Here's Why Graham (NYSE:GHM) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Graham (NYSE:GHM). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Graham's Improving Profits

Graham has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Outstandingly, Graham's EPS shot from US$0.71 to US$1.24, over the last year. It's a rarity to see 74% year-on-year growth like that.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Graham is growing revenues, and EBIT margins improved by 2.3 percentage points to 7.0%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

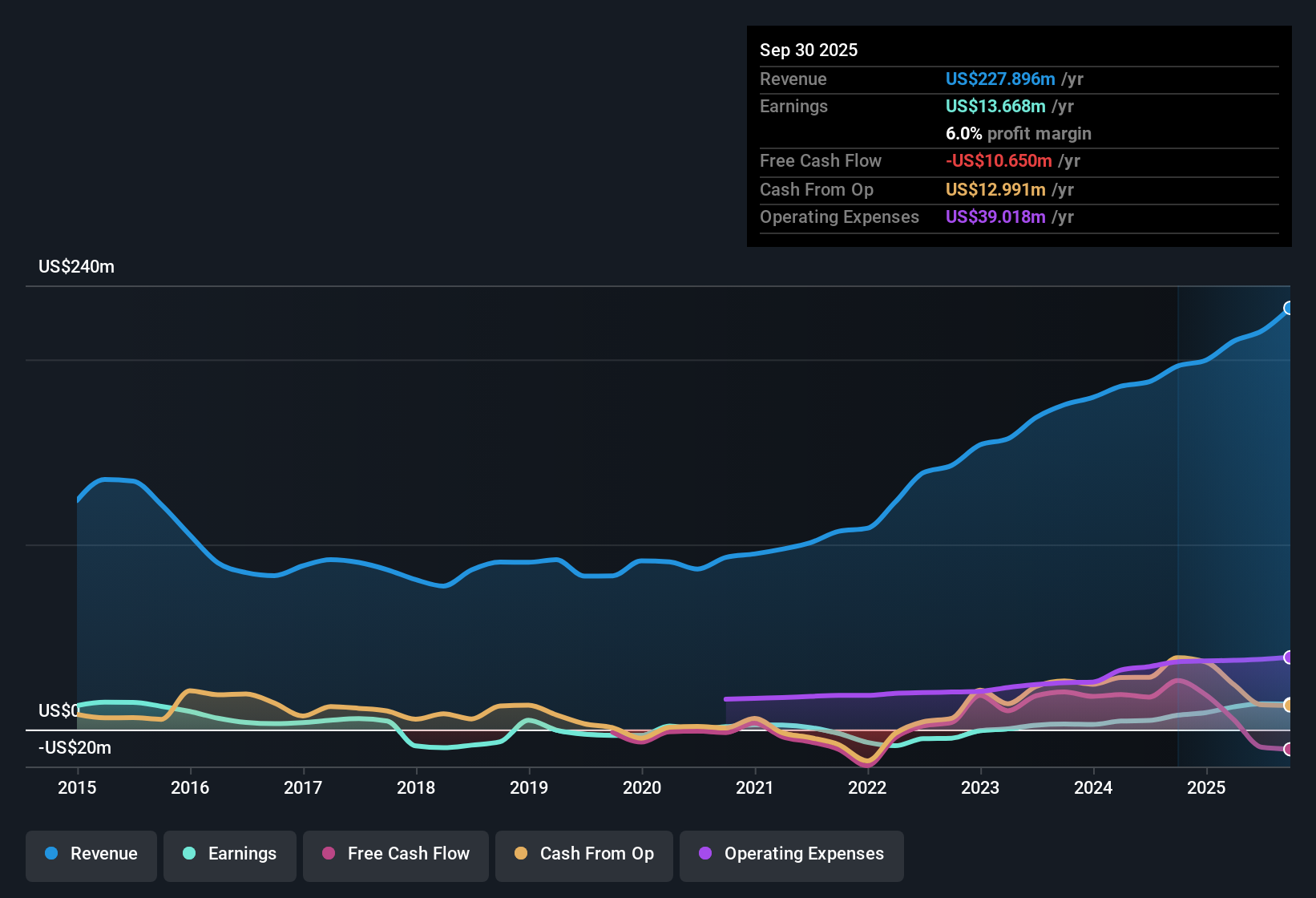

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

See our latest analysis for Graham

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Graham?

Are Graham Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

With strong conviction, Graham insiders have stood united by refusing to sell shares over the last year. But more importantly, Director Mauro Gregorio spent US$59k acquiring shares, doing so at an average price of US$49.01. Strong buying like that could be a sign of opportunity.

The good news, alongside the insider buying, for Graham bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$42m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. As a percentage, this totals to 6.2% of the shares on issue for the business, an appreciable amount considering the market cap.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Graham's CEO, Matt Malone, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations between US$400m and US$1.6b, like Graham, the median CEO pay is around US$3.5m.

The CEO of Graham only received US$828k in total compensation for the year ending March 2025. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Graham Worth Keeping An Eye On?

Graham's earnings have taken off in quite an impressive fashion. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Graham belongs near the top of your watchlist. We don't want to rain on the parade too much, but we did also find 1 warning sign for Graham that you need to be mindful of.

The good news is that Graham is not the only stock with insider buying. Here's a list of small cap, undervalued companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal