Is TD Stock Still Attractive After a 61% Rally in 2025?

- If you are wondering whether Toronto-Dominion Bank is still attractive after such a strong run, or if the value has already been priced in, you are not alone. That is exactly what we are going to unpack here.

- The stock has climbed 4.9% over the last week, 8.6% over the past month, and 61.4% year to date, capping off a 70.7% gain over 1 year and 113.7% over 5 years that has clearly shifted how the market views its prospects.

- Recently, investors have been watching TD navigate a tougher macro backdrop for North American banks, including higher-for-longer interest rate expectations and renewed scrutiny on credit quality. At the same time, ongoing expansion of its wealth and capital markets businesses, along with moves to streamline operations, have helped support sentiment as the bank leans into more diversified growth.

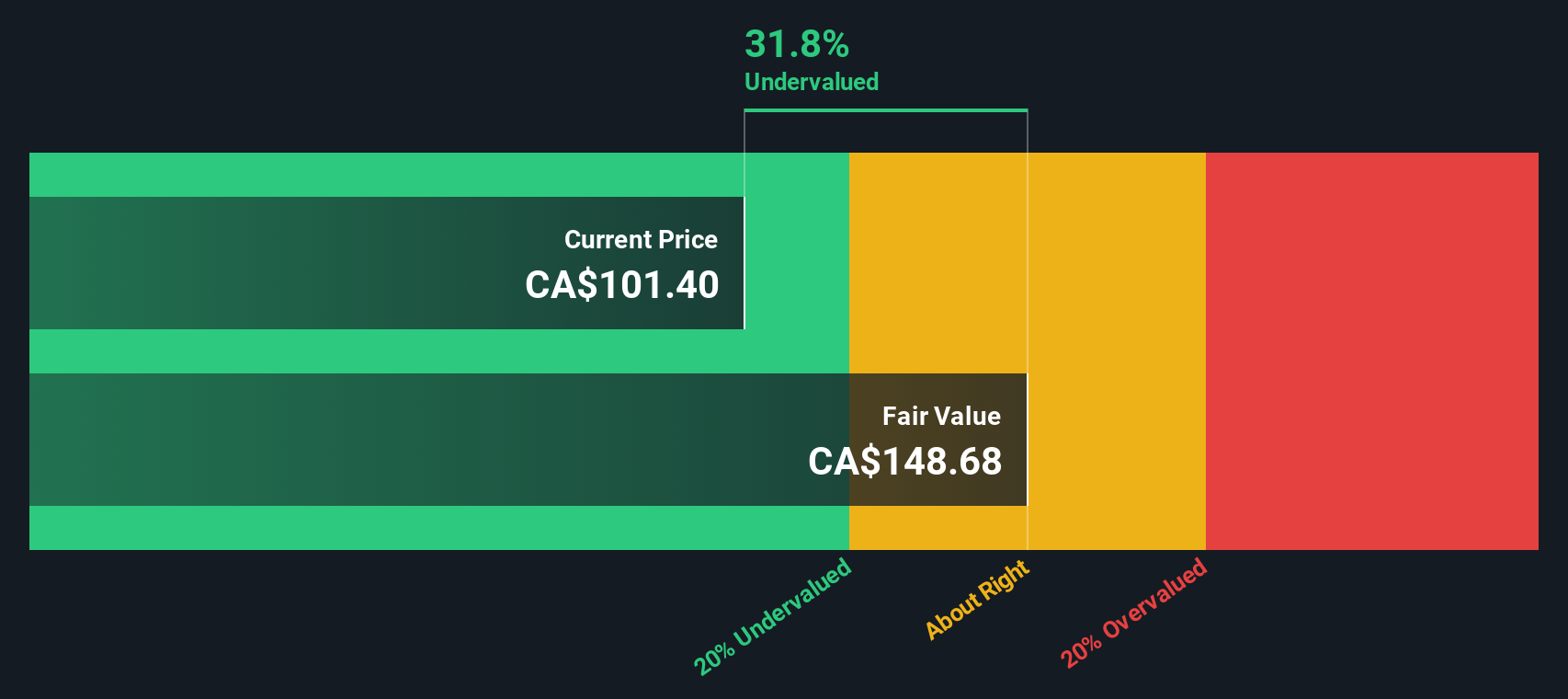

- Despite this rally, TD still scores a 5/6 on our valuation checks. This suggests there may be more value under the hood. In the next sections we will walk through multiple valuation approaches, then finish by exploring a way to think about TD's worth beyond just the numbers.

Approach 1: Toronto-Dominion Bank Excess Returns Analysis

The Excess Returns model looks at how much value Toronto-Dominion Bank can create above the return that shareholders reasonably demand, based on its equity cost and profitability. Instead of focusing on cash flows, it concentrates on the bank’s return on equity and how efficiently it compounds its book value over time.

For TD, the starting point is its Book Value of CA$73.79 per share and a Stable EPS of CA$9.47 per share, derived from weighted future Return on Equity estimates from 12 analysts. With a Cost of Equity of CA$5.27 per share, the bank is expected to generate an Excess Return of CA$4.19 per share, supported by an Average Return on Equity of 13.01%. Analysts also see a Stable Book Value of CA$72.78 per share, based on estimates from 10 analysts.

Putting these inputs through the Excess Returns framework yields an intrinsic value of about CA$166.06 per share, implying the stock is roughly 25.6% undervalued relative to its current price.

Result: UNDERVALUED

Our Excess Returns analysis suggests Toronto-Dominion Bank is undervalued by 25.6%. Track this in your watchlist or portfolio, or discover 895 more undervalued stocks based on cash flows.

Approach 2: Toronto-Dominion Bank Price vs Earnings

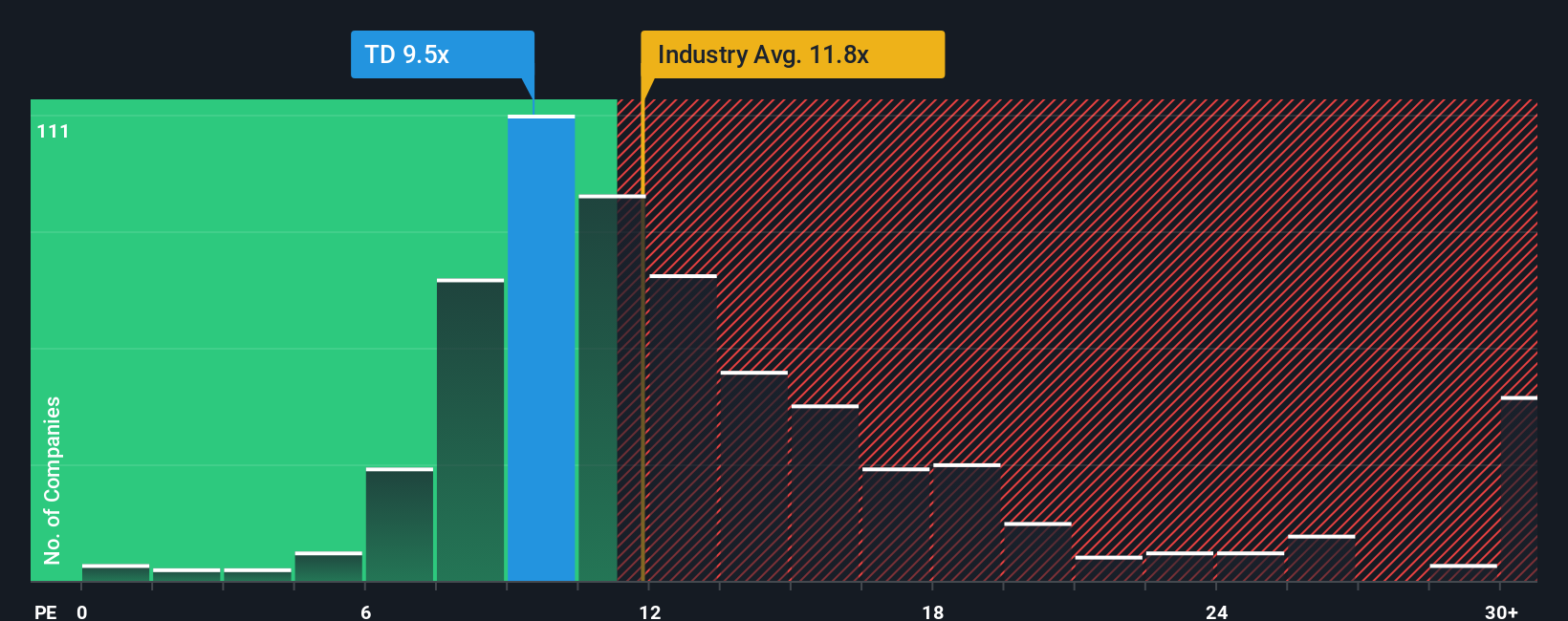

For consistently profitable companies like Toronto-Dominion Bank, the price to earnings ratio is a practical way to gauge how much investors are willing to pay for each dollar of earnings. A higher PE can be justified when a business is expected to grow faster or is viewed as lower risk, while slower growth or higher uncertainty typically warrant a lower, more conservative multiple.

TD currently trades on a PE of 10.44x, which sits just below the broader Banks industry average of about 10.63x and well below the peer group average of 15.61x. To move beyond these broad comparisons, Simply Wall St uses a Fair Ratio, which for TD is 11.50x. This proprietary metric estimates the multiple a stock should reasonably trade at given its earnings growth profile, industry, profit margins, market capitalization and risk factors.

Because the Fair Ratio incorporates TD’s specific fundamentals rather than relying only on simple peer or industry averages, it can provide a more tailored view of value. With TD’s current PE of 10.44x sitting below the Fair Ratio of 11.50x, the multiple based assessment suggests the shares still trade at a discount to what its earnings profile might justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Toronto-Dominion Bank Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to link your story about Toronto-Dominion Bank to clear numbers such as fair value and expected future revenue, earnings and margins. This approach ensures that your view of the business is explicitly connected to a financial forecast, and then to a fair value estimate you can compare with today’s share price on Simply Wall St’s Community page, where millions of investors share their Narratives. These Narratives automatically update as new news or earnings arrive. For example, one TD Narrative might lean cautious, focusing on fintech disruption, regulatory costs and a CA$93.00 fair value. Another could emphasize digital innovation, cost savings and diversified growth to arrive at a CA$120.00 fair value. Seeing where your own Narrative sits between those perspectives can help you decide how you view TD at its current market price.

Do you think there's more to the story for Toronto-Dominion Bank? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal