Investors Give Palram Industries (1990) Ltd (TLV:PLRM) Shares A 25% Hiding

Palram Industries (1990) Ltd (TLV:PLRM) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

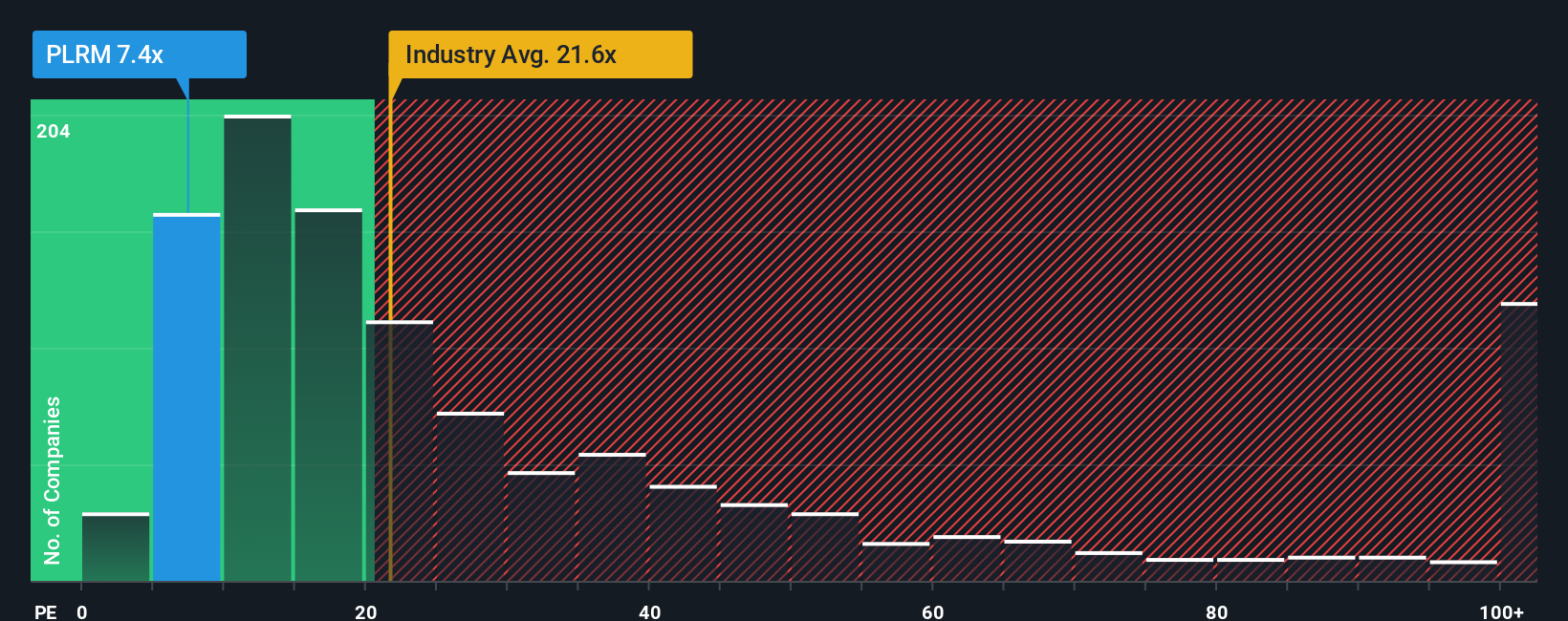

Since its price has dipped substantially, Palram Industries (1990) may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 7.4x, since almost half of all companies in Israel have P/E ratios greater than 16x and even P/E's higher than 26x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For instance, Palram Industries (1990)'s receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Palram Industries (1990)

Is There Any Growth For Palram Industries (1990)?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Palram Industries (1990)'s to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. Even so, admirably EPS has lifted 42% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Comparing that to the market, which is predicted to deliver 12% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

In light of this, it's peculiar that Palram Industries (1990)'s P/E sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On Palram Industries (1990)'s P/E

Palram Industries (1990)'s P/E looks about as weak as its stock price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Palram Industries (1990) revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching the company's performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Palram Industries (1990) that you should be aware of.

If you're unsure about the strength of Palram Industries (1990)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal