Does S&P Global Near $490 Still Offer Upside After Strong Multi Year Gains?

- If you are wondering whether S&P Global at around $490 a share is still worth buying, or if most of the upside has already been priced in, you are not alone. That is exactly what we are going to unpack here.

- The stock is roughly flat in the short term, down 1.8% over the last week, 0.6% over the last month, and 1.0% year to date. However, it is still sitting on gains of 42.2% over 3 years and 59.4% over 5 years.

- Recent moves come against a backdrop of investors reassessing high quality data and analytics names as interest rate expectations shift and regulatory scrutiny of credit ratings stays in focus. In addition, the market is weighing S&P Global's continued push into index and data businesses and its integration of prior acquisitions, which together shape expectations for long term growth and resilience.

- Despite its quality reputation, S&P Global currently scores just 1 out of 6 on our undervaluation checks. We will break down what that means across different valuation methods, and then finish by looking at a broader way to think about valuation that goes beyond any single model.

S&P Global scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: S&P Global Excess Returns Analysis

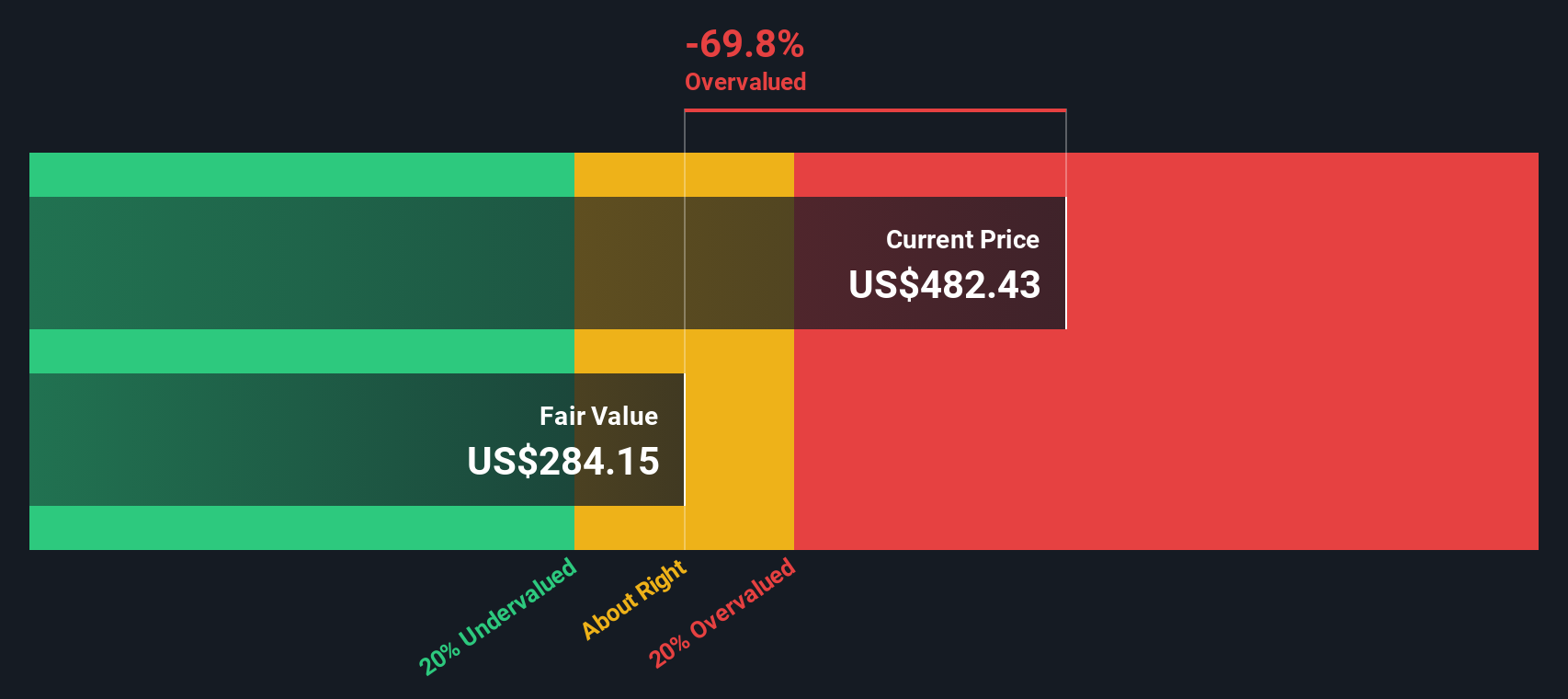

The Excess Returns model looks at how much value S&P Global can create above the minimum return investors demand on its equity, rather than just projecting cash flows. It starts with an estimated book value of $109.21 per share and a stable book value of $112.81 per share, based on future balance sheet estimates from five analysts.

Using weighted future return on equity forecasts from four analysts, the model estimates stable earnings of $19.45 per share. With a cost of equity of $9.40 per share, that implies excess returns of about $10.05 per share, supported by an average return on equity of 17.24%. In other words, the company is expected to keep earning well above its required return, which is what justifies a premium valuation.

Even so, when these excess returns are capitalized, the intrinsic value comes out at about $311 per share, which is roughly 57.8% below the current share price near $490. On this framework, the stock screens as materially overvalued.

Result: OVERVALUED

Our Excess Returns analysis suggests S&P Global may be overvalued by 57.8%. Discover 899 undervalued stocks or create your own screener to find better value opportunities.

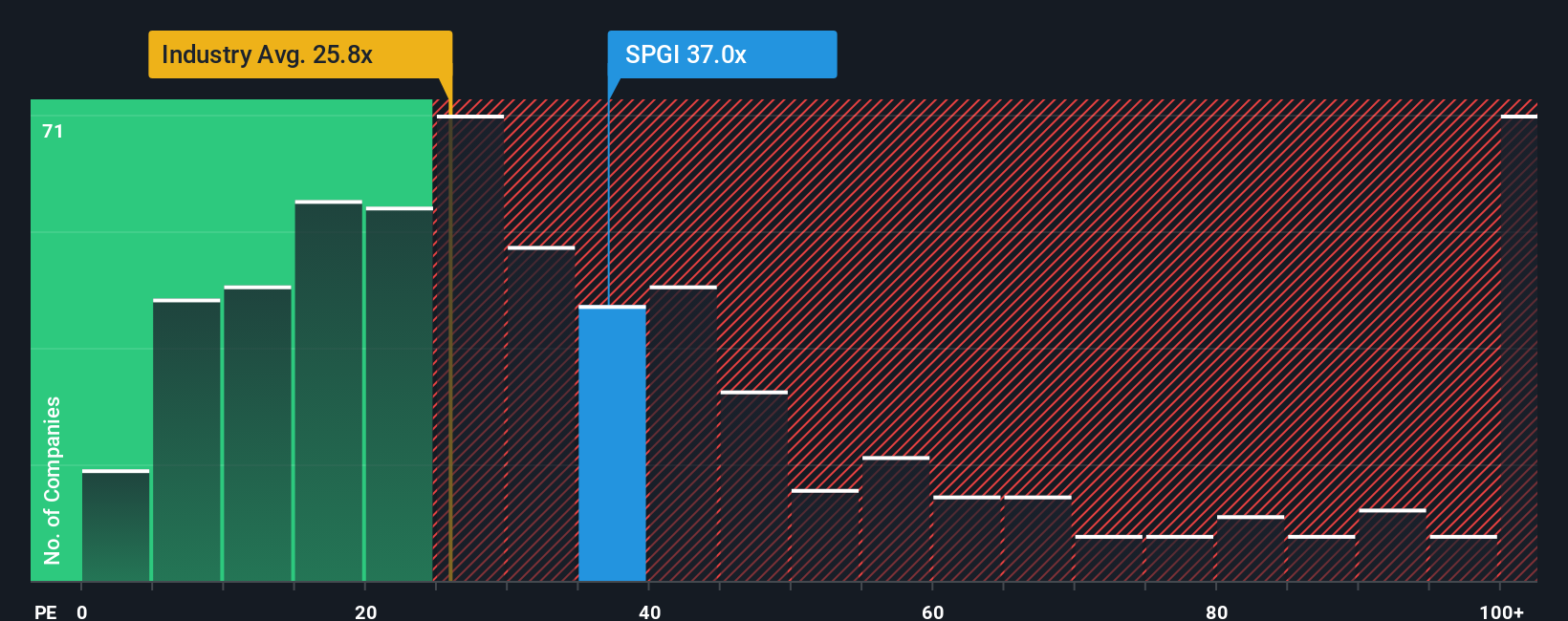

Approach 2: S&P Global Price vs Earnings

For a consistently profitable company like S&P Global, the price to earnings, or PE, ratio is a practical way to judge valuation because it ties the share price directly to today’s earnings power. In general, faster expected earnings growth and lower perceived risk justify a higher PE, while slower growth and higher risk point to a lower “normal” or “fair” PE range.

S&P Global currently trades at about 35.2x earnings, which is well above both the Capital Markets industry average of roughly 25.3x and the peer average of 31.3x. On the surface, that premium suggests investors are paying up for the company’s quality and growth profile. However, Simply Wall St’s Fair Ratio framework goes a step further.

The Fair Ratio of 17.8x is a proprietary estimate of what S&P Global’s PE should be, given its earnings growth outlook, risk profile, profit margins, industry positioning, and market cap. Because it blends these company specific drivers, it is more tailored than a simple comparison to peers or broad industry averages. With the actual PE of 35.2x sitting almost double the Fair Ratio, this approach also points to S&P Global being materially overvalued at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your S&P Global Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you connect your view of S&P Global’s story to a specific financial forecast and a clear fair value estimate. A Narrative is your explanation of what you think will happen to a company, expressed through assumptions about future revenue growth, profit margins, and risk. The platform automatically turns these inputs into projected earnings and a fair value you can compare to today’s share price to help guide investment decisions. Because Narratives are updated dynamically as new news, earnings, or guidance arrives, your valuation view evolves in real time rather than staying fixed on outdated models.

For example, one S&P Global Narrative on the platform might assume very strong growth and high margins. This could lead to a much higher fair value than another Narrative that bakes in slower growth and thinner margins, showing how different, clearly framed perspectives can coexist and be compared.

Do you think there's more to the story for S&P Global? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal