Barrick Gold (NYSE:GOLD): Reassessing Valuation After a Strong Multi‑Month Share Price Rally

Performance snapshot and why the stock is on radars

Barrick Mining (B) has quietly turned into a strong momentum story, with the stock up roughly 24 % over the past month and nearly 39 % in the past 3 months.

See our latest analysis for Barrick Mining.

That momentum sits on top of a powerful backdrop, with the share price up triple digits on a year to date basis and long term total shareholder returns comfortably more than doubling investors’ money, hinting that confidence in Barrick’s growth story is still building.

If Barrick’s run has you rethinking what strong execution looks like, this could be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

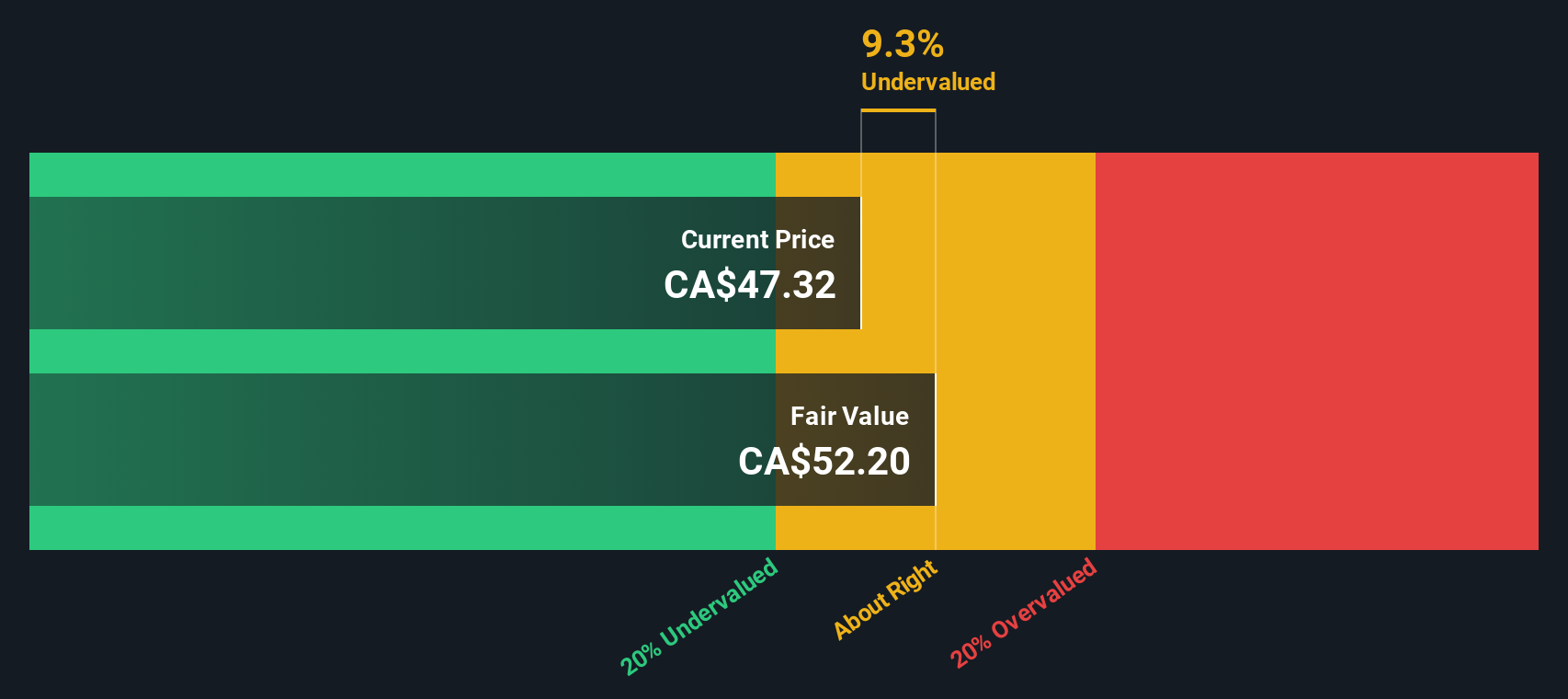

Yet with earnings and cash flows accelerating alongside a hefty intrinsic value gap, the real question is whether Barrick is still trading below what it is worth, or if the market has already priced in the next leg of growth.

Price-to-Earnings of 19.3x: Is it justified?

Barrick Mining currently trades on a price-to-earnings ratio of 19.3 times. When set against the last close of $40.91, this points to shares that still look modestly undervalued relative to peers and the broader industry.

The price-to-earnings ratio compares what investors are willing to pay today with the company’s current earnings. It is a key gauge for a mature, profitable miner like Barrick. With earnings having surged 120.2% over the past year and net profit margins improving from 13.2% to 24.5%, this multiple suggests that the market may not be fully reflecting the change in profitability.

Relative to the US Metals and Mining industry average P/E of 22 times and a peer average of 23.1 times, Barrick’s 19.3 times looks restrained rather than stretched. It is also below an estimated fair P/E of 26.1 times, indicating potential room for the market multiple to expand if earnings and margins remain close to recent levels.

Explore the SWS fair ratio for Barrick Mining

Result: Price-to-Earnings of 19.3x (UNDERVALUED)

However, investors should watch for commodity price softness or project delays, which could pressure margins and challenge assumptions behind Barrick’s recent valuation rerating.

Find out about the key risks to this Barrick Mining narrative.

Another angle on value

Our DCF model paints a far stronger picture than the earnings multiple. It suggests Barrick’s fair value is around $127.85 per share, versus the current $40.91, which implies it is deeply undervalued. If both views are right, is the market simply underestimating how long this upturn can last?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Barrick Mining for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 896 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Barrick Mining Narrative

If your view of Barrick differs, or you simply want to dig into the numbers yourself, you can build a custom narrative in minutes, Do it your way.

A great starting point for your Barrick Mining research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with Barrick. Use the Simply Wall Street Screener to quickly surface focused opportunities that match your strategy before other investors move in.

- Capture high-upside potential early by targeting these 3591 penny stocks with strong financials that already show real financial strength and credible growth paths.

- Ride structural trends shaping tomorrow’s markets by zeroing in on these 30 healthcare AI stocks blending medical innovation with intelligent data insights.

- Lock in reliable income streams by tracking these 15 dividend stocks with yields > 3% that offer attractive yields supported by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal