Has Ingredion’s 2024 Share Price Slide Created a Long Term Opportunity?

- If you have been wondering whether Ingredion at around $106 a share is a bargain or a value trap, you are not alone. This article is designed to walk you through that question step by step.

- The stock is down 2.4% over the last week and 1.1% over the last month. More notably, it has slid 22.1% year to date and 24.6% over the past year, even though the 3 year and 5 year returns are still up 15.1% and 52.6% respectively.

- Recently, investors have been digesting a mix of macro headlines around food ingredient input costs and shifting consumer demand, alongside company specific updates on productivity initiatives and portfolio optimization. Together, these have nudged sentiment away from the steady compounder narrative and toward a more cautious, wait and see stance.

- On our framework, Ingredion scores a 3/6 valuation score. This suggests pockets of undervaluation but not an obvious slam dunk. In the next sections we will unpack what that means across multiples, discounted cash flow, and asset based views, before finishing with a more holistic way to think about the company’s true value.

Find out why Ingredion's -24.6% return over the last year is lagging behind its peers.

Approach 1: Ingredion Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting them back to today, using a required rate of return. For Ingredion, the model uses a 2 Stage Free Cash Flow to Equity approach based on cash flow projections in $.

Ingredion generated last twelve month free cash flow of about $656 million, with analysts and model assumptions pointing to $778 million in 2024. Beyond the formal forecast window, Simply Wall St extrapolates cash flows, with projected free cash flow in 2035 of roughly $277 million, still comfortably positive but lower than today as growth normalizes.

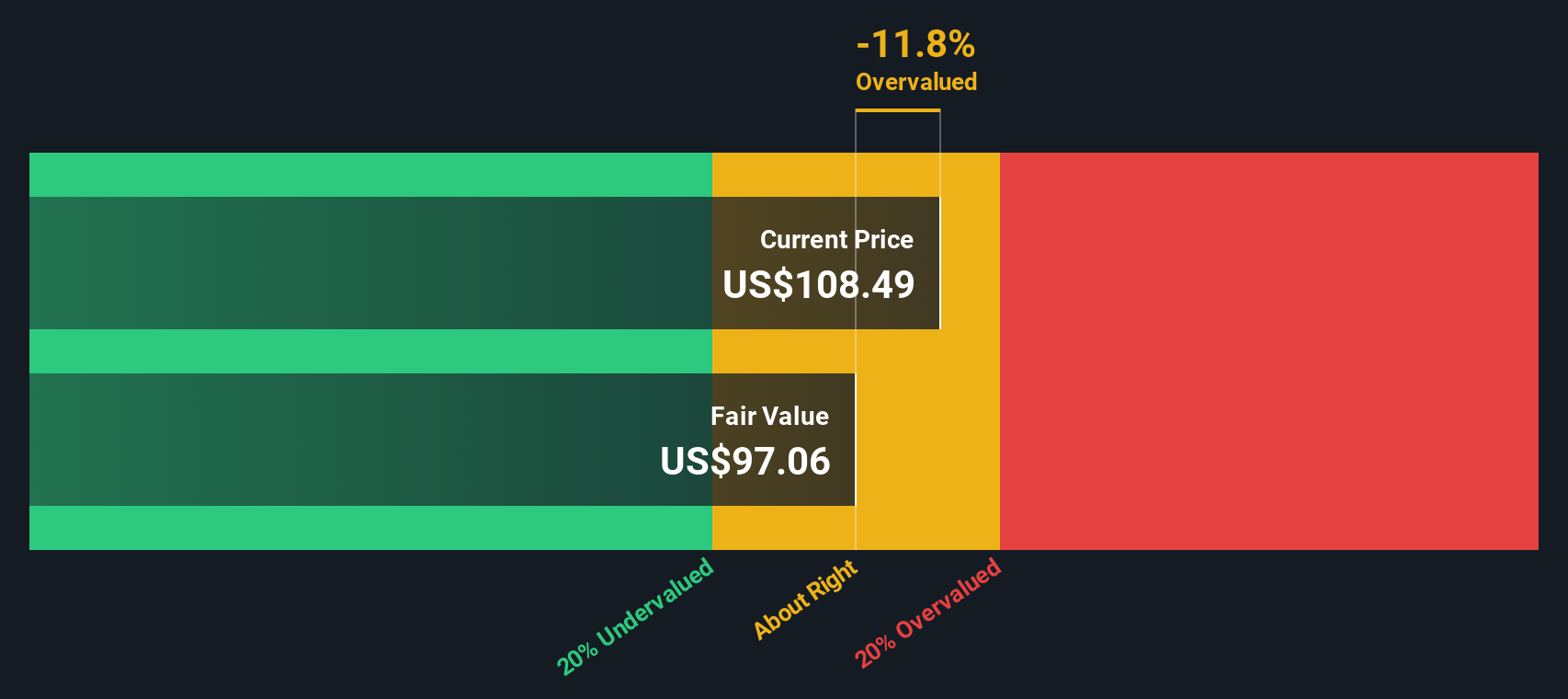

When all these future cash flows are discounted back, the model arrives at an intrinsic value of about $97.06 per share. With the stock trading around $106, the DCF suggests Ingredion is approximately 9.5% overvalued. This is close enough to consider it broadly in line with fair value rather than dramatically mispriced.

Result: ABOUT RIGHT

Ingredion is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Ingredion Price vs Earnings

For consistently profitable companies like Ingredion, the price to earnings ratio is a practical way to gauge valuation, because it links what investors pay directly to the profits the business is generating today. What counts as a normal or fair PE depends on how quickly earnings are expected to grow and how risky those earnings are, with faster growing and lower risk businesses typically justifying higher multiples.

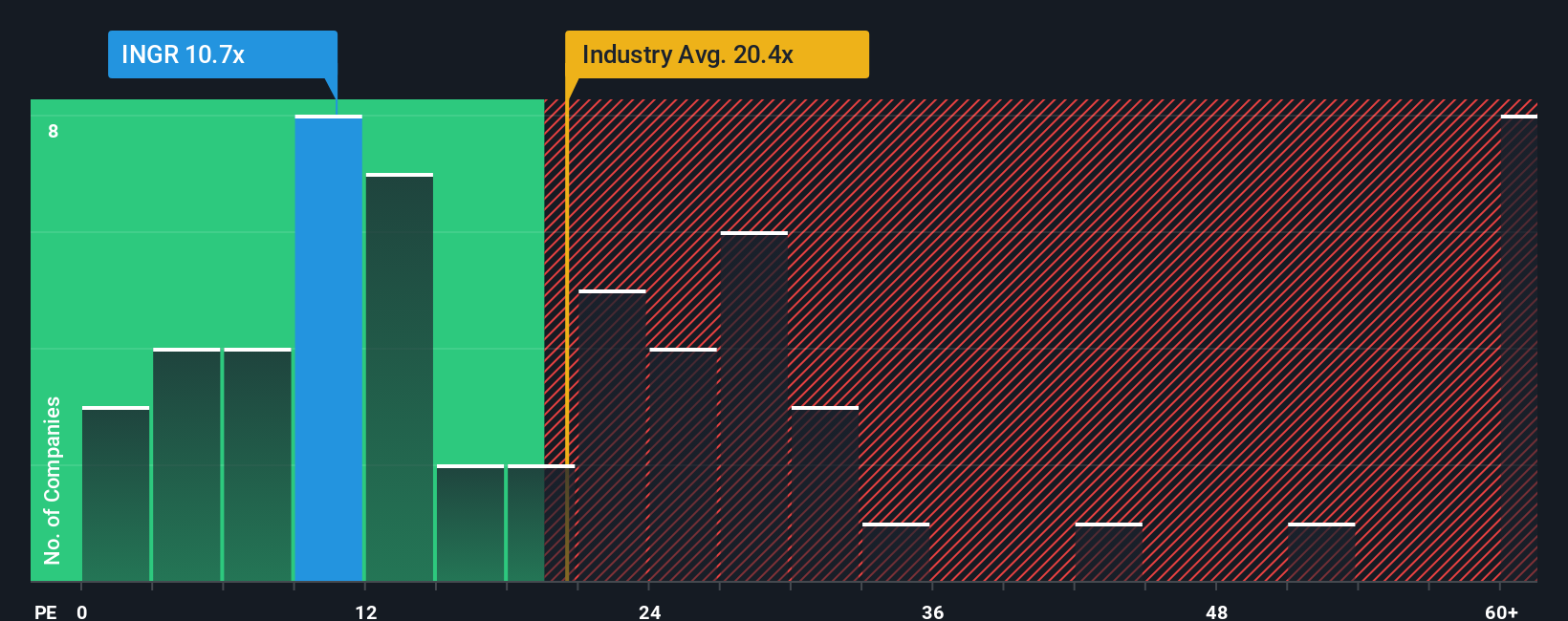

Ingredion currently trades on about 10.25x earnings, which is well below both the broader Food industry average of roughly 21.51x and a peer group average near 27.75x. That headline discount might suggest a bargain, but it does not automatically account for Ingredion’s specific growth profile, margins, scale and risk factors.

Simply Wall St’s Fair Ratio metric aims to address this by estimating the PE multiple the company should trade on, given its earnings growth outlook, profitability, industry, market cap and risk characteristics. For Ingredion, the Fair Ratio is 13.73x, which sits between its current PE and the richer multiples of peers. Because this fair value anchor is materially higher than today’s 10.25x, the PE approach indicates that the shares may be undervalued on a risk adjusted basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ingredion Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Ingredion’s story with a transparent financial forecast and a Fair Value estimate on Simply Wall St’s Community page, where investors share and compare ideas.

A Narrative is your structured story for a company, where you spell out what you think will happen to its revenues, earnings and margins. The platform then automatically turns that into a forecast and a Fair Value that you can compare with today’s share price as part of your decision to buy, hold or sell.

Because Narratives are dynamic, they update as new information, such as earnings releases or news, arrives. This helps your fair value view evolve instead of staying locked to a static report.

For example, one Ingredion investor might build a bullish Narrative that assumes health focused specialty ingredients keep growing and supports a Fair Value closer to a higher analyst target near $168. A more cautious investor could instead model weaker demand in legacy products and arrive nearer a lower value around $140. Both investors can clearly see how their assumptions drive those different valuations.

Do you think there's more to the story for Ingredion? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal