High Growth Tech In Asia Featuring Three Prominent Stocks

As global markets experience fluctuations with hopes for interest rate adjustments, the technology sector in Asia continues to capture significant attention, particularly as Chinese stock markets show enthusiasm for domestic tech and AI despite broader economic challenges. In this context, identifying strong stocks often involves looking at companies that demonstrate resilience and innovation in rapidly evolving sectors, which can be crucial amid shifting market dynamics.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Fositek | 37.83% | 51.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.80% | 36.87% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Zhongji Innolight | 34.82% | 35.50% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Gan & Lee Pharmaceuticals (SHSE:603087)

Simply Wall St Growth Rating: ★★★★☆☆

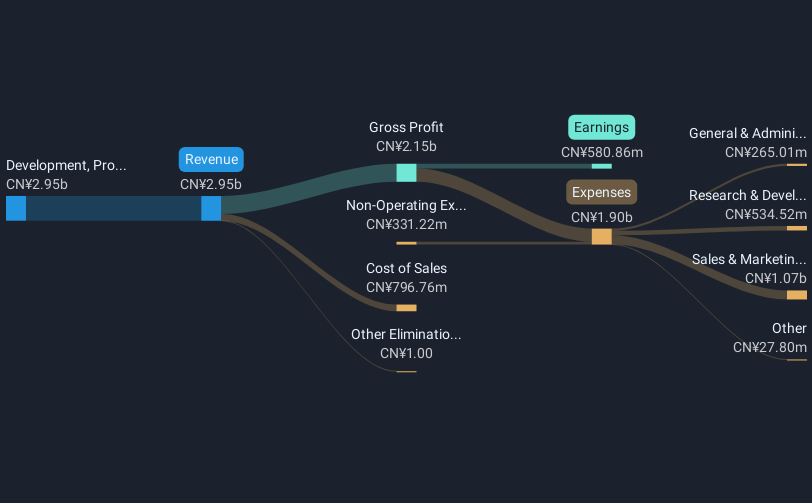

Overview: Gan & Lee Pharmaceuticals is a biopharmaceutical company focused on the research, development, production, and sale of insulin analog APIs and injections in China with a market capitalization of CN¥37.75 billion.

Operations: Gan & Lee Pharmaceuticals generates revenue primarily through the development, production, and sale of insulin and related products, amounting to approximately CN¥3.85 billion. The company's focus on insulin analog APIs and injections positions it within China's biopharmaceutical sector.

Gan & Lee Pharmaceuticals, a frontrunner in the insulin market, has shown robust financial and operational progress. In the recent quarter ending September 2025, the company reported a significant revenue increase to CNY 3.05 billion from CNY 2.25 billion year-over-year, with net income surging to CNY 818.34 million from CNY 507.27 million. These figures underscore a dynamic growth trajectory with earnings up by an impressive 59.4% over the past year, outpacing the broader biotech industry's decline of -8.2%. Moreover, Gan & Lee's strategic expansion into European markets is evidenced by their recent product approval by EMA’s CHMP for their biosimilar insulin glargine injection Ondibta®, marking it as the first Chinese-developed insulin product of its kind to enter this market after rigorous Phase III trials in Europe and the U.S., demonstrating therapeutic biosimilarity in efficacy and safety compared to established brands like Lantus®?. This move not only diversifies their portfolio but also enhances their global footprint—an essential step for sustained growth in a competitive sector.

- Delve into the full analysis health report here for a deeper understanding of Gan & Lee Pharmaceuticals.

Gain insights into Gan & Lee Pharmaceuticals' past trends and performance with our Past report.

Integrity Technology Group (SHSE:688244)

Simply Wall St Growth Rating: ★★★★★☆

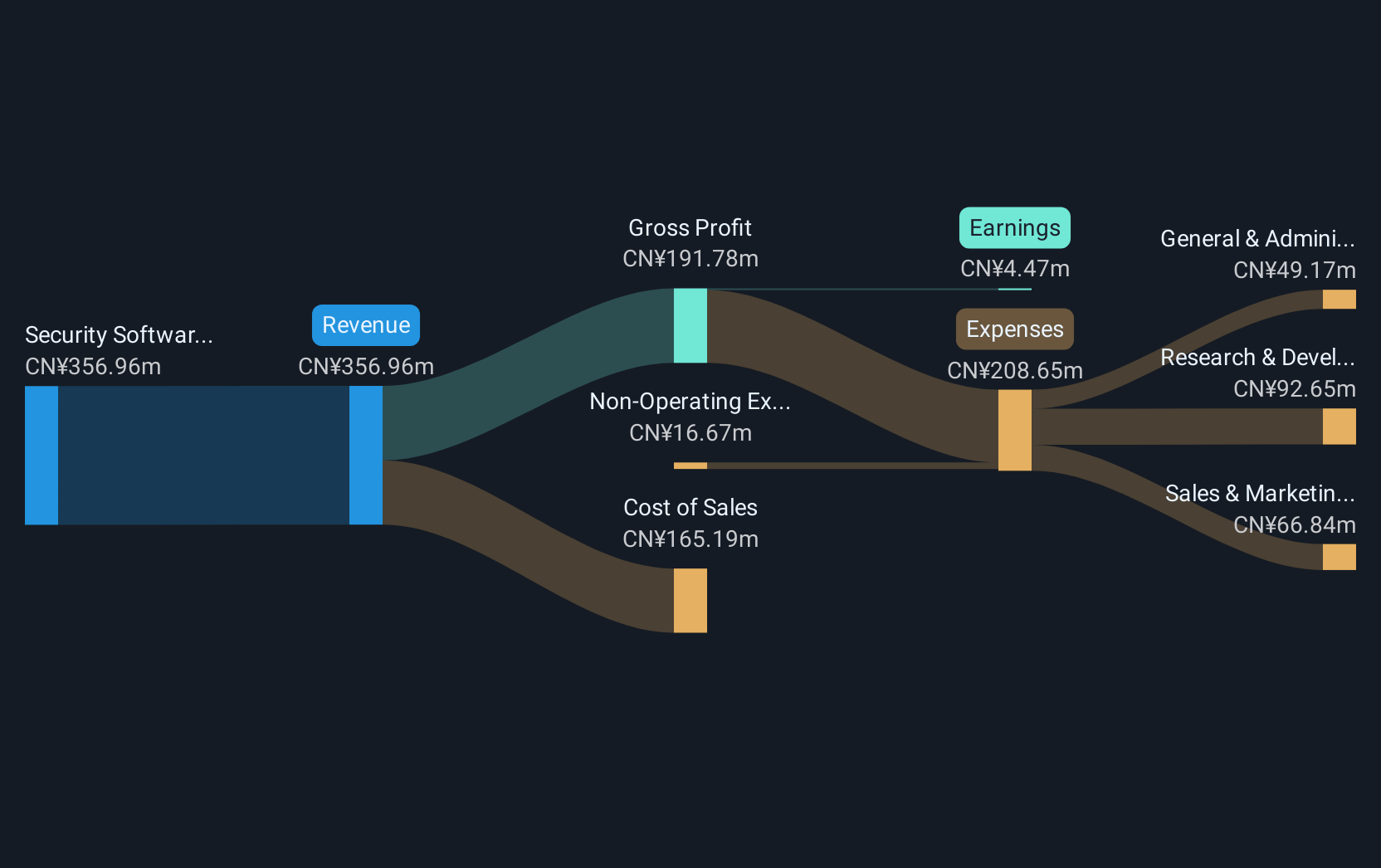

Overview: Integrity Technology Group Inc. is a network security enterprise offering network security solutions in China, with a market capitalization of CN¥3.63 billion.

Operations: Integrity Technology Group Inc. focuses on network security solutions in China, generating revenue primarily from its Security Software & Services segment, which amounts to CN¥325.68 million.

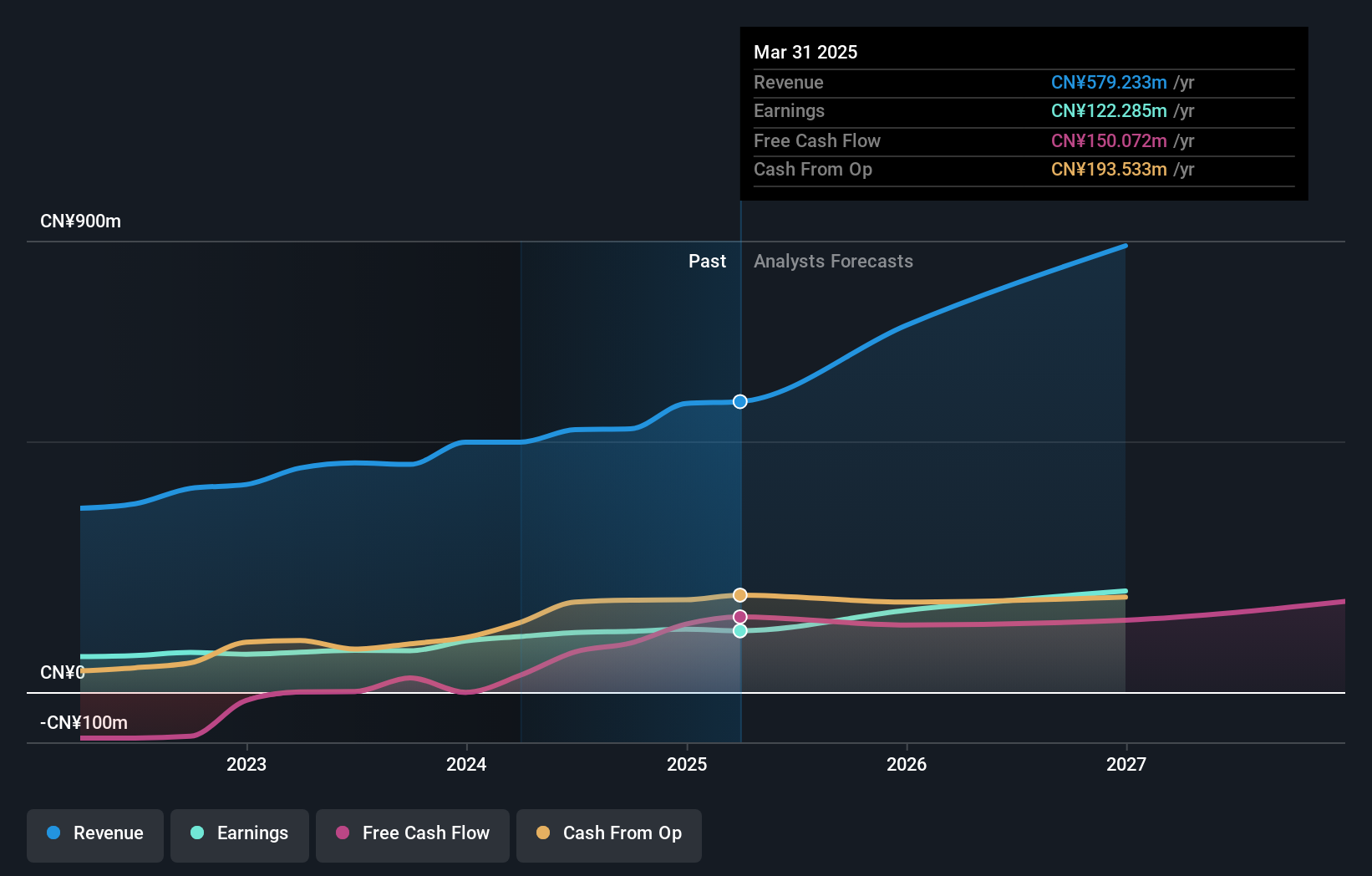

Integrity Technology Group, amidst a challenging fiscal year, has demonstrated resilience with its strategic focus on R&D and market expansion. The company's annual revenue growth at 24.7% outpaces the Chinese market average of 14.5%, showcasing a robust trajectory despite recent revenue dips to CNY 142.29 million from CNY 172.94 million year-over-year. With earnings forecasted to grow by an impressive 67.64% annually, Integrity is pivoting towards profitability, underscored by its aggressive investment in innovation which aligns with broader industry shifts towards advanced tech solutions in Asia's competitive landscape.

- Get an in-depth perspective on Integrity Technology Group's performance by reading our health report here.

Learn about Integrity Technology Group's historical performance.

Beijing ConST Instruments Technology (SZSE:300445)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing ConST Instruments Technology Inc. researches, develops, manufactures, and sells digital testing instruments and equipment in China, with a market cap of CN¥4.50 billion.

Operations: ConST Instruments focuses on the research, development, manufacturing, and sale of digital testing instruments and equipment within China.

Beijing ConST Instruments Technology has demonstrated a robust growth trajectory, with revenue and earnings expanding by 35.7% and 42.3% annually, respectively. This performance outstrips broader market averages significantly, positioning the company as a dynamic player in the tech sector. Recent strategic amendments to its corporate governance underscore an agile approach to scaling operations and enhancing internal systems, crucial for sustaining growth in the competitive Asian tech landscape. With R&D expenses meticulously aligned with industry demands, Beijing ConST is poised to capitalize on emerging technological trends, ensuring its continued relevance and market penetration.

Summing It All Up

- Click here to access our complete index of 188 Asian High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal