Reddit (RDDT): Revisiting Valuation After a Strong Year-to-Date Share Price Rally

Reddit (RDDT) has quietly become one of this year’s more closely watched social media trades, with shares up about 16% over the past month even after a slight pullback this week.

See our latest analysis for Reddit.

At around $236.11 per share, Reddit’s strong year to date share price return of 42.31% and similar 1 year total shareholder return suggest momentum is rebuilding after a choppy few months as investors reassess its growth and data licensing story.

If Reddit’s move has you rethinking exposure to platform and infrastructure plays, it might be worth scanning other high growth tech and AI names via high growth tech and AI stocks for fresh ideas.

With shares hovering just below analyst targets but still trading at a hefty intrinsic discount, the real debate now is whether Reddit is mispriced growth or if the market has already banked its next leg higher.

Most Popular Narrative Narrative: 1.9% Undervalued

With Reddit closing at $236.11 against a narrative fair value just over $240, the story leans only modestly in favor of upside from here.

The value of Reddit's data for AI/LLM training is gaining wider recognition, as demonstrated by their data licensing deals and status as a top-cited source for LLMs; Reddit's growing corpus and unique conversation base position the company to expand high-margin data licensing revenues in the years ahead.

Curious how a fast rising margin profile, ambitious top line projections, and a premium future earnings multiple all combine to justify that fair value? The answer might surprise you.

Result: Fair Value of $240.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained moderation challenges and intensifying competition for younger users could quickly undermine Reddit’s engagement engine and call that upbeat growth narrative into question.

Find out about the key risks to this Reddit narrative.

Another View: Lofty Earnings Multiple Sends a Different Signal

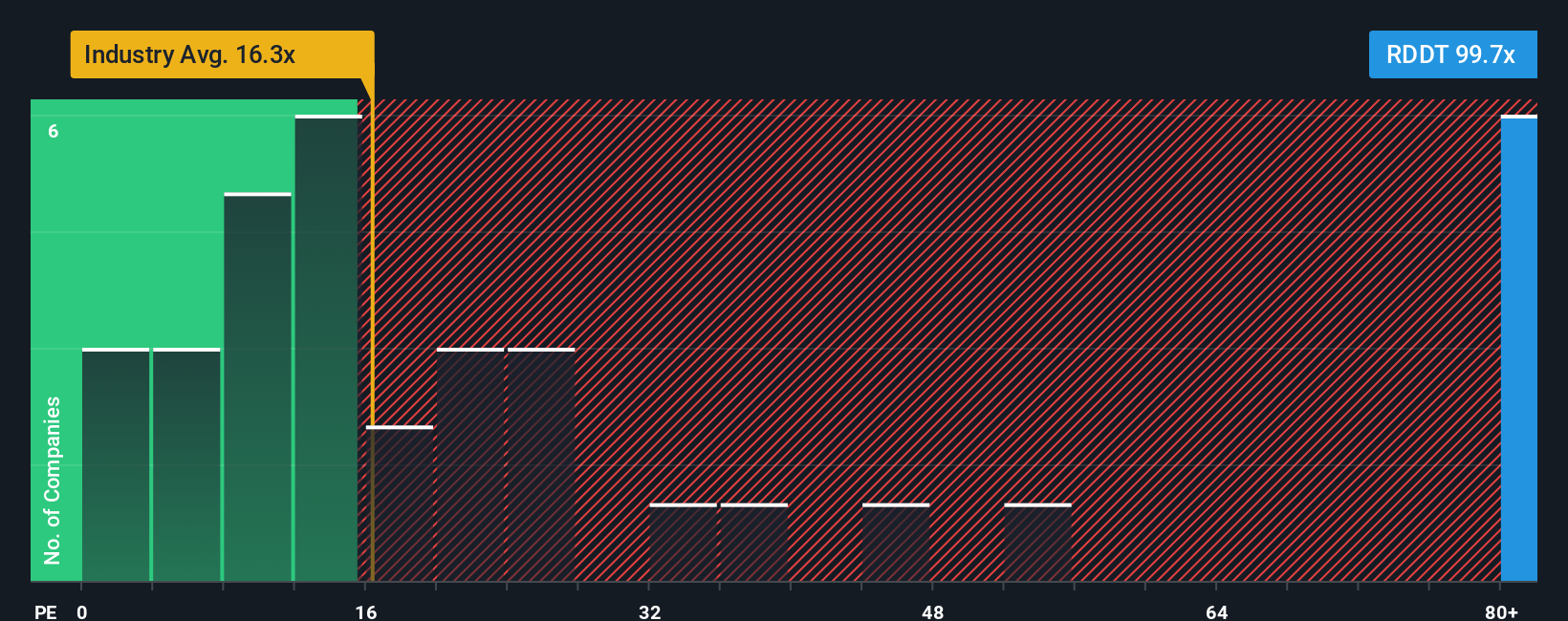

While the narrative fair value suggests Reddit is slightly undervalued, its current price implies a price-to-earnings ratio of about 128 times, versus 17.6 times for the US Interactive Media and Services industry, a 38 times fair ratio, and 38.9 times for peers, leaving a lot of downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Reddit Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalized Reddit thesis in just minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Reddit.

Looking for more investment ideas you do not want to overlook?

Before you move on, lock in your next potential winner by using the Simply Wall St screener to uncover opportunities that match your strategy with precision.

- Capture potential mispricings early by scanning these 899 undervalued stocks based on cash flows that the market may be sleeping on right now.

- Ride structural growth by targeting these 27 AI penny stocks positioned at the intersection of innovation and accelerating demand.

- Strengthen your cash flow with these 15 dividend stocks with yields > 3% that aim to combine reliable income with solid business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal