Samsara (IOT): Rethinking Valuation After Surging Growth, New Profitability and Upgraded Outlook

Samsara (IOT) just checked several big boxes in one go, posting faster revenue growth, a move into profitability, and higher guidance that leans into strong demand for its fleet and equipment monitoring platform.

See our latest analysis for Samsara.

The market seems to be waking back up to that story, with a 7 day share price return of 12.25% and 90 day share price return of 13.18% even as 1 year total shareholder return is still negative. This suggests renewed momentum after a volatile stretch.

If Samsara’s move has you thinking about where else growth and execution might line up, this could be a good moment to explore high growth tech and AI stocks.

Yet with shares now trading just below Wall Street’s targets and profits finally turning positive, is Samsara still flying under the radar as a growth at a reasonable price story, or is the market already baking in its next leg of expansion?

Most Popular Narrative: 11.9% Undervalued

With the most popular narrative placing Samsara’s fair value above the recent 43.79 dollars close, the spotlight shifts to what is driving that optimism.

Samsara is experiencing strong growth in annual recurring revenue (ARR), evidenced by a 32% year over year increase. This growth is primarily driven by their success in landing large enterprise customers, indicating future revenue expansion opportunities with existing clients. Impact: Revenue growth.

Curious why this narrative still sees upside even with a premium valuation tag? The answer blends outsized revenue compounding, margin lift, and a future earnings multiple usually reserved for elite software names. Want to know which assumptions have to land almost perfectly to support that price? Explore the full narrative to see the exact growth and profitability runway it is relying on.

Result: Fair Value of $49.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could be challenged if AI monetization lags expectations, or if intensified competition following the patent ruling begins to cap ARR momentum.

Find out about the key risks to this Samsara narrative.

Another Lens on Value

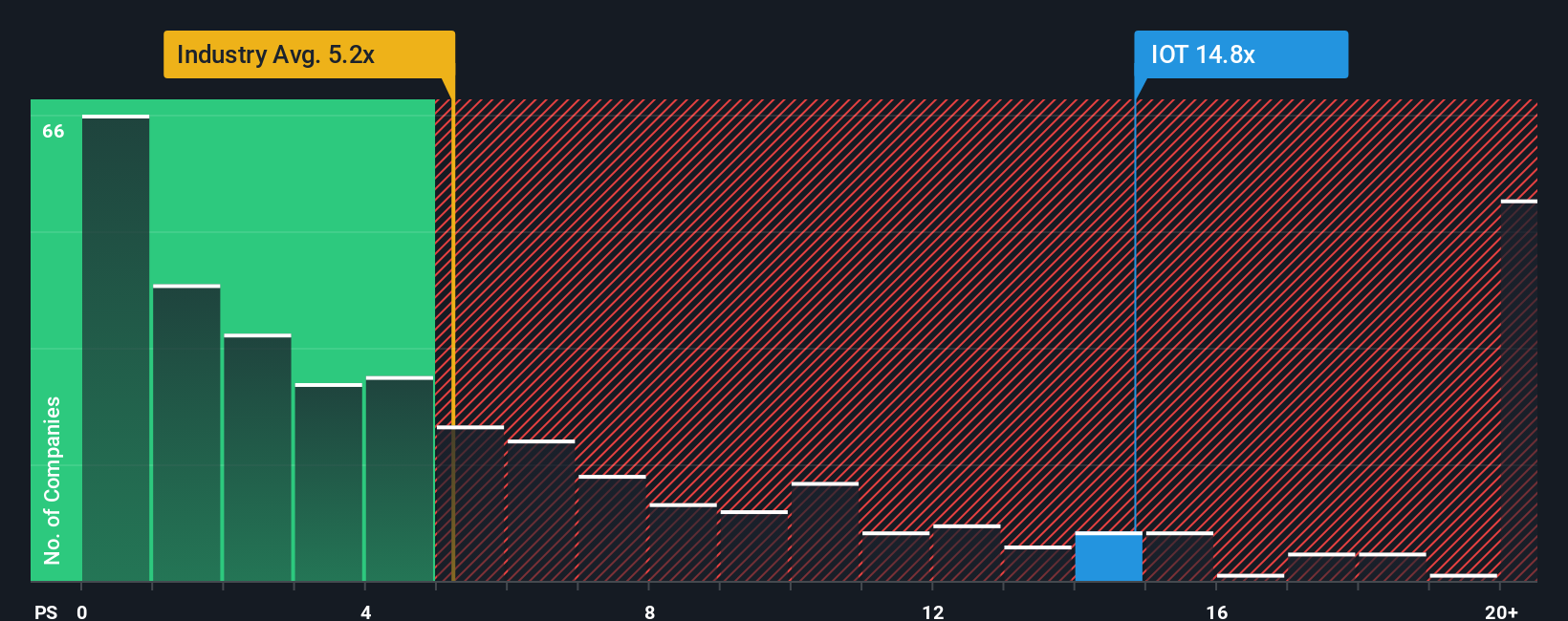

While the popular narrative points to upside, our fair ratio work using the price to sales multiple paints a different picture. Samsara trades at 16.5 times sales versus a US software average of 5 times and a fair ratio of 10.3 times, which implies meaningful valuation risk if growth cools or sentiment normalizes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Samsara Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a fresh view in minutes: Do it your way.

A great starting point for your Samsara research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready For Your Next Move?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover focused ideas tailored to your strategy before the market prices them in.

- Target reliable income growth by scanning these 15 dividend stocks with yields > 3% that combine attractive yields with the fundamentals to keep those payouts flowing.

- Capitalize on megatrends in automation and data by sorting through these 27 AI penny stocks that may benefit from accelerating AI adoption.

- Spot mispriced potential early by reviewing these 899 undervalued stocks based on cash flows where cash flow strength is not yet fully reflected in the share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal