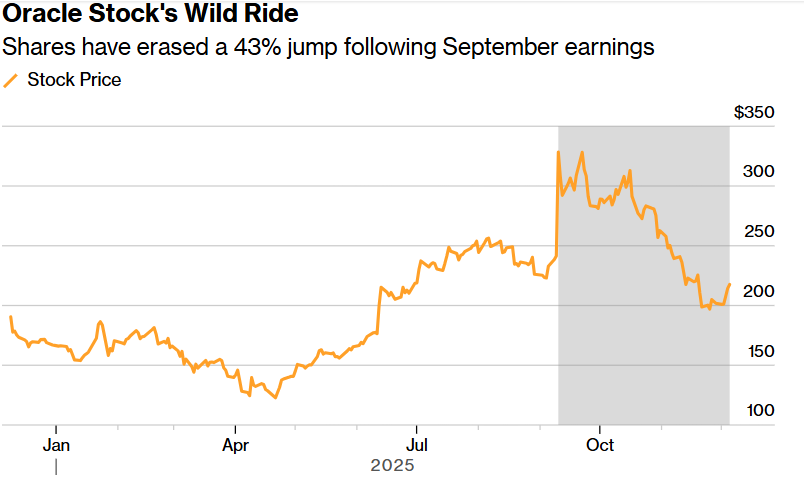

Since the stock price hit a record high on September 10 — the surge at the time was based on a surge in orders for its cloud computing business, Oracle's stock price has plummeted 33%. Today, Oracle and many other artificial intelligence technology companies are facing a wave of doubts stemming from the huge capital expenses of tech giants that are not in line with the revenue generation path, as well as the “chain-link circular financing” arranged and led by OpenAI.

“They're pushing their balance sheets to the limit, free cash flow is negative, and their balance sheets are highly leveraged.” Portfolio manager Jed Ellerbroek from Argent Capital Management said the company holds Oracle shares. “Their necks are very long.”

As shown in the chart above, Oracle's stock price has fluctuated sharply recently, and the stock price has erased the 43% increase after the release of the strong earnings report in September.

Investors are particularly concerned about Oracle's huge debt risk. The company recently sold tens of billions of dollars in bonds through bond issuance and indirectly supported projects. Last week, CDS transaction costs to protect Oracle debts from default reached their highest level since March 2009. Wall Street analysts who track the company generally say that this long-term uncertainty far exceeds any good news in its quarterly earnings report.

“It's not as important as how fast their performance is growing, but rather a cognitive question of how they can achieve this goal, and how are they financing all of this?” Gabelli Funds analyst Ryuta Makino said. “During the construction of large-scale AI data centers around the world, they will have negative free cash flow for a long time, so there are many questions surrounding this issue.”

Wall Street analysts expect that the Austin-based tech giant's backlog of cloud computing orders will continue to grow in its second fiscal quarter (the quarter ending November), and is mainly due to OpenAI; remaining performance obligations (that is, RPO indicators) — this data played an important role in the sharp rise in Oracle's stock price by more than 30% at the end of September, and is expected to reach about US$520 billion, which means it will increase by more than 400% compared to last year, and will continue to rise in the next fiscal quarter, if cloud computing orders or RPO fail to achieve a level comparable to Nvidia 2024 With such explosive growth and cash flow still negative, what awaits Oracle may be a sharp drop.

cognitive problems

“It's not just about the rate of growth, but also about how they perceive how to achieve these ambitious goals,” said Michael Sansoterra, chief investment officer at Silvant Capital Management, which holds Oracle shares in its portfolio. “I'm not sure if the earnings report will change this unfavorable situation. I'm guessing the earnings report for this quarter will be good, and I expect the guidance to be good, but I don't know if it will be favored by the market.”

Wall Street analysts expect Oracle to release an 11% year-on-year increase in adjusted earnings per share, while total revenue is expected to increase by about 15%. According to data compiled by the agency, the company's gross margin is expected to be close to 69%, which means it is likely to be lower than 71% last year. The biggest change is reflected in its capital expenditure, which is expected to reach 8.2 billion US dollars, compared to less than 4 billion US dollars last year, and free cash flow is expected to be negative 5.9 billion US dollars, compared to a positive 2.7 billion US dollars last year.

At the performance conference call, Oracle executives will almost certainly be asked about a number of issues relating to OpenAI's orders and revenue generation prospects. The latter signed a huge contract with Oracle for cloud computing infrastructure services in September. Investors are very concerned about Oracle's expected revenue and the diversification of cloud computing orders/RPO sources. Any major new customer that signs up during the quarter is likely to be warmly welcomed by market investors.

“I've always thought it would be dangerous for the company to take huge amounts of leverage while tying its future to numerous AI startups. Now that OpenAI is facing difficulties, the risks are even higher,” said Michael O'Rourke, chief market strategist from Jonestrading. “If implementation of OpenAI is slow or unable to be implemented, Oracle's management must come up with a contingency plan.”

Regardless of the outcome, options traders expect Oracle's stock price to fluctuate sharply due to the after-market financial report, and expect the stock price to fluctuate within the 10% range (that is, rise 10% or fall by more than 10%) after the earnings report is released. The stock has recently rebounded markedly, rising nearly 10% in December.

In terms of valuation, the stock is relatively expensive. The price-earnings ratio based on expected earnings for the next 12 months is about 30x, far higher than its 10-year average 17x, and also higher than the expected price-earnings ratio of 26x of the Nasdaq 100 Index.

All of these factors have made some investors wary of buying Oracle now. Sansoterra from Silvant Capital said he is currently on the sidelines.

“If we see any degree of improvement in gross margin, or if the trend of improving gross margin is not just empty talk, but real execution, then we will be more interested.” he said. “But we haven't seen that yet, and we're not making any investments we hope will be in the future.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal