Is Astronics Stock Still Attractive After Its 236.6% Surge Amid Defense Contract Momentum?

- Wondering if Astronics is still a smart buy after its huge run, or if you are turning up late to the party? This breakdown is designed to help you decide whether the current price still makes sense.

- The stock has pulled back slightly over the last week, down 0.2%, but it is still up 13.1% over the past month and an eye catching 236.6% year to date, with a 222.5% gain over the last year and more than 400% over three years.

- Those kinds of moves usually do not happen in a vacuum. For Astronics, the backdrop has been a steady drumbeat of contract wins, defense and aerospace spending tailwinds, and growing interest in its aircraft connectivity and power solutions. Together, these themes have shifted how investors are thinking about Astronics, from a niche supplier to a potentially more scalable aerospace technology play.

- Despite that optimism, Astronics only scores 1/6 on our valuation checks, so we will walk through what different valuation methods say about the stock today, and then finish by exploring a more nuanced way to think about its true long term value.

Astronics scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Astronics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in dollar terms.

For Astronics, the 2 Stage Free Cash Flow to Equity model starts with last twelve months free cash flow of about $59.2 million and then projects how that cash flow might grow. Analysts provide estimates out to 2026, where free cash flow is expected to reach roughly $69.0 million. Beyond that point, Simply Wall St extrapolates growth gradually moderating over the following years.

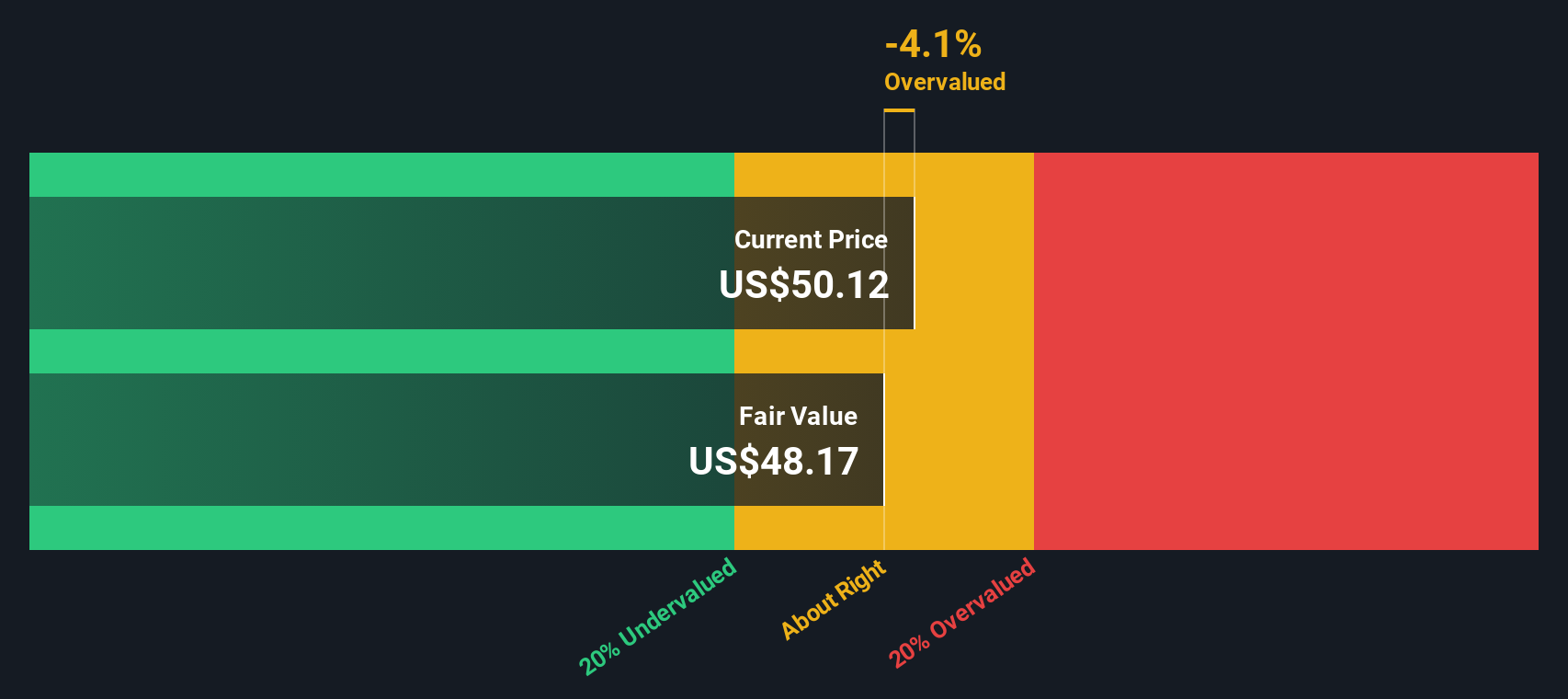

By discounting these projected cash flows, including around $109.0 million of free cash flow expected by 2035, the model arrives at an intrinsic value of about $48.03 per share. That is roughly 10.7% above the current share price, which suggests the stock screens as slightly overvalued on a pure DCF basis. In other words, much of the anticipated cash flow growth already appears to be reflected in the price.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Astronics may be overvalued by 10.7%. Discover 895 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Astronics Price vs Sales

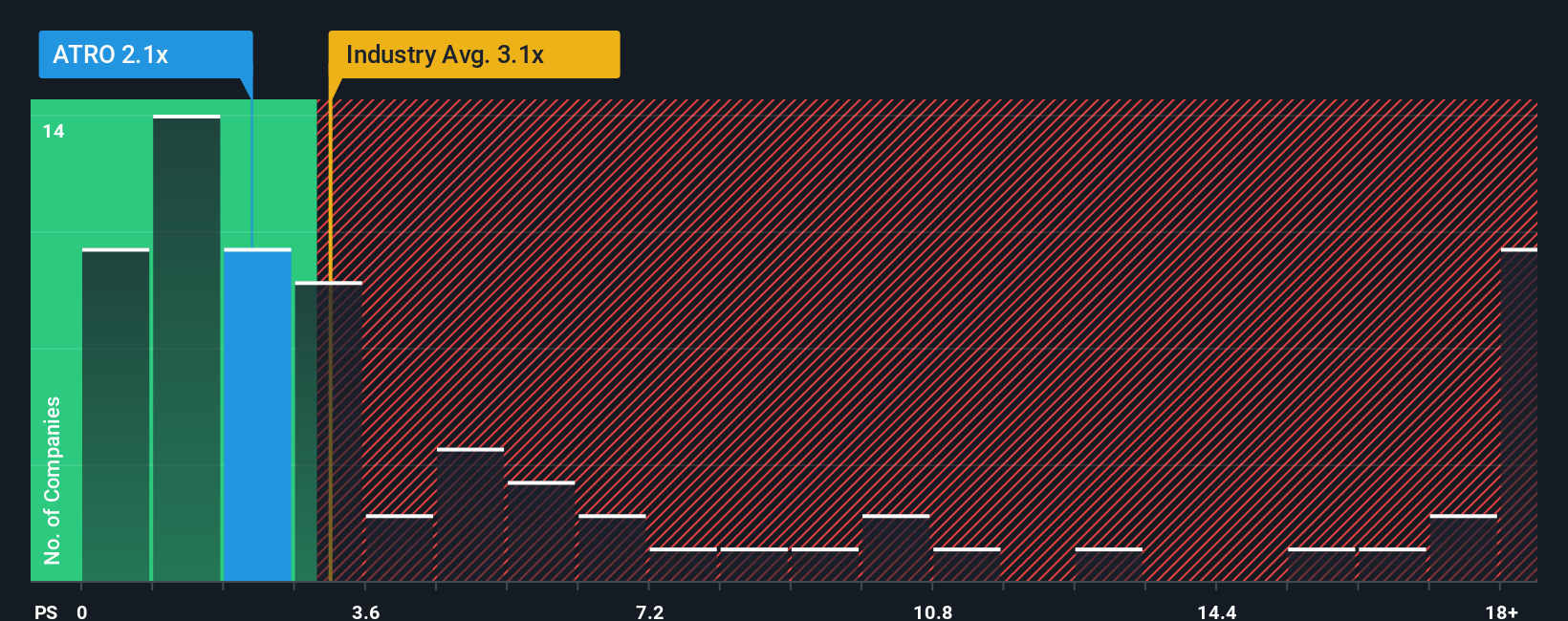

For companies where profits are still normalizing, the price to sales ratio is often a better yardstick than earnings because it focuses on the scale of revenue the market is paying for, rather than volatile or temporarily depressed profits.

In general, higher growth and lower risk justify a higher price to sales multiple, while slower growth or more uncertainty usually mean investors should demand a lower ratio. That gives a framework for what a normal or fair multiple might look like for Astronics.

Astronics currently trades at about 2.28x sales, which is above Simply Wall St's peer average of 1.50x, but slightly below the broader Aerospace and Defense industry average of 2.95x. To refine that view, Simply Wall St uses a proprietary Fair Ratio, which, for Astronics, sits at 1.16x. This Fair Ratio adjusts for the company’s specific earnings growth outlook, margins, risk profile, industry positioning and market capitalization, making it more tailored than a simple peer or sector comparison.

Comparing the current 2.28x sales to the 1.16x Fair Ratio suggests the market is paying a premium to Astronics underlying fundamentals and risk profile.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Astronics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This is a simple tool on Simply Wall St's Community page that lets you attach a story and your view on Astronics future revenue, earnings and margins to a financial forecast and then to a specific fair value, so you can see at a glance whether your fair value suggests it is a buy or a sell at today’s price.

Because Narratives are dynamic, they automatically update when new information arrives, such as earnings results or major contract announcements. This helps you keep your thesis current without having to rebuild your model from scratch each time.

For Astronics, one investor might build a bullish Narrative that leans on robust aircraft production, rising demand for in seat power and connectivity and higher long term margins to justify a fair value closer to the recent 62.75 analyst target. Another, more cautious investor might focus on tariff, legal and execution risks to arrive at a fair value nearer the low 32.75 target, and seeing where your own view sits between those bookends is what makes Narratives so powerful.

Do you think there's more to the story for Astronics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal