Risks Still Elevated At These Prices As Calnex Solutions plc (LON:CLX) Shares Dive 28%

Calnex Solutions plc (LON:CLX) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

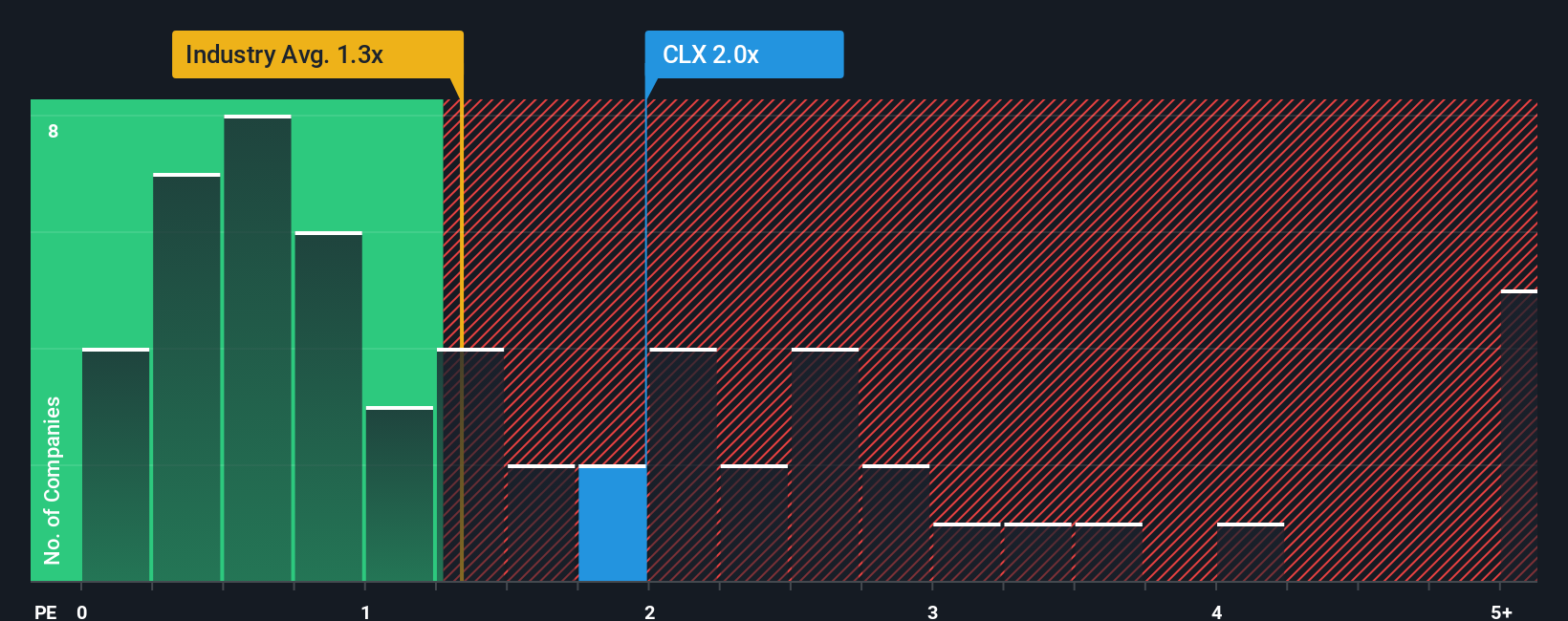

In spite of the heavy fall in price, when almost half of the companies in the United Kingdom's Communications industry have price-to-sales ratios (or "P/S") below 1x, you may still consider Calnex Solutions as a stock probably not worth researching with its 2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Calnex Solutions

What Does Calnex Solutions' Recent Performance Look Like?

Calnex Solutions could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Calnex Solutions.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Calnex Solutions' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 21%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 25% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 12% as estimated by the dual analysts watching the company. That's shaping up to be similar to the 13% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Calnex Solutions' P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Calnex Solutions' P/S?

Despite the recent share price weakness, Calnex Solutions' P/S remains higher than most other companies in the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Analysts are forecasting Calnex Solutions' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Calnex Solutions that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal