How Investors Are Reacting To Global Ship Lease (GSL) Cash-Funded ECO Fleet Expansion And Preferred Dividend

- In early December 2025, Global Ship Lease, Inc. announced the US$90.0 million purchase of three 8,600 TEU Korean-built ECO containerships with attached below-market but flexible charters, which are expected to lift its fleet to 71 vessels totaling 422,567 TEU when delivered around year‑end 2025.

- The company also recently declared a quarterly cash dividend of US$0.546875 per depositary share on its 8.75% Series B preferred stock, underscoring its continued use of cash returns alongside fleet expansion funded initially from cash on hand.

- We’ll now examine how adding three ECO‑upgraded, charter‑attached vessels funded with cash on hand may influence Global Ship Lease’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Global Ship Lease Investment Narrative Recap

To own Global Ship Lease, you need to believe in its ability to translate contracted charter income and disciplined fleet renewal into resilient cash flows despite volatile freight markets. The three ECO containership purchases and continued preferred dividends slightly reinforce this income‑plus‑asset‑value story, but they do not materially change the near term focus on charter rate risk and potential pressure from weaker trade flows.

The acquisition of three 8,600 TEU ECO‑upgraded vessels with below‑market but contracted charters is the clearest link to the current thesis. It modestly extends revenue visibility into 2030 while tying more of GSL’s fortunes to midsize ships, a segment where limited long term charter appetite and the risk of oversupply remain central to how the next few years could unfold.

Yet investors also need to weigh how a meaningful correction in charter rates could affect those same cash flows and asset values...

Read the full narrative on Global Ship Lease (it's free!)

Global Ship Lease's narrative projects $621.0 million revenue and $270.6 million earnings by 2028. This implies a 5.3% yearly revenue decline and an earnings decrease of $112.4 million from $383.0 million today.

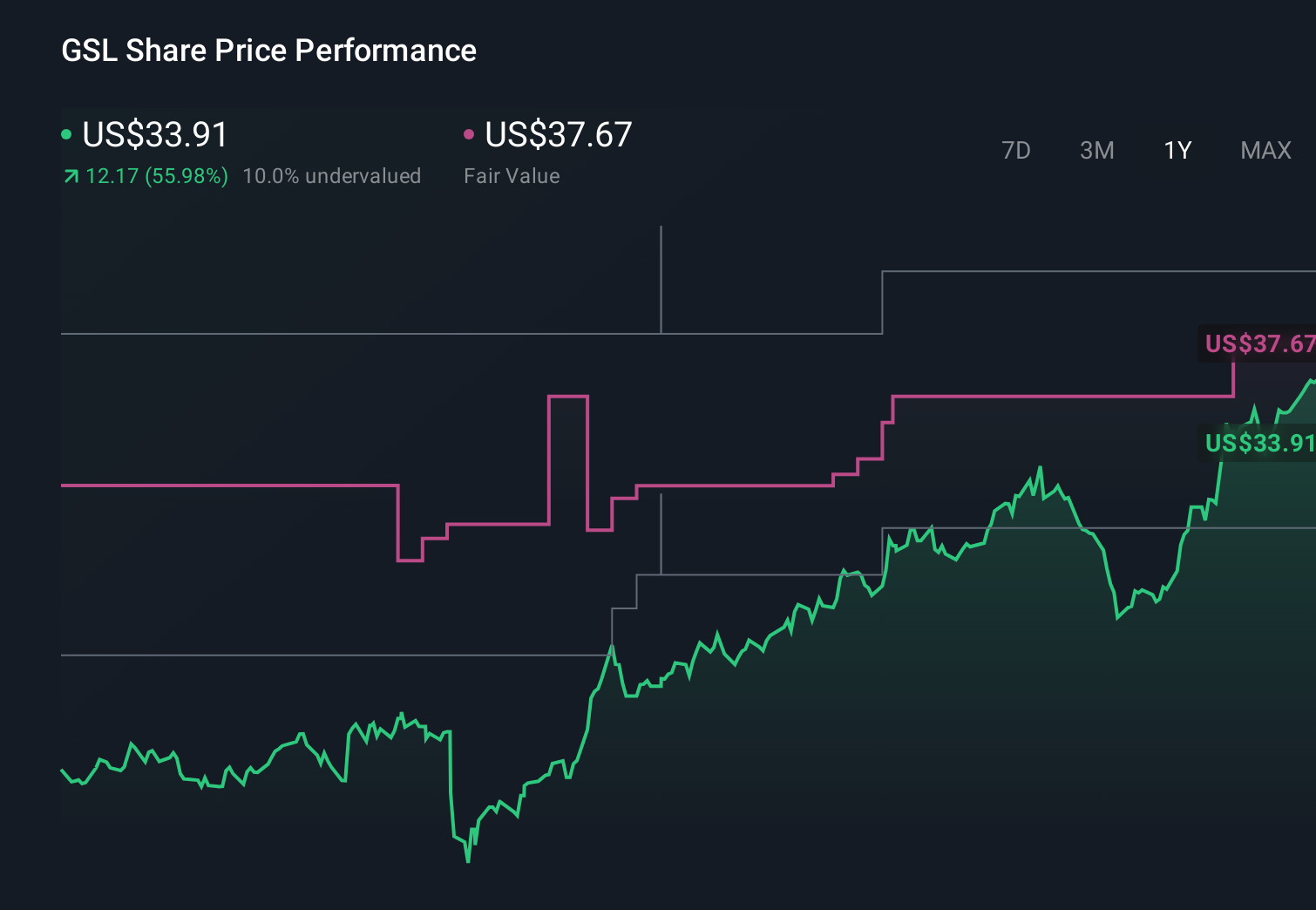

Uncover how Global Ship Lease's forecasts yield a $37.67 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span roughly US$23.59 to US$101.64 per share, showing how far apart views on GSL can be. When you set those opinions against the risk that charter markets could correct sharply, it underlines why many readers will want to explore several different takes on the company’s prospects.

Explore 9 other fair value estimates on Global Ship Lease - why the stock might be worth over 2x more than the current price!

Build Your Own Global Ship Lease Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Ship Lease research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Global Ship Lease research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Ship Lease's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal