Tyler Technologies (TYL): Assessing Valuation After Recent Share Price Weakness

Tyler Technologies (TYL) has had a rough stretch lately, with the stock sliding over the past month and past 3 months, even as revenue and net income keep growing at a solid double digit clip.

See our latest analysis for Tyler Technologies.

The latest slide leaves Tyler’s share price about $453, and while the year to date share price return has been weak, the three year total shareholder return still reflects meaningful compounding, suggesting momentum has cooled rather than disappeared.

If this pullback has you reassessing your watchlist, it could be a good moment to explore other high quality software names through high growth tech and AI stocks.

So with the share price down sharply over the past year but growth still humming along, is Tyler a rare chance to buy a quality gov-tech leader at a discount, or is the market already pricing in years of expansion?

Most Popular Narrative Narrative: 30.2% Undervalued

With the most followed narrative placing fair value near $650 against a last close around $453, the implied upside rests on ambitious growth and margin assumptions.

The analysts have a consensus price target of $678.778 for Tyler Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $800.0, and the most bearish reporting a price target of $585.0.

Want to see how steady revenue gains, rising margins, and a premium earnings multiple all intersect to justify that punchy upside case? The full narrative explains the growth runway in detail, outlines the potential path for profit expansion, and describes the valuation level it believes Tyler can sustain.

Result: Fair Value of $649.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower government tech spending or more uneven large deal bookings could easily derail those upbeat assumptions and challenge Tyler’s lofty multiple.

Find out about the key risks to this Tyler Technologies narrative.

Another Angle on Valuation

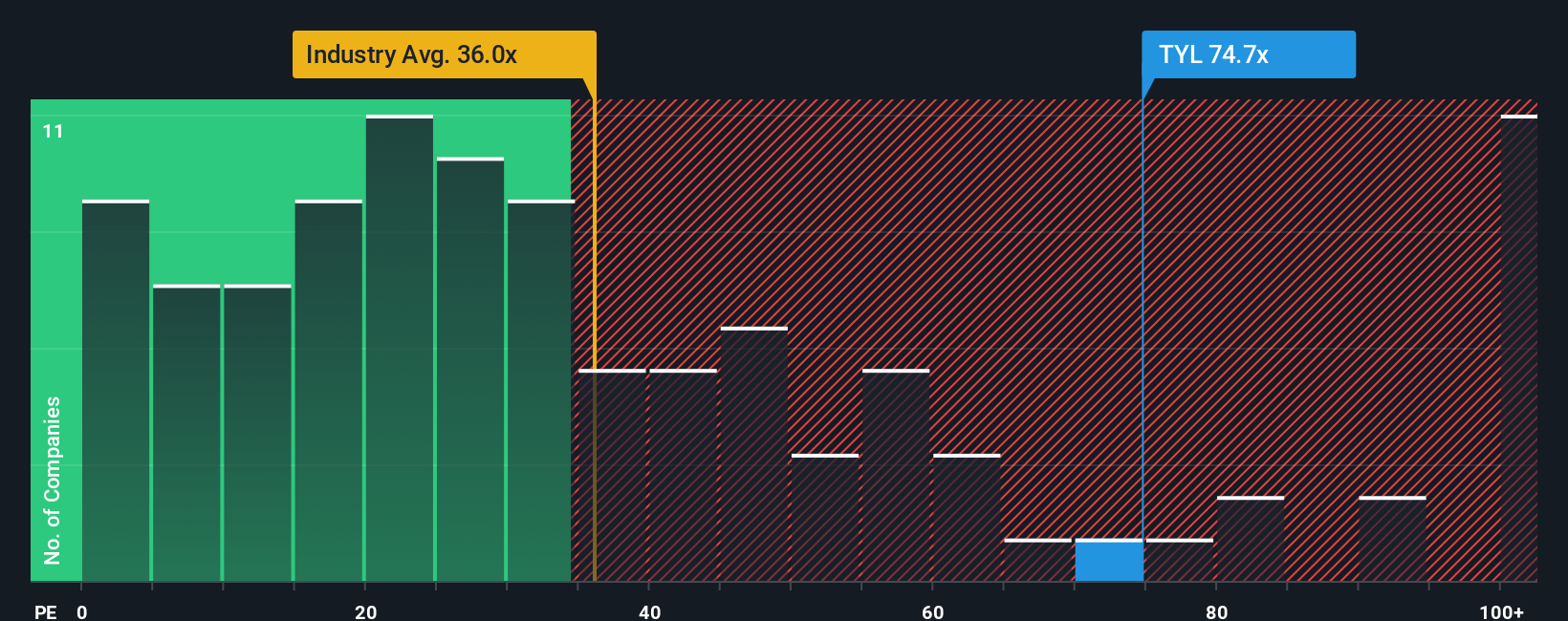

Even though Tyler screens near fair value on our models, its current P/E of 61.9 times still towers over the US software average of 32 times and a fair ratio of 32.8 times. This points to meaningful rerating risk if growth or sentiment cools further. Is the premium still worth paying?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tyler Technologies Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized Tyler thesis in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Tyler Technologies.

Looking for your next investing edge?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover targeted ideas that match your exact strategy today.

- Capture potential mispricings by hunting for quality businesses trading below their estimated worth through these 894 undervalued stocks based on cash flows before the rest of the market catches on.

- Capitalize on powerful technology trends by scanning these 27 AI penny stocks that could reshape industries and fuel long term portfolio growth.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that may offer cash returns alongside capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal