3 Dividend Stocks On The TSX With Up To 14.8% Yield

As we approach the end of 2025, Canadian markets have shown impressive resilience, with the TSX up by a robust 27% amid favorable economic conditions and key central bank meetings on the horizon. In this environment, dividend stocks can be an attractive option for investors seeking steady income streams, especially as interest rate decisions and employment data continue to shape market dynamics.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Wajax (TSX:WJX) | 5.04% | ★★★★★☆ |

| Toronto-Dominion Bank (TSX:TD) | 3.50% | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | 14.87% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 3.43% | ★★★★★☆ |

| Pizza Pizza Royalty (TSX:PZA) | 6.07% | ★★★★☆☆ |

| Olympia Financial Group (TSX:OLY) | 6.37% | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | 7.62% | ★★★★☆☆ |

| Great-West Lifeco (TSX:GWO) | 3.78% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.41% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 3.81% | ★★★★★☆ |

Click here to see the full list of 17 stocks from our Top TSX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

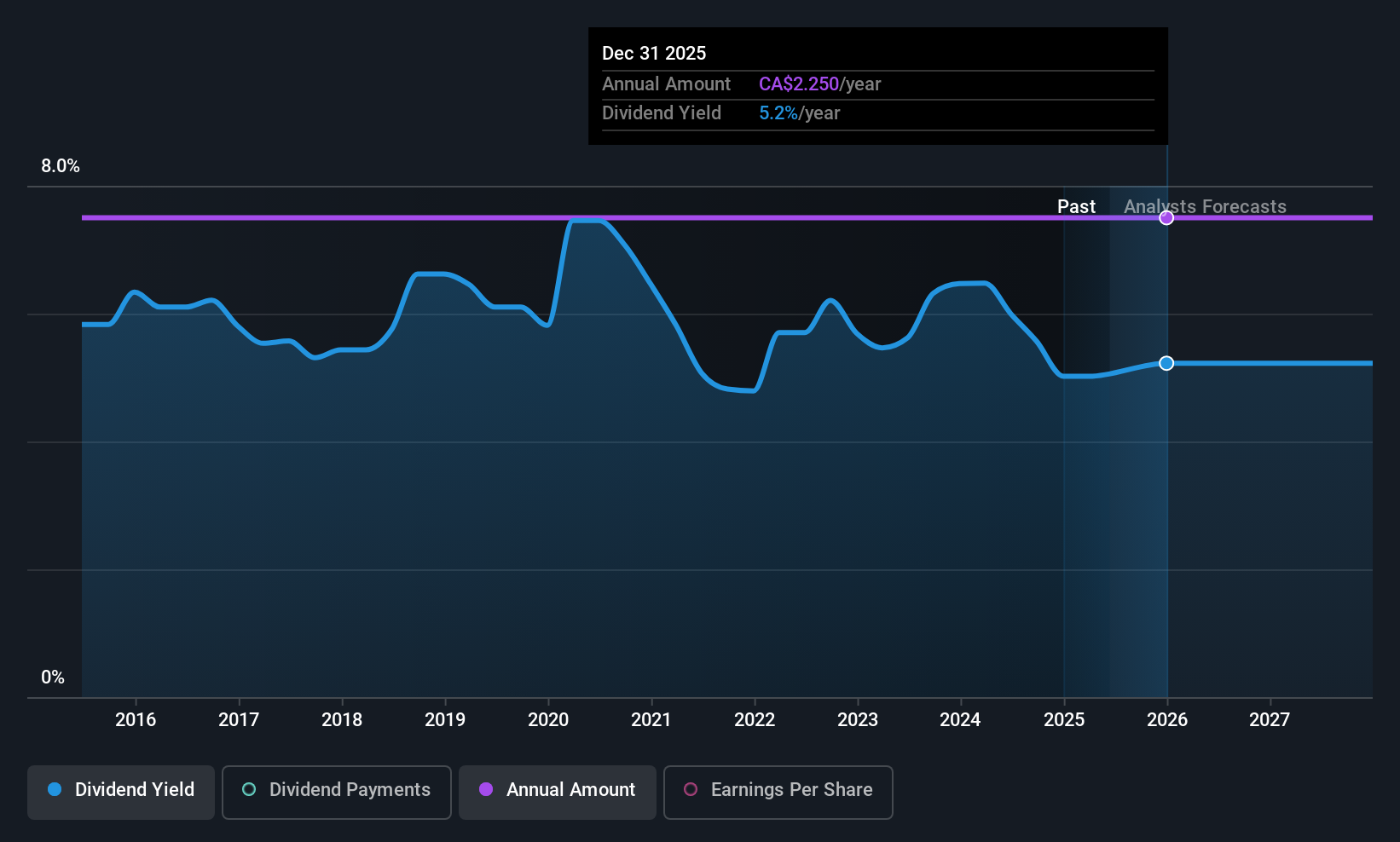

IGM Financial (TSX:IGM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IGM Financial Inc. operates in the asset management business in Canada, with a market cap of CA$13.94 billion.

Operations: IGM Financial Inc.'s revenue is primarily derived from its Wealth Management segment, generating CA$2.65 billion, and its Asset Management segment, contributing CA$1.33 billion.

Dividend Yield: 3.8%

IGM Financial's dividend yield of 3.81% is lower than the top Canadian dividend payers but remains stable, with a payout ratio of 51.6% and cash flow coverage at 57%. Despite not increasing over the past decade, dividends are supported by recent earnings growth and revenue increases, as evidenced by Q3 results showing CAD 971.88 million in revenue and CAD 298.09 million in net income. The company also expanded its share buyback plan to include an additional one million shares.

- Delve into the full analysis dividend report here for a deeper understanding of IGM Financial.

- The valuation report we've compiled suggests that IGM Financial's current price could be quite moderate.

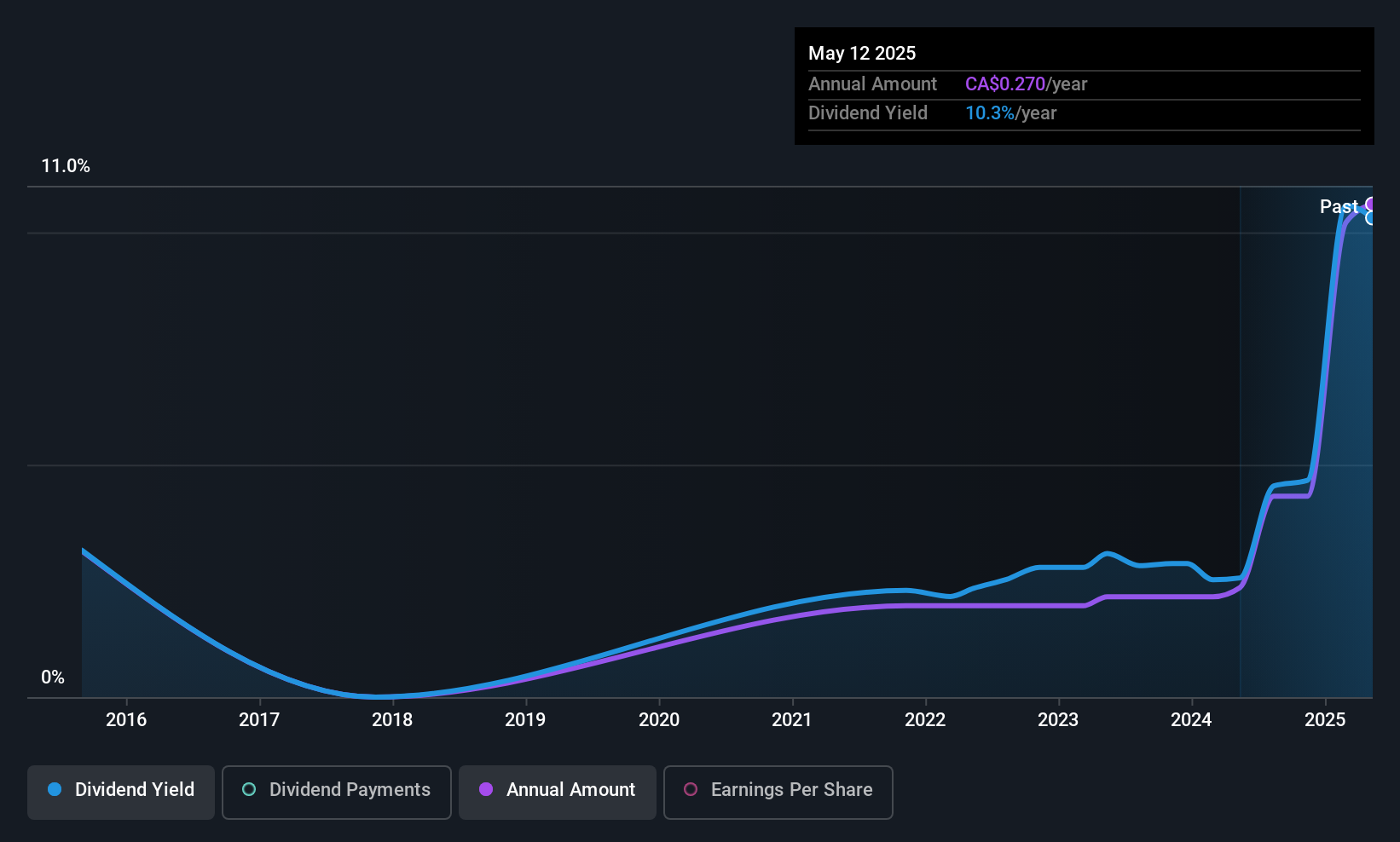

Pulse Seismic (TSX:PSD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Pulse Seismic Inc. acquires, markets, and licenses 2D and 3D seismic data for the energy sector in Canada, with a market cap of CA$160.29 million.

Operations: Pulse Seismic Inc.'s revenue is primarily derived from the oil well equipment and services segment, which generated CA$50.07 million.

Dividend Yield: 14.9%

Pulse Seismic's dividend yield of 14.87% ranks in the top 25% of Canadian payers, though its history is marked by volatility. The payout ratio is low at 14.9%, indicating dividends are well-covered by earnings, and a cash payout ratio of 72.8% suggests sustainability from cash flows. Recent earnings growth to CAD 21.44 million for nine months supports this coverage despite a Q3 net loss of CAD 1.5 million, with dividends affirmed at $0.0175 per share.

- Get an in-depth perspective on Pulse Seismic's performance by reading our dividend report here.

- The analysis detailed in our Pulse Seismic valuation report hints at an deflated share price compared to its estimated value.

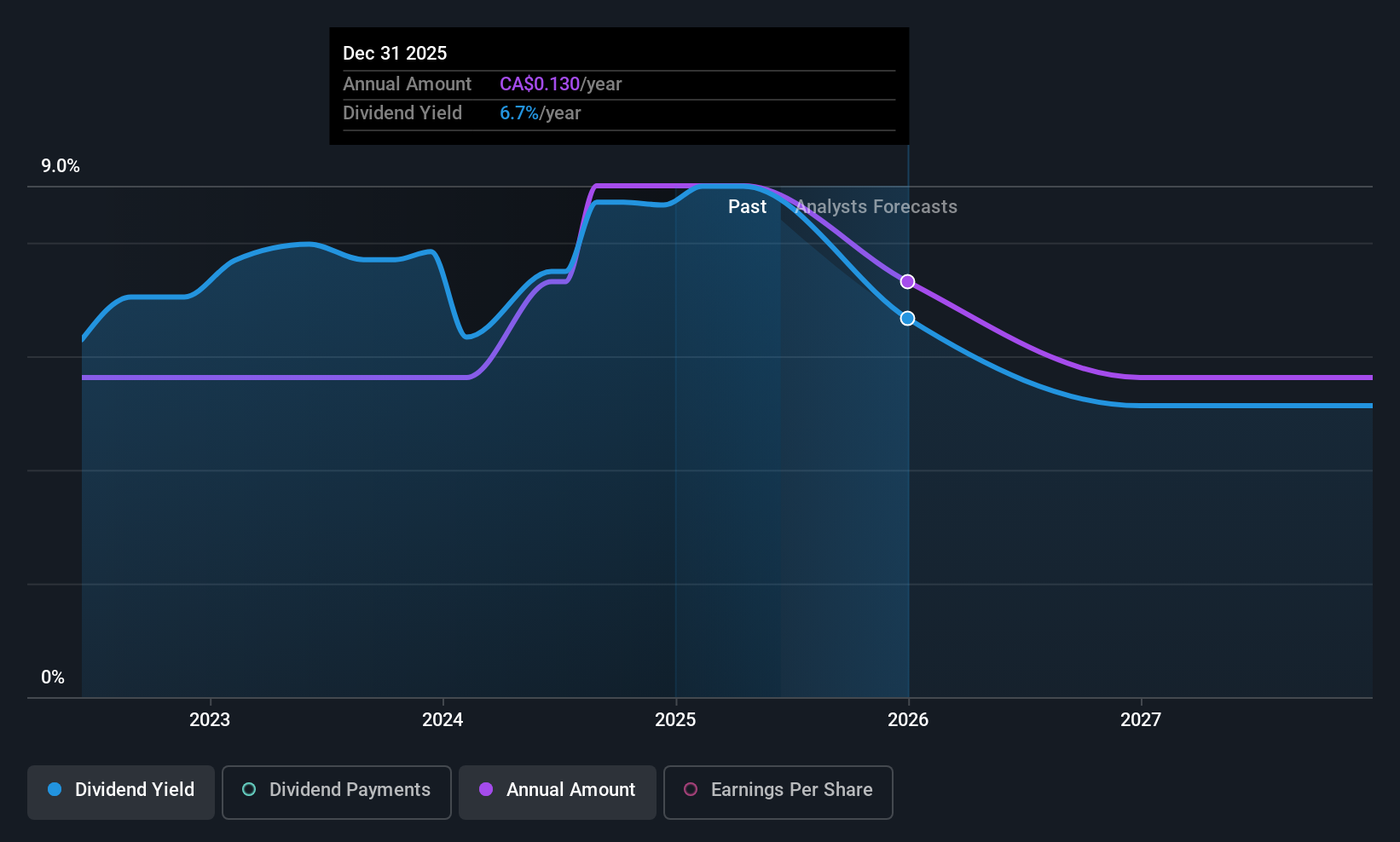

Hemisphere Energy (TSXV:HME)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hemisphere Energy Corporation engages in the acquisition, exploration, development, and production of petroleum and natural gas properties in Canada with a market cap of CA$198.72 million.

Operations: Hemisphere Energy Corporation generates revenue of CA$80.35 million from its petroleum and natural gas interests in Canada.

Dividend Yield: 7.6%

Hemisphere Energy's dividend yield of 7.62% places it in the top 25% of Canadian dividend payers. Despite a brief history, dividends have been stable and well-covered by earnings and cash flows, with payout ratios at 31.9% and 34.7%, respectively. The company recently affirmed its quarterly dividend at CAD 0.025 per share amid declining Q3 revenues to CAD 19.1 million from CAD 20.87 million last year, while executing stock buybacks worth CAD 12 million since July 2024.

- Unlock comprehensive insights into our analysis of Hemisphere Energy stock in this dividend report.

- In light of our recent valuation report, it seems possible that Hemisphere Energy is trading behind its estimated value.

Seize The Opportunity

- Get an in-depth perspective on all 17 Top TSX Dividend Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal