We Think The Compensation For Property & Building Corp. Ltd.'s (TLV:PTBL) CEO Looks About Right

Key Insights

- Property & Building's Annual General Meeting to take place on 16th of December

- CEO Baruch Yitzhak's total compensation includes salary of ₪801.0k

- The overall pay is 53% below the industry average

- Over the past three years, Property & Building's EPS fell by 40% and over the past three years, the total shareholder return was 84%

Shareholders may be wondering what CEO Baruch Yitzhak plans to do to improve the less than great performance at Property & Building Corp. Ltd. (TLV:PTBL) recently. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 16th of December. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

Check out our latest analysis for Property & Building

How Does Total Compensation For Baruch Yitzhak Compare With Other Companies In The Industry?

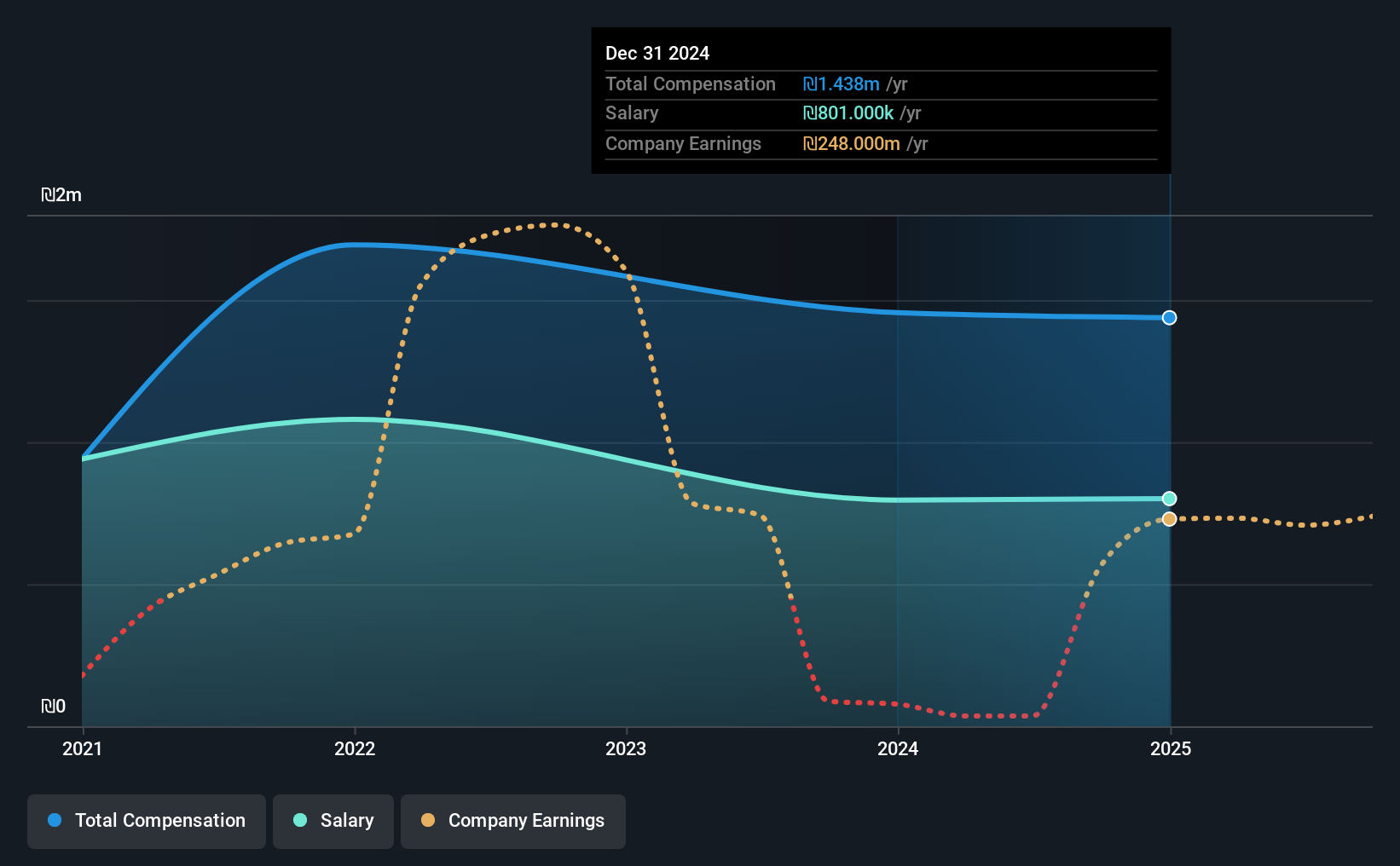

At the time of writing, our data shows that Property & Building Corp. Ltd. has a market capitalization of ₪2.7b, and reported total annual CEO compensation of ₪1.4m for the year to December 2024. This means that the compensation hasn't changed much from last year. We note that the salary of ₪801.0k makes up a sizeable portion of the total compensation received by the CEO.

In comparison with other companies in the Israel Real Estate industry with market capitalizations ranging from ₪1.3b to ₪5.2b, the reported median CEO total compensation was ₪3.0m. That is to say, Baruch Yitzhak is paid under the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₪801k | ₪796k | 56% |

| Other | ₪637k | ₪660k | 44% |

| Total Compensation | ₪1.4m | ₪1.5m | 100% |

On an industry level, around 62% of total compensation represents salary and 38% is other remuneration. Although there is a difference in how total compensation is set, Property & Building more or less reflects the market in terms of setting the salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Property & Building Corp. Ltd.'s Growth Numbers

Over the last three years, Property & Building Corp. Ltd. has shrunk its earnings per share by 40% per year. Its revenue is down 26% over the previous year.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Property & Building Corp. Ltd. Been A Good Investment?

Boasting a total shareholder return of 84% over three years, Property & Building Corp. Ltd. has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us wonder if these strong returns can continue. These concerns could be addressed to the board and shareholders should revisit their investment thesis to see if it still makes sense.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for Property & Building (of which 1 is significant!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal