Is Paramount Skydance (PSKY) Still Undervalued After Its 2024 Share Price Rebound?

Paramount Skydance (PSKY) has quietly become one of 2024’s more interesting media rebound stories, with the stock up roughly 38% year to date despite pressure on traditional TV and streaming economics.

See our latest analysis for Paramount Skydance.

That year to date share price return of about 38% at a latest share price of $14.64 has come even as the 3 month share price return of roughly negative 16% shows some of the initial rebound enthusiasm cooling. At the same time, the 1 year total shareholder return of around 33% still points to a broader recovery story taking shape.

If you are looking for more opportunities in media and content driven names, this could be a good moment to explore fast growing stocks with high insider ownership.

With shares still trading at a reported intrinsic discount of roughly 23 percent, yet sitting near analysts’ price targets after a sharp rebound, is Paramount Skydance a mispriced recovery story, or has the market already baked in future growth?

Price-to-Sales of 0.6x: Is it justified?

Based on a price to sales ratio of roughly 0.6 times at a last close of $14.64, Paramount Skydance screens as undervalued versus both peers and the wider US media space.

The price to sales multiple compares the company’s market value to the revenue it generates. This can be a useful lens for large media groups that are currently loss making but still generate substantial top line scale across studios, streaming, and TV media.

For Paramount Skydance, trading at about 0.6 times sales compared with a US media industry average nearer 1 time and a peer group average closer to 1.1 times, this implies investors are paying a significantly lower price for each dollar of revenue than they do elsewhere in the sector.

Most striking, the current 0.6 times price to sales ratio also sits well below an estimated fair price to sales level of about 1.5 times, suggesting considerable room for the valuation multiple to expand if the company delivers on its profit growth and streaming transition narrative.

Explore the SWS fair ratio for Paramount Skydance

Result: Price-to-Sales of 0.6x (UNDERVALUED)

However, sustained net losses and a sharp five year share price decline could undermine confidence in a clean turnaround and limit any valuation re-rating.

Find out about the key risks to this Paramount Skydance narrative.

Another View on Value

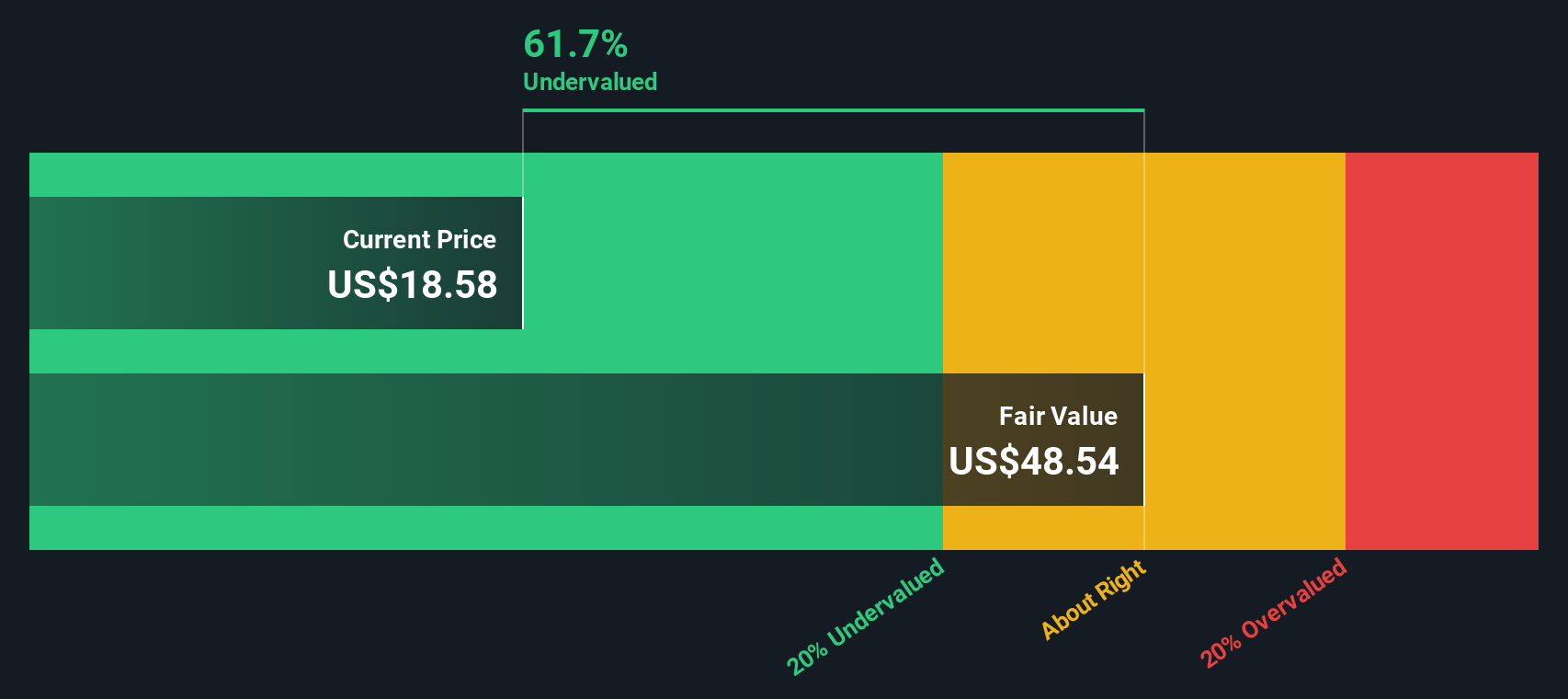

Our DCF model points to a fair value around $19.04 per share, roughly 23% above the current $14.64 price, which also suggests Paramount Skydance is undervalued. If both sales based multiples and cash flow estimates agree, is the market still clinging to old worries?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Paramount Skydance for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 893 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Paramount Skydance Narrative

If you would rather dig into the numbers yourself or challenge these assumptions, you can quickly build a personalized view in just minutes: Do it your way.

A great starting point for your Paramount Skydance research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before the market makes its next big move, consider putting your capital to work in fresh opportunities uncovered by the Simply Wall St Screener, rather than relying on yesterday’s headlines.

- Seek potential multi baggers early by targeting resilient small caps through these 3591 penny stocks with strong financials before they appear on everyone else’s radar.

- Look for powerful long term tailwinds in automation and machine learning by focusing on companies highlighted in these 27 AI penny stocks that are leading real world adoption.

- Explore income opportunities that may help offset inflation by concentrating on reliable payers surfaced in these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal