Cognyte (CGNT) Q3 2026 Revenue Growth Contrasts With Renewed EPS Loss, Pressuring Profit Narratives

Cognyte Software (CGNT) just posted its Q3 2026 results, with revenue of about $100.7 million and basic EPS of roughly -$0.07. This keeps the focus firmly on how efficiently that top line is translating into the bottom line. The company has seen revenue move from $89 million in Q3 2025 to $100.7 million this quarter, while quarterly EPS has swung between -$0.05 and $0.02 over the past year as management works through a still loss-making backdrop. With revenue momentum set against lingering negative EPS, investors will be watching whether margins can steadily firm from here or if profitability continues to lag the growth story.

See our full analysis for Cognyte Software.With the headline numbers on the table, the next step is to see how this mix of growth and lingering losses matches up with the prevailing narratives around Cognyte, and where the latest quarter might start to shift the story.

Curious how numbers become stories that shape markets? Explore Community Narratives

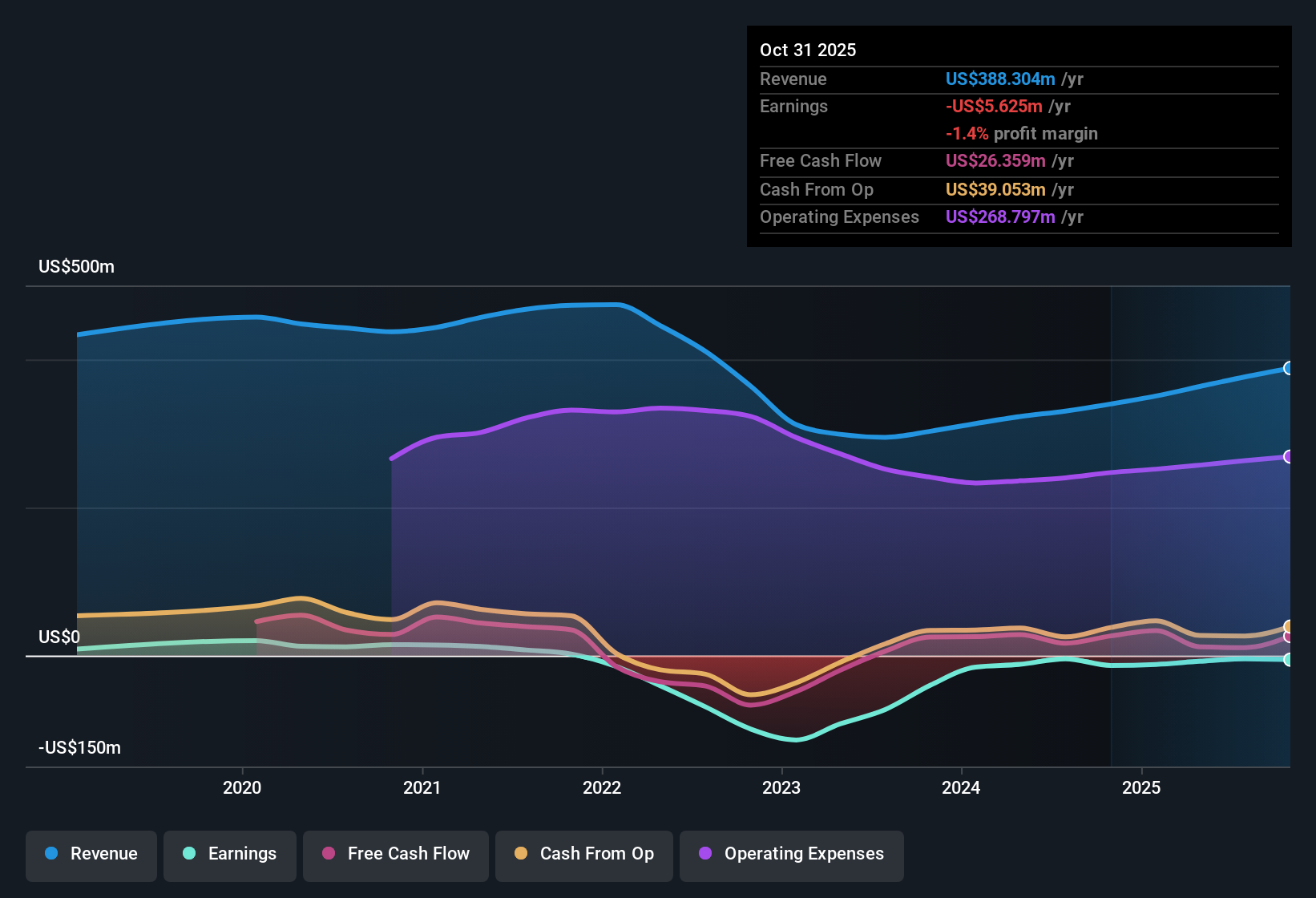

TTM revenue climbs to about $388 million

- Over the last twelve months, Cognyte generated about $388.3 million in revenue, up from roughly $339.8 million a year earlier, while trailing net losses narrowed from about $13.4 million to $5.6 million.

- What stands out for a bullish view is that revenue is also forecast to grow about 11.1% per year. At the same time:

- trailing EPS remains negative at around -$0.08 even after losses narrowed versus the prior year,

- so any upbeat growth story still has to be weighed against a business that has not yet moved into sustained profitability.

Five year earnings slide remains a key risk

- Across the last five years, earnings have declined by about 4.4% per year and the latest Q3 2026 net loss of roughly $4.9 million shows that Cognyte is still unprofitable despite higher revenue.

- Critics highlight that this multi year earnings decline reinforces a bearish case that focuses on execution risk, and the current numbers leave that concern very much alive, because:

- the company is still loss making on a trailing twelve month basis, with about $5.6 million in net losses,

- and quarterly EPS has stayed volatile, moving between roughly -$0.05 and $0.02 over the last year without establishing a clear, consistent profit trend.

DCF fair value far above $9.72 price

- On valuation, Cognyte trades at a Price to Sales ratio of about 1.8 times compared with roughly 4.9 times for the US software industry and 5.2 times for peers, while a DCF fair value of about $30.58 sits well above the current $9.72 share price.

- Supporters see these metrics as heavily backing a bullish value case that the stock could rerate if profitability improves. The same data also reminds investors that:

- the discounted cash flow estimate assumes future cash generation that is not reflected in today’s trailing net loss of about $5.6 million,

- and the relatively low sales multiple may partly reflect the market’s caution around that five year pattern of roughly 4.4% annual earnings decline.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Cognyte Software's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Cognyte’s five year earnings decline, ongoing net losses and volatile quarterly EPS indicate that profitability remains unproven, even with improving revenue and an apparently cheap valuation.

If that instability makes you cautious, use our stable growth stocks screener (2092 results) to quickly focus on companies already delivering consistent revenue and earnings progress, giving you a clearer basis for your investment decisions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal