CoreWeave (CRWV): Assessing Valuation After Recent Share Price Volatility

CoreWeave (CRWV) has been on a wild ride this year, and the latest swing in the stock is pushing investors to ask a simple question: Do the gains still match the fundamentals?

See our latest analysis for CoreWeave.

That surge to a latest share price of $90.66, alongside a 1 week share price return of 14.24 percent but a 3 month share price return of negative 19.55 percent, shows hot short term momentum after a sharp cooldown, with year to date gains still firmly in growth stock territory.

If CoreWeave’s moves have you thinking more broadly about AI infrastructure, it could be a good moment to explore other high growth tech and AI stocks that are reshaping the space.

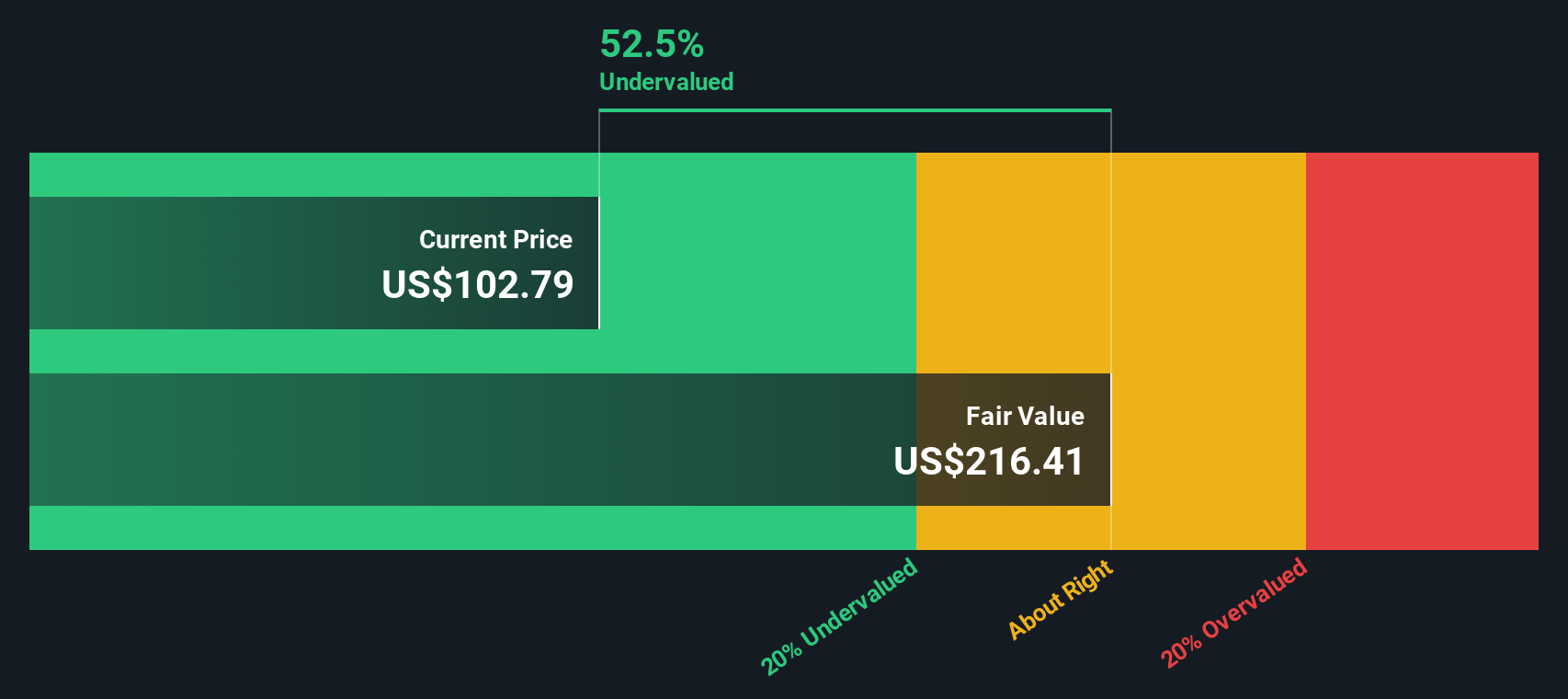

With revenues surging but profits still deep in the red, and the stock trading nearly 46 percent below analyst targets, is CoreWeave quietly undervalued, or are markets already pricing in every ounce of its future AI growth?

Price-to-Sales of 10.5x: Is it justified?

On a price-to-sales basis, CoreWeave looks expensive at its last close of $90.66 compared to much of the IT sector, but cheap versus its closest high growth peers.

The price-to-sales ratio compares the company’s market value with its annual revenue, a common way to value fast growing, loss making software and infrastructure businesses where earnings are not yet meaningful.

CoreWeave trades at 10.5 times sales, far above the broader US IT industry average of 2.5 times. This suggests investors are willing to pay a steep premium for its AI infrastructure growth story. However, that same 10.5 times multiple sits well below the 30.5 times peer average and the estimated fair price-to-sales ratio of 28.8 times, implying a valuation gap if the market starts valuing CoreWeave more like its closest comparables.

This gap between today’s multiple and the higher fair ratio highlights how much room sentiment could have to shift if revenue continues to scale and profitability arrives on schedule. In that scenario, the valuation multiple could move closer to levels usually associated with top tier growth leaders.

Explore the SWS fair ratio for CoreWeave

Result: Price-to-Sales of 10.5x (UNDERVALUED)

However, CoreWeave still faces risks, including intensifying GPU cloud competition and uncertainty about whether it can scale profits fast enough to justify its premium multiple.

Find out about the key risks to this CoreWeave narrative.

Another View

While the price to sales story points to upside, our DCF model paints a far harsher picture, flagging CoreWeave as deeply overvalued at current levels. If cash flows disappoint or take longer to materialize, how much of today’s AI optimism could unwind?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CoreWeave for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 896 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CoreWeave Narrative

If you are not fully convinced by this view, or prefer to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your CoreWeave research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by using the Simply Wall St Screener to uncover fresh, data driven stock ideas that others may overlook.

- Explore early stage opportunities with real momentum by scanning these 3591 penny stocks with strong financials. These still trade at accessible prices and show improving fundamentals.

- Position your portfolio in the AI theme by targeting these 27 AI penny stocks involved in automation, data processing, and intelligent software.

- Strengthen your focus on long term returns by using these 15 dividend stocks with yields > 3% to find stocks that aim to deliver consistent income alongside potential capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal