How Investors May Respond To ING Groep (ENXTAM:INGA) Buyback And Transparency Push

- Earlier in December 2025, ING Groep reported that it had repurchased 1,710,214 shares under its ongoing €1.10 billion buyback, bringing total repurchases to 11,382,155 shares, while its American depositary receipts traded modestly higher alongside other European names in US markets.

- At the same time, ING’s confirmation of participation in the European Banking Authority’s 2025 Transparency Exercise underlines its focus on regulatory disclosure as it returns capital through a sizeable buyback programme.

- Next, we’ll examine how ING’s sizeable share buyback, alongside heightened regulatory transparency, may influence its existing investment narrative and outlook.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

ING Groep Investment Narrative Recap

To own ING Groep, you generally need to believe in its ability to turn a large, digitally focused European banking franchise into resilient earnings and steady capital returns, despite macro and regulatory headwinds. The latest share buyback update and participation in the 2025 EBA Transparency Exercise do not materially change the near term catalysts around digital growth and cost efficiency, nor the key risk of fragmented European regulation and its impact on capital requirements.

The ongoing €1.10 billion buyback, with 11,382,155 shares already repurchased, is the most relevant development here, as it directly ties into ING’s capital return story while it continues to invest in digital capabilities and fee income growth. Combined with more granular regulatory disclosures via the Transparency Exercise, this supports a narrative where capital return, balance sheet strength and earnings quality remain central discussion points for the stock’s near term outlook.

Yet even with sizeable buybacks, investors should be aware that regulatory fragmentation across Europe could still...

Read the full narrative on ING Groep (it's free!)

ING Groep's narrative projects €24.9 billion revenue and €6.6 billion earnings by 2028. This implies 8.3% yearly revenue growth and about a €1.8 billion earnings increase from €4.8 billion today.

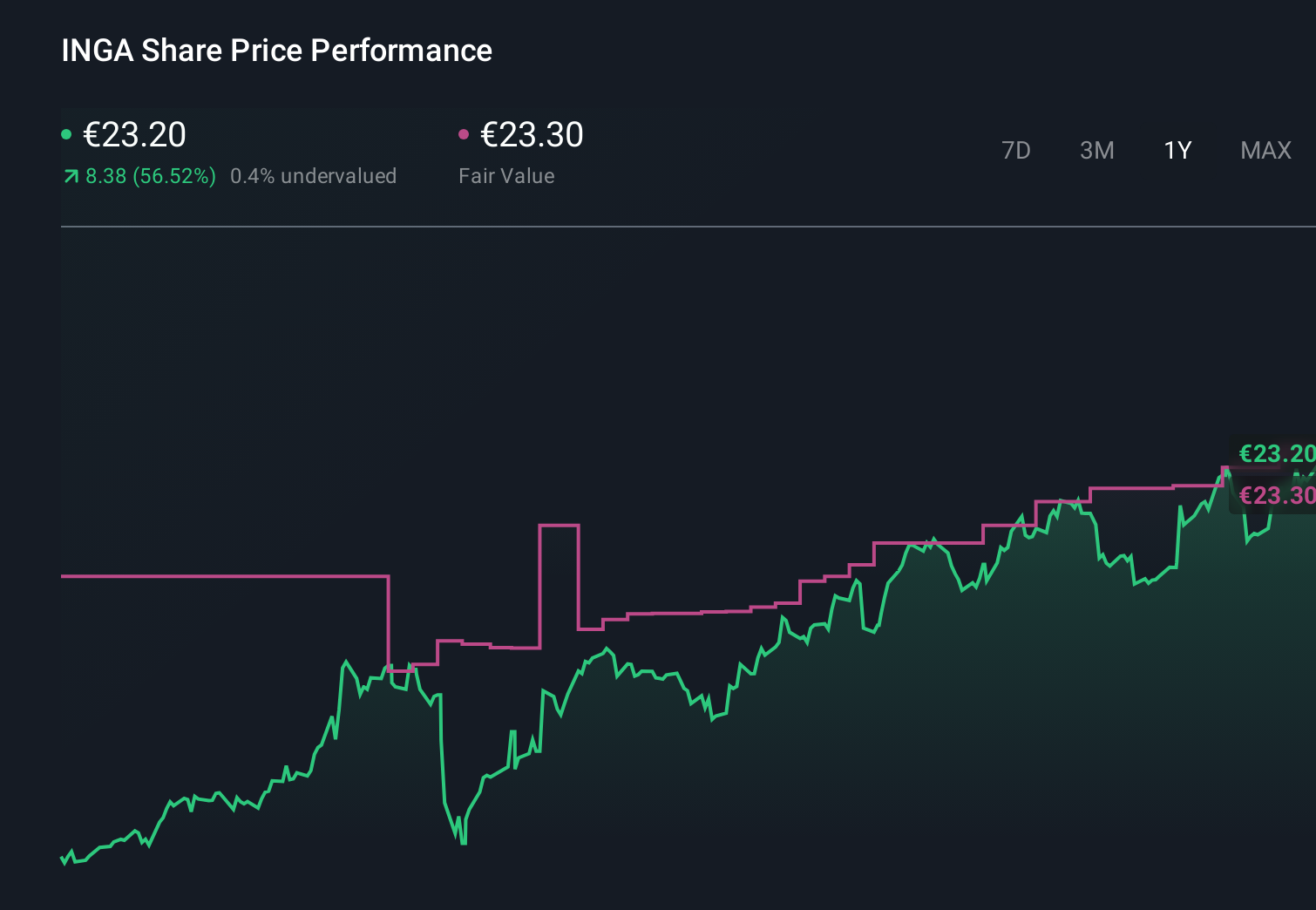

Uncover how ING Groep's forecasts yield a €23.28 fair value, in line with its current price.

Exploring Other Perspectives

Ten members of the Simply Wall St Community currently see ING’s fair value between €21 and €46.30, reflecting very different expectations for the bank. You can weigh those views against the risk that fragmented European regulation keeps capital needs and structural costs higher for longer, affecting how much of ING’s earnings power ultimately reaches shareholders.

Explore 10 other fair value estimates on ING Groep - why the stock might be worth 9% less than the current price!

Build Your Own ING Groep Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ING Groep research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ING Groep research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ING Groep's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal