Top Asian Dividend Stocks To Consider In December 2025

As global markets closely watch the final Federal Reserve meeting of the year and navigate mixed economic signals, Asian markets have been marked by enthusiasm for technology and AI trades, despite some signs of economic slowdown. In this environment, dividend stocks in Asia offer a compelling option for investors seeking stable income streams amidst market fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.86% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.72% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.94% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.74% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.09% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.46% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.87% | ★★★★★★ |

Click here to see the full list of 1037 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

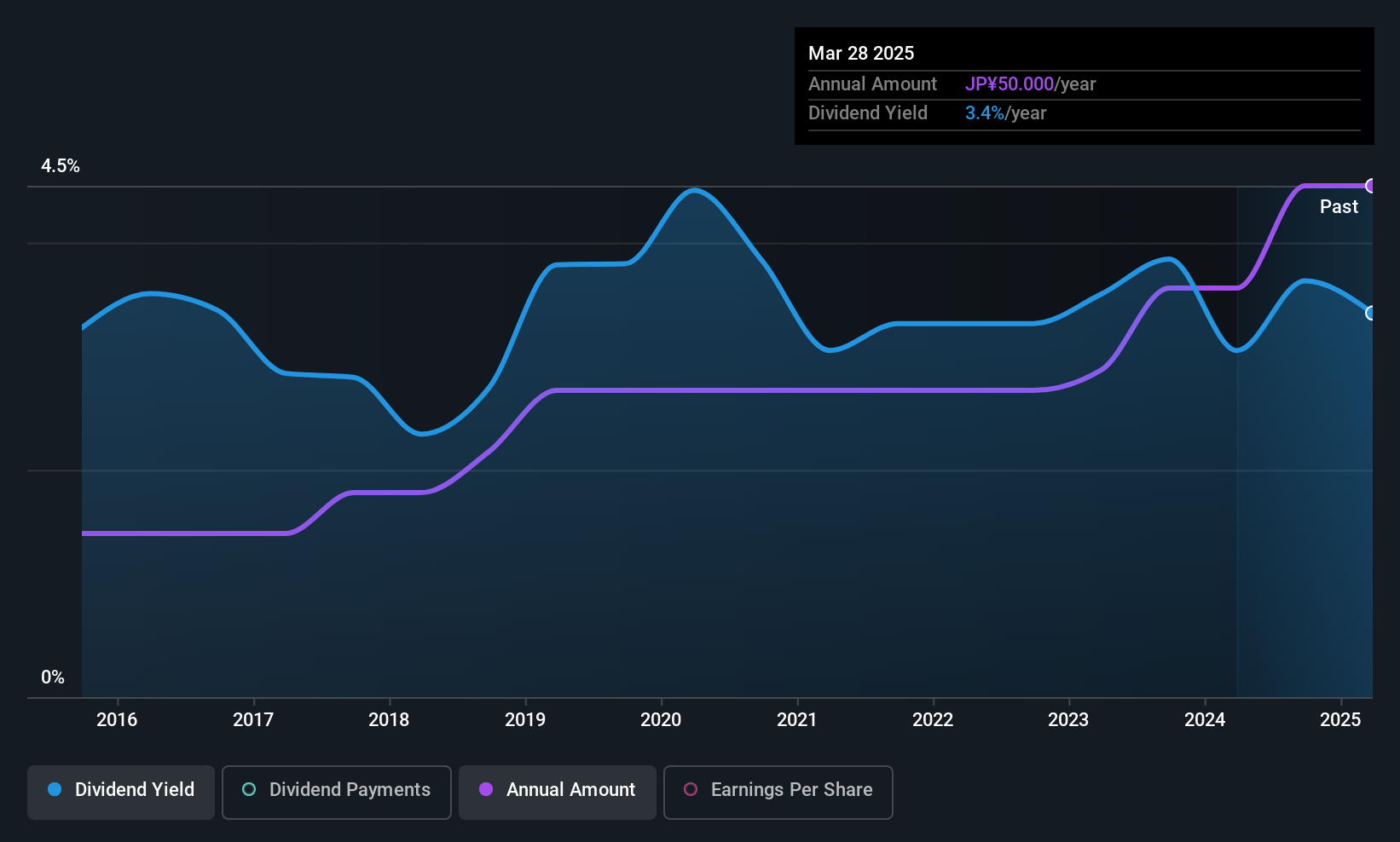

Fujita Engineering (TSE:1770)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fujita Engineering Co., Ltd. operates in the facilities construction sector both within Japan and internationally, with a market cap of ¥15.89 billion.

Operations: Fujita Engineering Co., Ltd. generates its revenue from facilities construction activities in both domestic and international markets.

Dividend Yield: 3.5%

Fujita Engineering offers a stable dividend profile with a reliable history of payments over the past decade. The dividends are well-supported by earnings and cash flows, reflected in low payout ratios of 24.6% and 15.2%, respectively, ensuring sustainability. Despite trading at a significant discount to its estimated fair value, the dividend yield of 3.47% is slightly below Japan's top-tier payers but remains attractive due to its consistent growth and stability over ten years.

- Dive into the specifics of Fujita Engineering here with our thorough dividend report.

- Our expertly prepared valuation report Fujita Engineering implies its share price may be lower than expected.

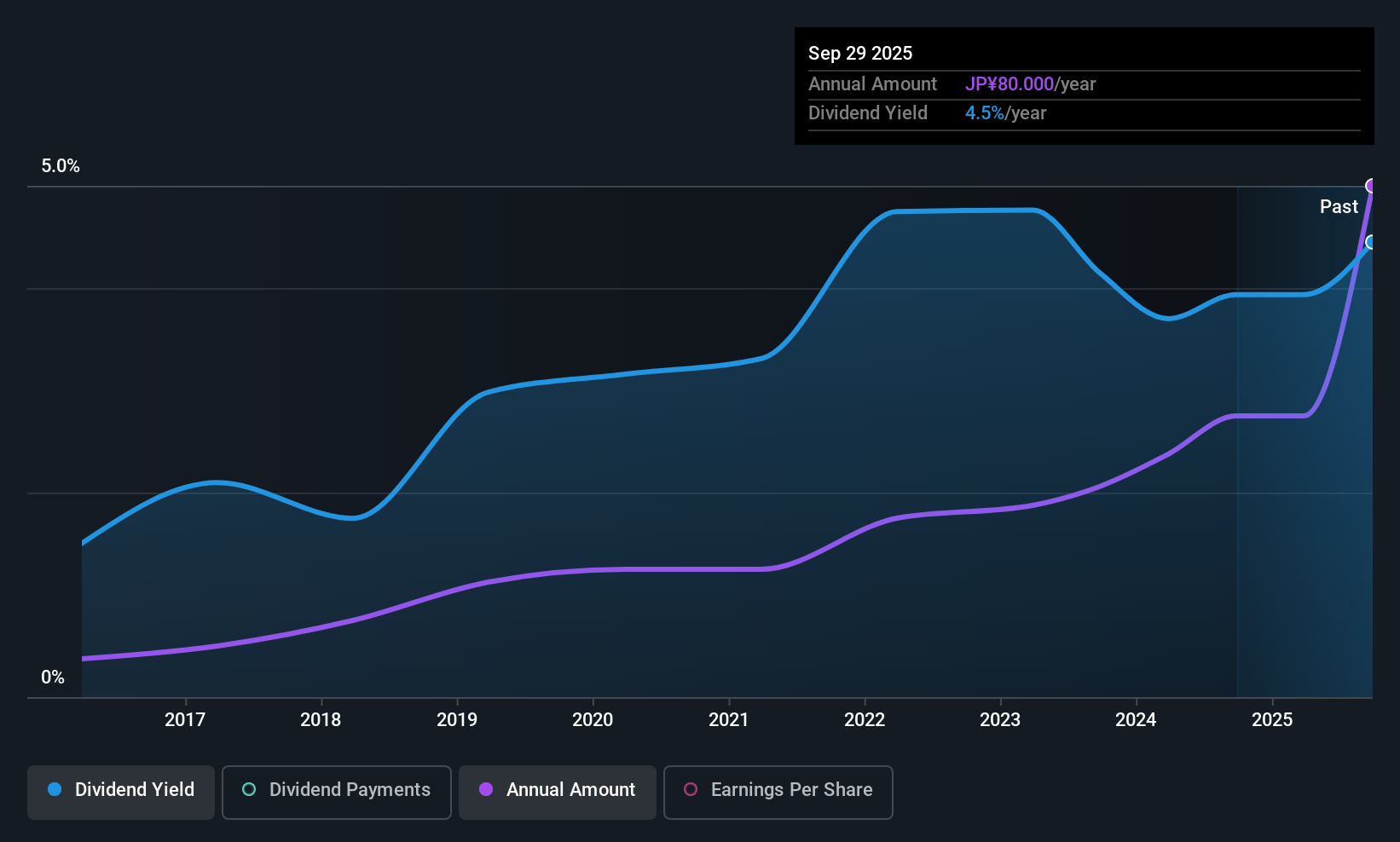

PS Construction (TSE:1871)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PS Construction Co., Ltd. operates in the civil engineering and architecture sectors in Japan, with a market cap of ¥124.31 billion.

Operations: PS Construction Co., Ltd. generates revenue through its Civil Engineering Business at ¥78.23 billion, Construction Business at ¥59.54 billion, and Affiliated Company Business at ¥15.62 billion.

Dividend Yield: 3%

PS Construction's dividend profile shows stability with consistent growth over the past decade. However, its 3.01% yield is below top-tier Japanese payers and not fully covered by free cash flows, raising sustainability concerns. Despite a reasonable payout ratio of 47.6%, the lack of free cash flow coverage suggests potential risks in maintaining current dividend levels, even as earnings have grown at 12.4% annually over five years.

- Delve into the full analysis dividend report here for a deeper understanding of PS Construction.

- The valuation report we've compiled suggests that PS Construction's current price could be inflated.

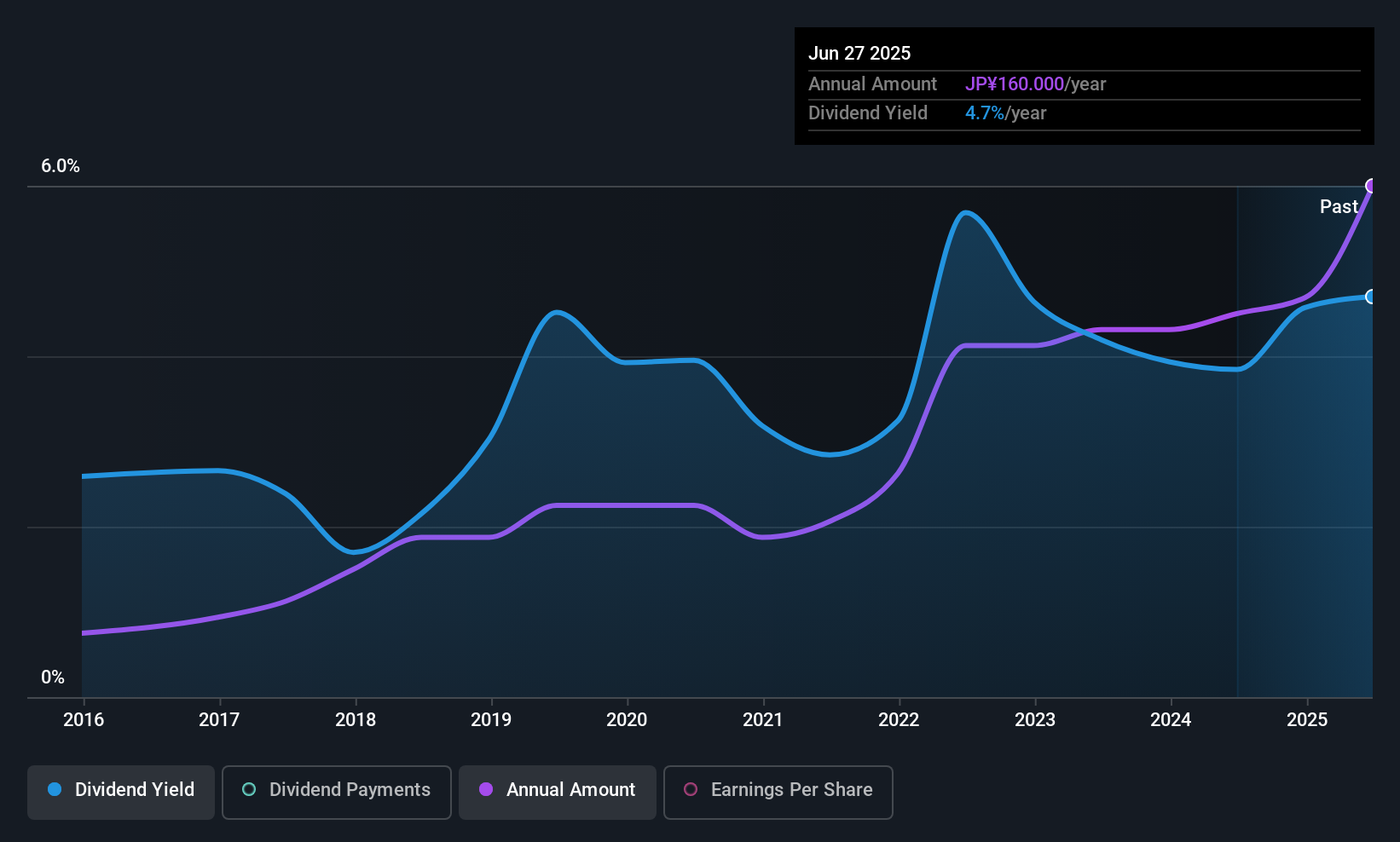

Daitron (TSE:7609)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Daitron Co., Ltd. is an electronic engineering trading company involved in the electronic equipment, components, and manufacturing equipment sectors both in Japan and internationally, with a market cap of ¥50.82 billion.

Operations: Daitron Co., Ltd.'s revenue is comprised of ¥28.59 billion from overseas operations, ¥70.22 billion from domestic sales, and ¥12.47 billion from its domestic manufacturing business.

Dividend Yield: 3.5%

Daitron has increased its dividend to JPY 70 per share, with a full-year forecast of JPY 100 per share for 2025. Despite past volatility in dividends, the current payout is well covered by both earnings and cash flows, with payout ratios of 34.5% and 22%, respectively. While trading significantly below estimated fair value, Daitron's yield remains slightly below top-tier levels in Japan. Earnings have grown substantially over the past year, supporting dividend sustainability.

- Get an in-depth perspective on Daitron's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Daitron's share price might be too pessimistic.

Summing It All Up

- Explore the 1037 names from our Top Asian Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal