Immutep (ASX:IMM): Valuation Check After Dr. Reddy’s Licensing Deal and New Phase II Breast Cancer Data

Immutep (ASX:IMM) has jumped onto investors radar after two meaningful updates: a lucrative licensing deal with Dr. Reddy’s for its cancer immunotherapy efti, and fresh Phase II breast cancer data reinforcing its development pathway.

See our latest analysis for Immutep.

The recent licensing deal and upbeat breast cancer data appear to have flipped sentiment, with a 1 month share price return of 25.49 percent and a 90 day share price return of 36.17 percent standing in contrast to a still negative year to date share price return and a modest 1 year total shareholder return decline. This suggests momentum is now building off a low base.

If this kind of clinical and deal driven catalyst appeals to you, it might be worth exploring other potential turnaround stories among healthcare stocks for fresh ideas beyond Immutep.

With Immutep still trading under A$0.35 yet carrying triple digit percentage upside to analyst targets, the key question now is simple: is this a genuine buying opportunity, or are markets already pricing in future growth?

Price to Book of 3.3x: Is it justified?

Immutep last closed at A$0.32 and the stock screens as undervalued on a price to book basis relative to both its peers and the broader Australian biotech space.

The price to book ratio compares a company’s market value to the net value of its assets on the balance sheet. This is a key lens for early stage, loss making biotechs that have limited revenue but significant R and D investment. For Immutep, a 3.3x multiple implies investors are paying a little over three times the company’s book value, a level that can hint at modest expectations for future commercialisation given typical sector premiums.

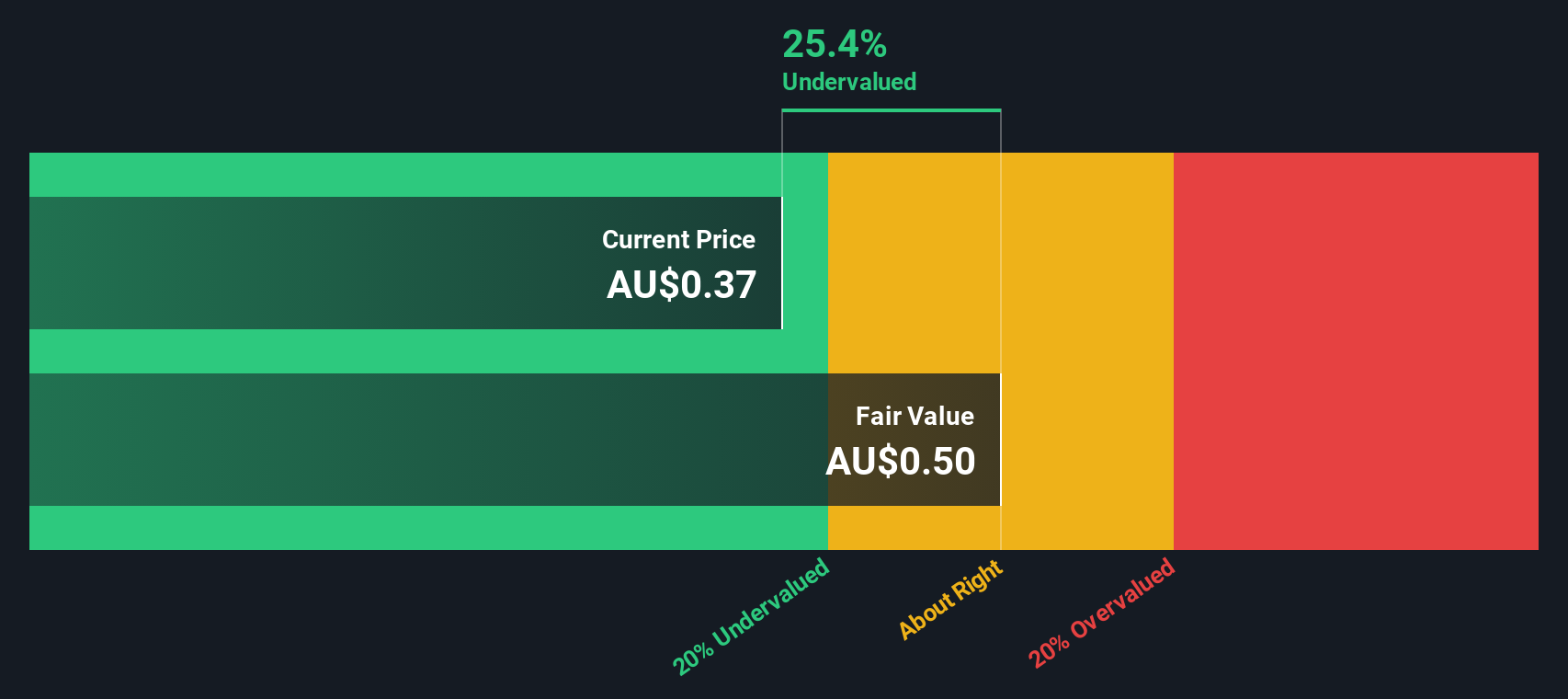

Immutep’s 3.3x price to book stands well below the Australian biotechs industry average of 6.7x and also under the peer group average of 4.4x, suggesting the market is assigning a discount despite forecasts for rapid revenue and earnings growth. Alongside this, our DCF model points to additional downside to intrinsic value, with the shares trading at 35.4 percent below an estimated fair value of about A$0.50.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 3.3x (UNDERVALUED)

However, investors still face key risks, including clinical setbacks across efti’s broad pipeline or delays in partnering that could derail sentiment driven momentum.

Find out about the key risks to this Immutep narrative.

Another View: SWS DCF Fair Value Check

Our DCF model suggests Immutep is worth around A$0.50 per share, meaning the stock is trading roughly 35 percent below that estimate and screens as undervalued on cash flow assumptions too. However, it is important to consider whether those long range forecasts are realistic for a still loss making biotech.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Immutep for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 893 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Immutep Narrative

If you see the story differently or want to stress test our assumptions with your own numbers, you can build a custom narrative in just a few minutes by using Do it your way.

A great starting point for your Immutep research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next opportunity?

Before sentiment shifts again, move beyond a single stock and use the Simply Wall St Screener to line up your next high conviction investment ideas today.

- Explore potential opportunities by targeting these 3591 penny stocks with strong financials that already pair tiny market caps with resilient fundamentals and identifiable, data backed growth runways.

- Consider the structural AI trend by focusing on these 27 AI penny stocks that are positioned at the center of automation, productivity improvements, and real world enterprise adoption.

- Identify potentially attractive entry points with these 893 undervalued stocks based on cash flows that our models highlight as mispriced relative to their forecast cash flow profiles and business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal